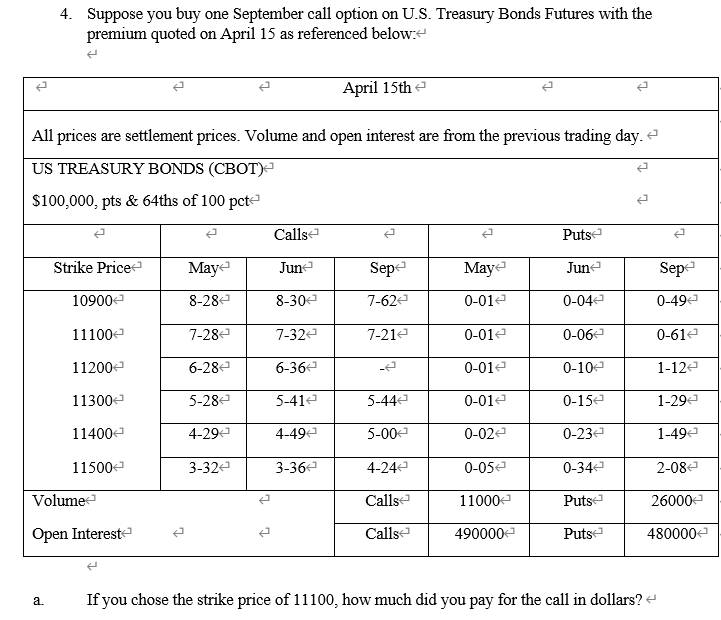

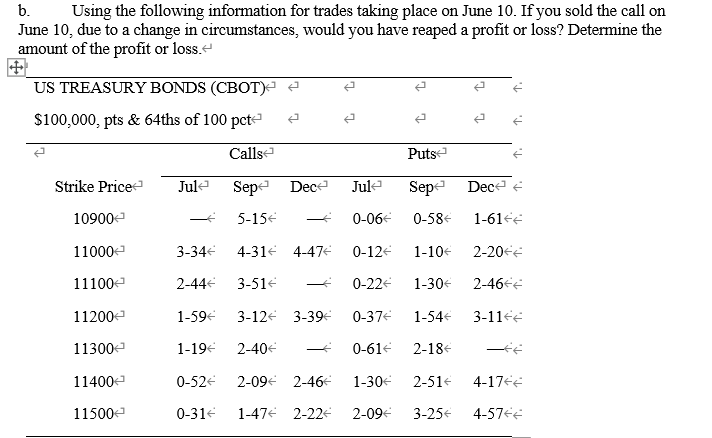

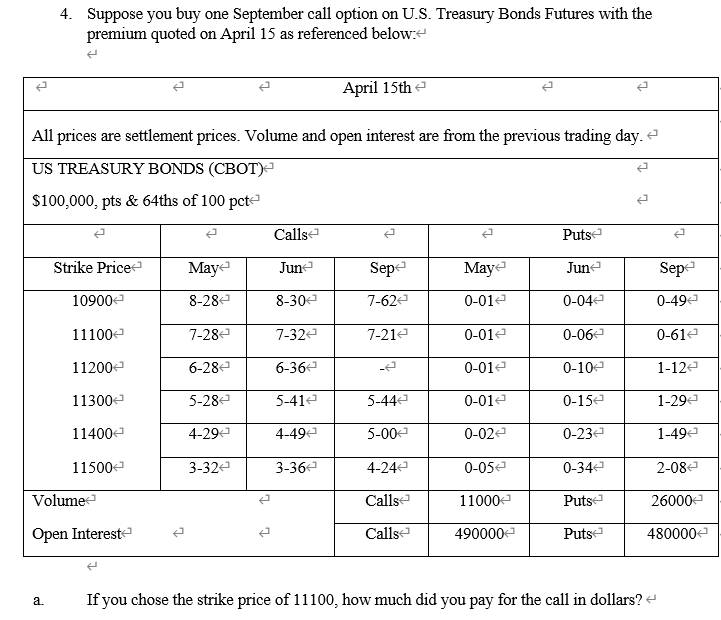

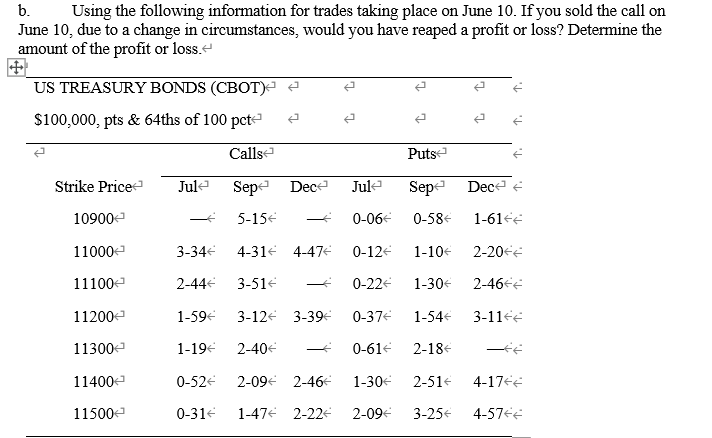

4. Suppose you buy one September call option on U.S. Treasury Bonds Futures with the premium quoted on April 15 as referenced below: April 15th All prices are settlement prices. Volume and open interest are from the previous trading day. US TREASURY BONDS (CBOT) $100,000, pts & 64ths of 100 pct Calls Puts Strike Price May Jun Sep May June Sep 109002 8-28 8-30 7-62 0-012 0-04 0-492 11100 7-282 7-32 7-21 0-012 0-06 0-612 11200 6-28 6-362 0-012 0-102 1-12 11300 5-28 5-412 5-442 0-012 0-15e 1-29 114002 4-292 4-492 5-002 0-02 0-23 1-492 11500 3-32 3-36 4-24 0-052 0-342 2-08 Volume Calls 110002 Puts 26000 Open Interest Calls 490000 Puts 480000 . a. If you chose the strike price of 11100, how much did you pay for the call in dollars? + b. Using the following information for trades taking place on June 10. If you sold the call on June 10, due to a change in circumstances, would you have reaped a profit or loss? Determine the amount of the profit or loss. US TREASURY BONDS (CBOT) $100,000, pts & 64ths of 100 pcte e Calls Puts 1. Strike Price Jule Sep-Dec- Jul Sep Dec 10900- 5-15 0-06 0-584 1-616 11000 3-34 4-31 4-47 0-12 1-10 2-20++ 11100 2-44 3-51 0-22 1-30 2-466 11200 1-59 3-12 3-396 0-374 1-54 3-11 11300 1-19 2-40 0-61 2-18 ! 11400 0-52 2-09 2-46 1-30 2-514 4-17 115002 0-31 1-47 2-22 2-09 3-254 4-57++. 4. Suppose you buy one September call option on U.S. Treasury Bonds Futures with the premium quoted on April 15 as referenced below: April 15th All prices are settlement prices. Volume and open interest are from the previous trading day. US TREASURY BONDS (CBOT) $100,000, pts & 64ths of 100 pct Calls Puts Strike Price May Jun Sep May June Sep 109002 8-28 8-30 7-62 0-012 0-04 0-492 11100 7-282 7-32 7-21 0-012 0-06 0-612 11200 6-28 6-362 0-012 0-102 1-12 11300 5-28 5-412 5-442 0-012 0-15e 1-29 114002 4-292 4-492 5-002 0-02 0-23 1-492 11500 3-32 3-36 4-24 0-052 0-342 2-08 Volume Calls 110002 Puts 26000 Open Interest Calls 490000 Puts 480000 . a. If you chose the strike price of 11100, how much did you pay for the call in dollars? + b. Using the following information for trades taking place on June 10. If you sold the call on June 10, due to a change in circumstances, would you have reaped a profit or loss? Determine the amount of the profit or loss. US TREASURY BONDS (CBOT) $100,000, pts & 64ths of 100 pcte e Calls Puts 1. Strike Price Jule Sep-Dec- Jul Sep Dec 10900- 5-15 0-06 0-584 1-616 11000 3-34 4-31 4-47 0-12 1-10 2-20++ 11100 2-44 3-51 0-22 1-30 2-466 11200 1-59 3-12 3-396 0-374 1-54 3-11 11300 1-19 2-40 0-61 2-18 ! 11400 0-52 2-09 2-46 1-30 2-514 4-17 115002 0-31 1-47 2-22 2-09 3-254 4-57++