Answered step by step

Verified Expert Solution

Question

1 Approved Answer

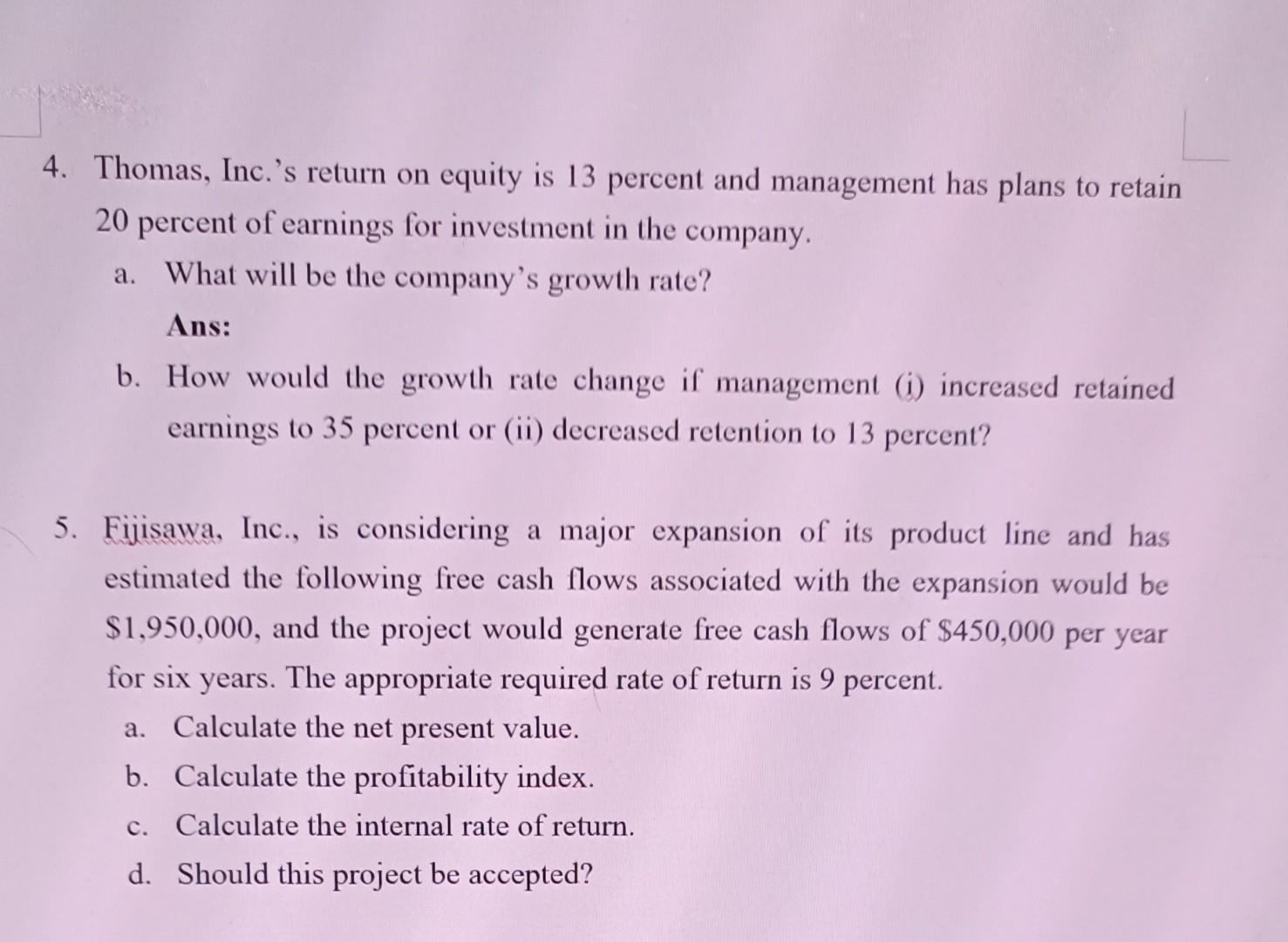

4. Thomas, Inc.'s return on equity is 13 percent and management has plans to retain 20 percent of earnings for investment in the company. a.

4. Thomas, Inc.'s return on equity is 13 percent and management has plans to retain 20 percent of earnings for investment in the company. a. What will be the company's growth rate? Ans: b. How would the growth rate change if management (i) increased retained earnings to 35 percent or (ii) decreased retention to 13 percent? 5. Fijisawa, Inc., is considering a major expansion of its product line and has estimated the following free cash flows associated with the expansion would be $1,950,000, and the project would generate free cash flows of $450,000 per year for six years. The appropriate required rate of return is 9 percent. a. Calculate the net present value. b. Calculate the profitability index. c. Calculate the internal rate of return. d. Should this project be accepted? 4. Thomas, Inc.'s return on equity is 13 percent and management has plans to retain 20 percent of earnings for investment in the company. a. What will be the company's growth rate? Ans: b. How would the growth rate change if management (i) increased retained earnings to 35 percent or (ii) decreased retention to 13 percent? 5. Fijisawa, Inc., is considering a major expansion of its product line and has estimated the following free cash flows associated with the expansion would be $1,950,000, and the project would generate free cash flows of $450,000 per year for six years. The appropriate required rate of return is 9 percent. a. Calculate the net present value. b. Calculate the profitability index. c. Calculate the internal rate of return. d. Should this project be accepted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started