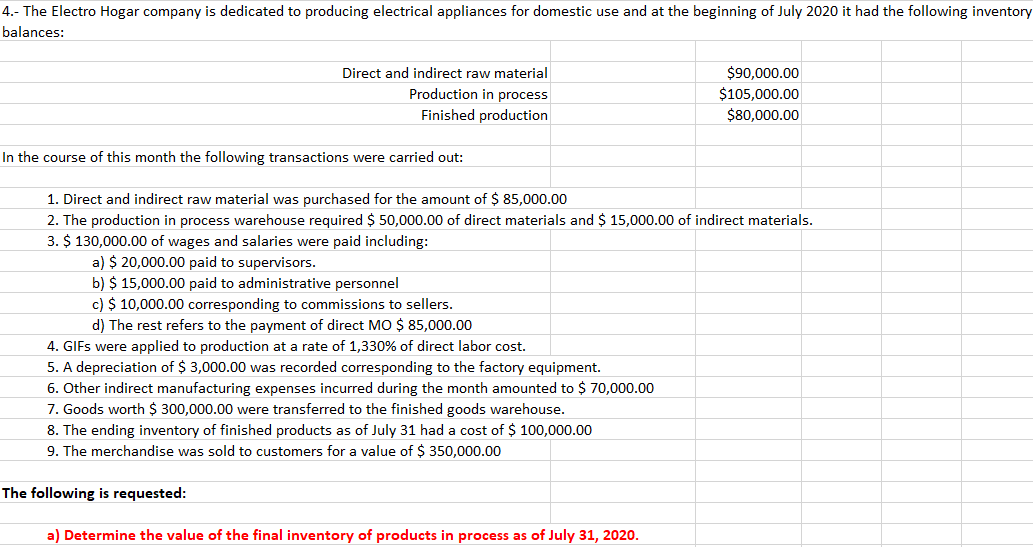

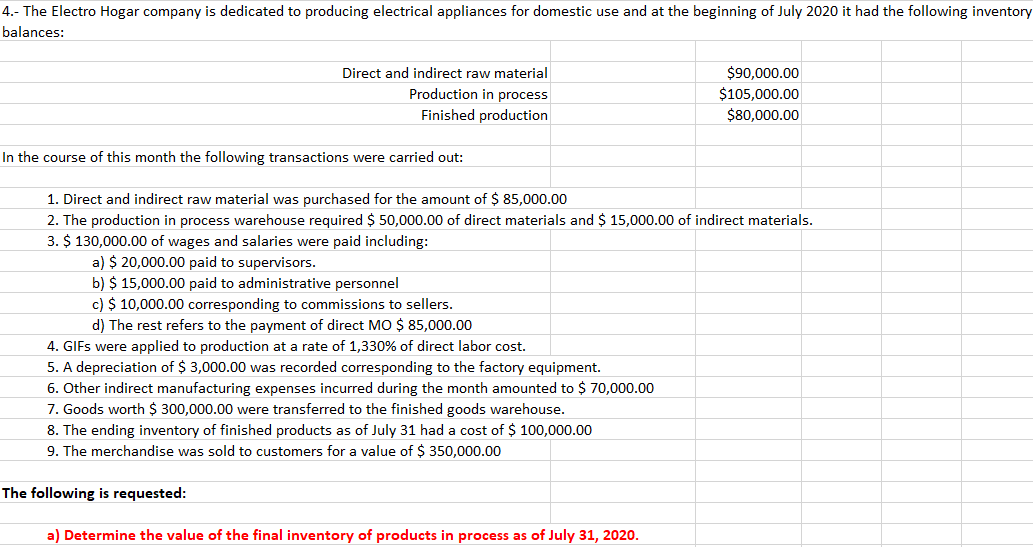

4.- The Electro Hogar company is dedicated to producing electrical appliances for domestic use and at the beginning of July 2020 it had the following inventory balances: Direct and indirect raw material Production in process Finished production $90,000.00 $105,000.00 $80,000.00 In the course of this month the following transactions were carried out: 1. Direct and indirect raw material was purchased for the amount of $ 85,000.00 2. The production in process warehouse required $ 50,000.00 of direct materials and $ 15,000.00 of indirect materials. 3. $ 130,000.00 of wages and salaries were paid including: a) $ 20,000.00 paid to supervisors. b) $ 15,000.00 paid to administrative personnel c) $ 10,000.00 corresponding to commissions to sellers. d) The rest refers to the payment of direct MO $ 85,000.00 4. GIFs were applied to production at a rate of 1,330% of direct labor cost. 5. A depreciation of $3,000.00 was recorded corresponding to the factory equipment. 6. Other indirect manufacturing expenses incurred during the month amounted to $ 70,000.00 7. Goods worth $ 300,000.00 were transferred to the finished goods warehouse. 8. The ending inventory of finished products as of July 31 had a cost of $ 100,000.00 9. The merchandise was sold to customers for a value of $ 350,000.00 The following is requested: a) Determine the value of the final inventory of products in process as of July 31, 2020. 4.- The Electro Hogar company is dedicated to producing electrical appliances for domestic use and at the beginning of July 2020 it had the following inventory balances: Direct and indirect raw material Production in process Finished production $90,000.00 $105,000.00 $80,000.00 In the course of this month the following transactions were carried out: 1. Direct and indirect raw material was purchased for the amount of $ 85,000.00 2. The production in process warehouse required $ 50,000.00 of direct materials and $ 15,000.00 of indirect materials. 3. $ 130,000.00 of wages and salaries were paid including: a) $ 20,000.00 paid to supervisors. b) $ 15,000.00 paid to administrative personnel c) $ 10,000.00 corresponding to commissions to sellers. d) The rest refers to the payment of direct MO $ 85,000.00 4. GIFs were applied to production at a rate of 1,330% of direct labor cost. 5. A depreciation of $3,000.00 was recorded corresponding to the factory equipment. 6. Other indirect manufacturing expenses incurred during the month amounted to $ 70,000.00 7. Goods worth $ 300,000.00 were transferred to the finished goods warehouse. 8. The ending inventory of finished products as of July 31 had a cost of $ 100,000.00 9. The merchandise was sold to customers for a value of $ 350,000.00 The following is requested: a) Determine the value of the final inventory of products in process as of July 31, 2020