Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 shares 16 shares 32 shares 40 shares 160 shares Darden Inc. is contemplating a stock split. Darden's current stock price is $15.00 per share,

4 shares

16 shares

32 shares

40 shares

160 shares

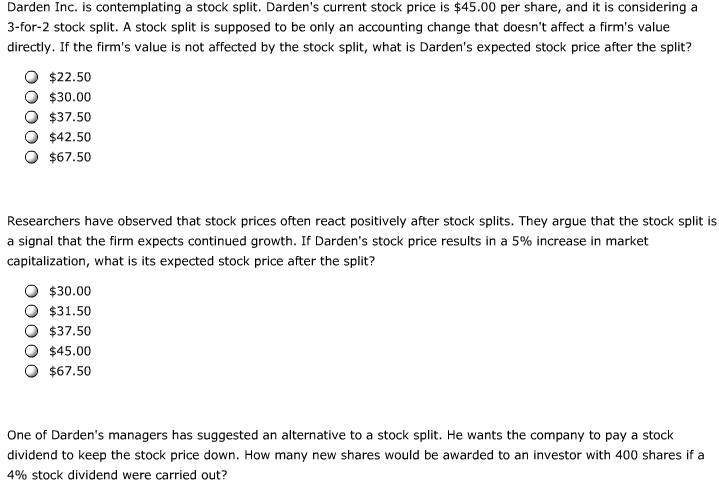

Darden Inc. is contemplating a stock split. Darden's current stock price is $15.00 per share, and it is considering a 3-for-2 stock split. A stock split is supposed to the only an accounting change that doesn't affect a firm's value directly. If the firm's value is not a affected by the stock split, what is Darden's expected stock price after the split? $22.50 #30.00 $37.50 $42.50 $67.50 Researchers have observed that stock prices often react positively after stock splits. They argue that the stock split is a signal that the firm expects continued growth. If Darden's stock price results in a 5% increase in market capitalization, what is its expected stock price after the split? $30.00 $31.00 $37.50 $45.00 $67.50 One of Darden's managers has suggested an alternative to a stock split. He wants the company to pay a stock dividend to keep the stock price down. How many new shares would be awarded to an investor 400 shares if a 4% stock dividend were carried outStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started