Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4 Sheridan Company entered into these transactions during May 2017, its first month of operations. 1. Stockholders invested $35,000 in the business in exchange for

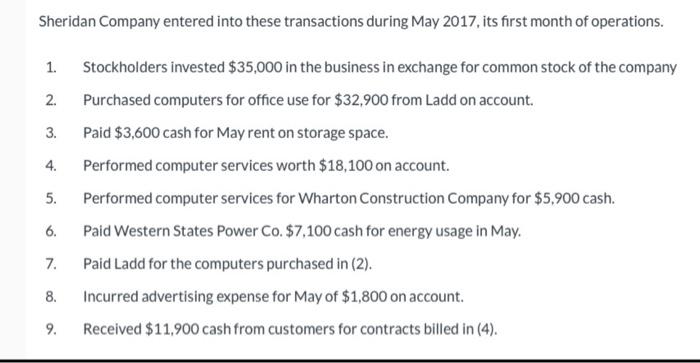

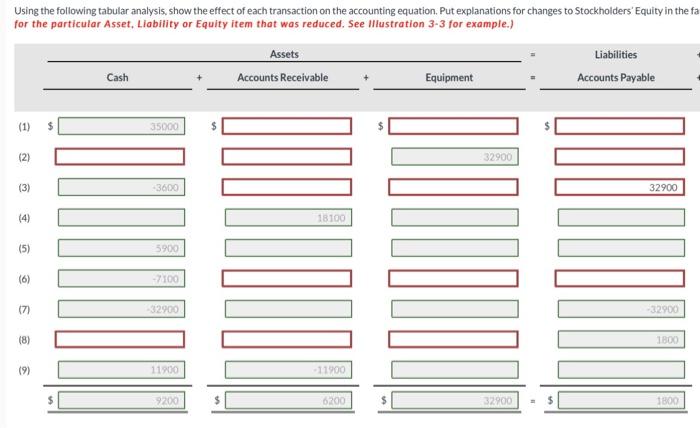

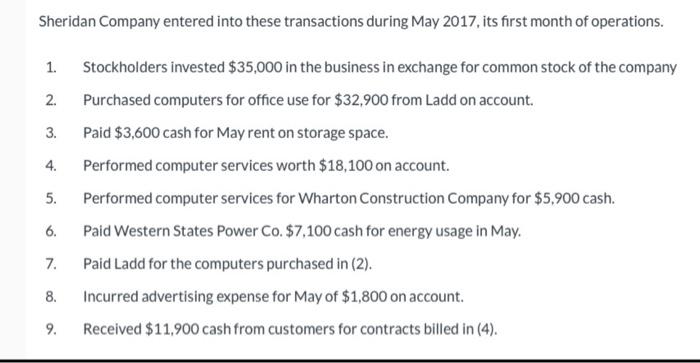

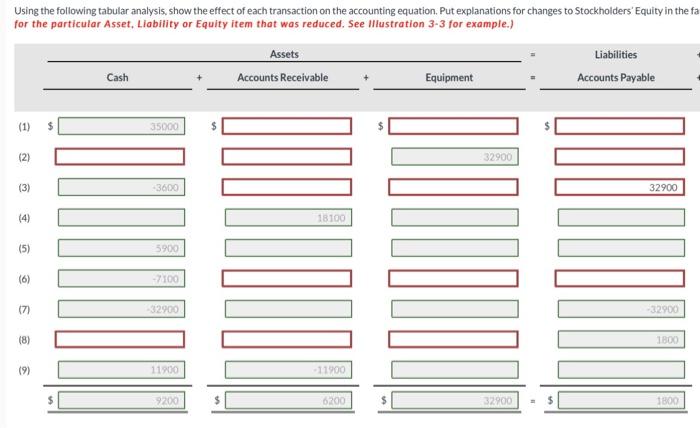

4 Sheridan Company entered into these transactions during May 2017, its first month of operations. 1. Stockholders invested $35,000 in the business in exchange for common stock of the company 2. Purchased computers for office use for $32,900 from Ladd on account. 3. Paid $3,600 cash for May rent on storage space. 4. Performed computer services worth $18,100 on account. 5. Performed computer services for Wharton Construction Company for $5,900 cash. 6. Paid Western States Power Co. $7,100 cash for energy usage in May. 7. Paid Ladd for the computers purchased in (2). 8. Incurred advertising expense for May of $1,800 on account. 9. Received $11,900 cash from customers for contracts billed in (4). Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to Stockholders' Equity in the f for the particular Asset, Llability or Equity item that was reduced. See Illustration 3-3 for example.) ar right column. (if a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity. place a negative sign (or parentheses) in front of the amount entered Stoclholders' Equity

4 Sheridan Company entered into these transactions during May 2017, its first month of operations. 1. Stockholders invested $35,000 in the business in exchange for common stock of the company 2. Purchased computers for office use for $32,900 from Ladd on account. 3. Paid $3,600 cash for May rent on storage space. 4. Performed computer services worth $18,100 on account. 5. Performed computer services for Wharton Construction Company for $5,900 cash. 6. Paid Western States Power Co. $7,100 cash for energy usage in May. 7. Paid Ladd for the computers purchased in (2). 8. Incurred advertising expense for May of $1,800 on account. 9. Received $11,900 cash from customers for contracts billed in (4). Using the following tabular analysis, show the effect of each transaction on the accounting equation. Put explanations for changes to Stockholders' Equity in the f for the particular Asset, Llability or Equity item that was reduced. See Illustration 3-3 for example.) ar right column. (if a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity. place a negative sign (or parentheses) in front of the amount entered Stoclholders' Equity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started