Answered step by step

Verified Expert Solution

Question

1 Approved Answer

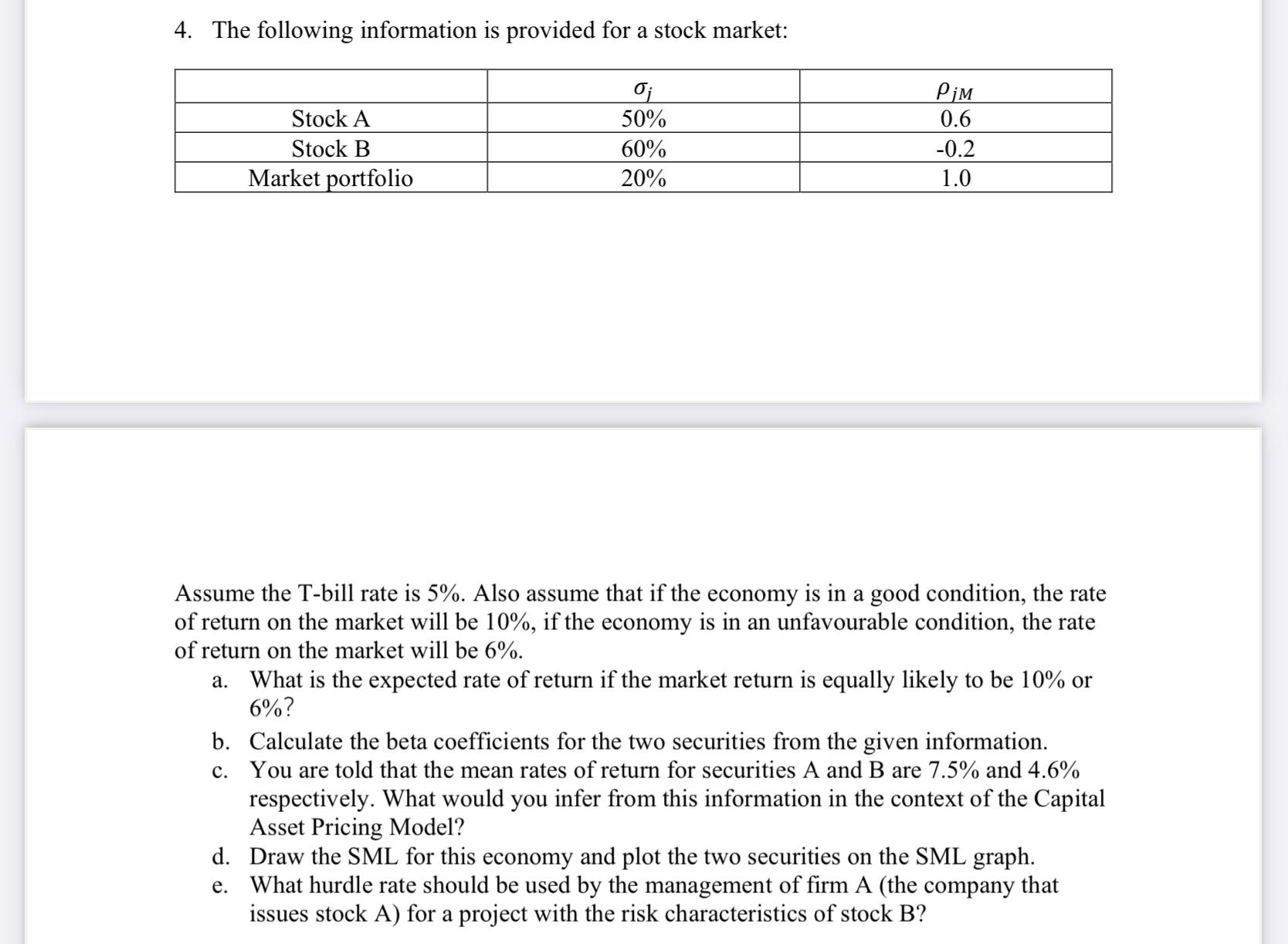

4. The following information is provided for a stock market: Stock A Stock B Market portfolio 50% 60% 20% 0.6 -0.2 1.0 Assume the

4. The following information is provided for a stock market: Stock A Stock B Market portfolio 50% 60% 20% 0.6 -0.2 1.0 Assume the T-bill rate is 5%. Also assume that if the economy is in a good condition, the rate of return on the market will be 10%, if the economy is in an unfavourable condition, the rate of return on the market will be 6%. a. What is the expected rate of return if the market return is equally likely to be 10% or 6%? b. Calculate the beta coefficients for the two securities from the given information. c. You are told that the mean rates of return for securities A and B are 7.5% and 4.6% respectively. What would you infer from this information in the context of the Capital Asset Pricing Model? d. Draw the SML for this economy and plot the two securities on the SML graph. e. What hurdle rate should be used by the management of firm A (the company that issues stock A) for a project with the risk characteristics of stock B?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started