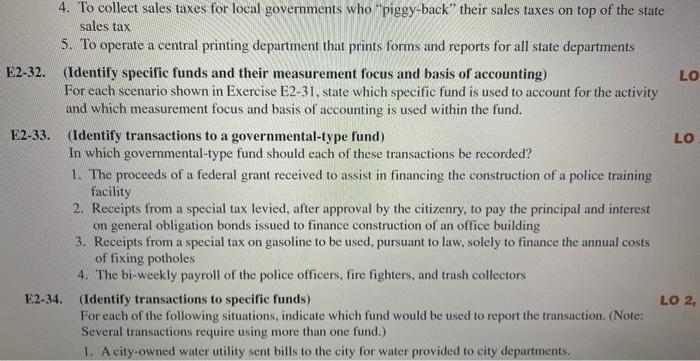

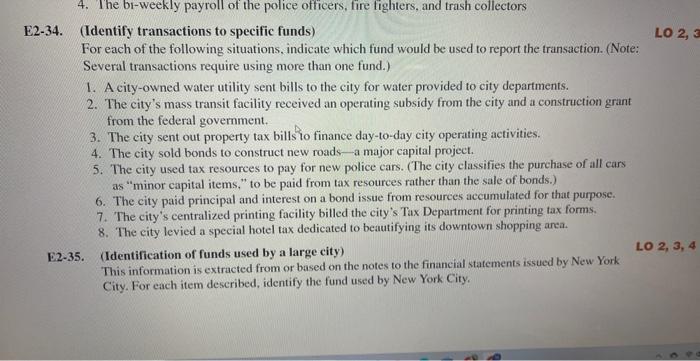

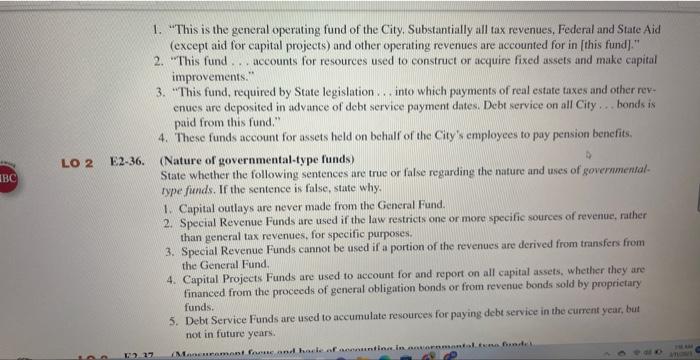

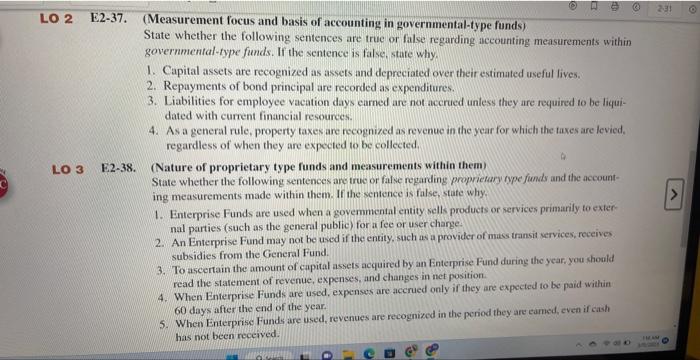

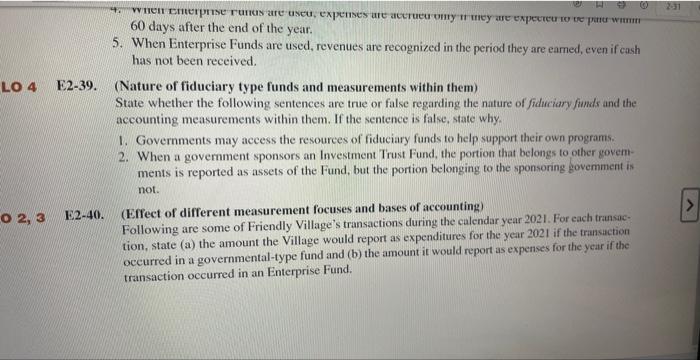

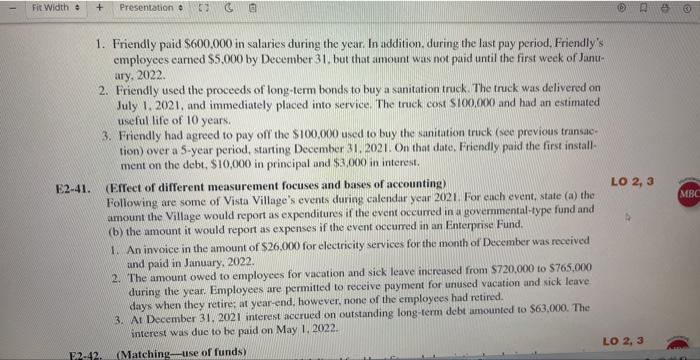

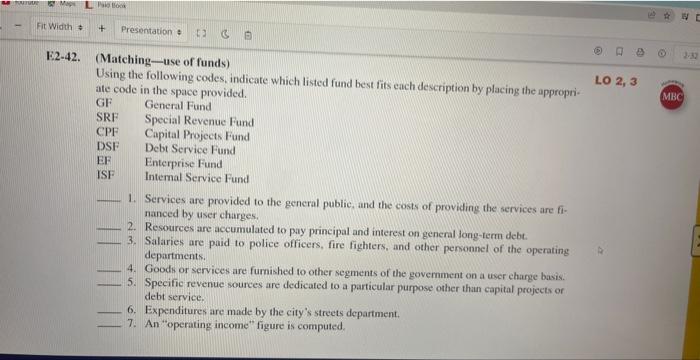

4. To collect sales taxes for local governments who "piggy-back" their sales taxes on top of the state sales tax 5. To operate a central printing department that prints forms and reports for all state departments -32. (Identify specific funds and their measurement focus and basis of accounting) For each scenario shown in Exercise E2-31, state which specific fund is used to account for the activity and which measurement focus and basis of accounting is used within the fund. 2-33. (Identify transactions to a governmental-type fund) In which governmental-type fund should each of these transactions be recorded? 1. The proceeds of a federal grant received to assist in financing the construction of a police training facility 2. Receipts from a special tax levied, after approval by the citizenry, to pay the principal and interest on general obligation bonds issued to finance construction of an office building 3. Receipts from a special tax on gasoline to be used, pursuant to law, solely to finance the annual costs of fixing potholes 4. The bi-weekly payroll of the police officers, fire fighters, and trash collectors E2-34. (Identify transactions to specific funds) For each of the following situations, indicate which fund would be used to report the transaction. (Note: Several transactions require using more than one fund.) 1. A city-owned water utility sent bills to the city for water provided to city deparments. 2-34. (Identify transactions to specific funds) For each of the following situations, indicate which fund would be used to report the transaction. (Note: Several transactions require using more than one fund.) 1. A city-owned water utility sent bills to the city for water provided to city departments. 2. The city's mass transit facility received an operating subsidy from the city and a construction grant from the federal government. 3. The city sent out property tax bills to finance day-to-day city operating activities. 4. The city sold bonds to construct new roads - a major capital project. 5. The city used tax resources to pay for new police cars. (The city classifies the purchase of all cars as "minor capital items," to be paid from tax resources rather than the sale of bonds.) 6. The city paid principal and interest on a bond issue from resources accumulated for that purpose. 7. The city's centralized printing facility billed the city's Tax Department for printing tax forms. 8. The city levied a special hotel tax dedicated to beautifying its downtown shopping anea. E2-35. (Identification of funds used by a large city) This information is extracted from or based on the notes to the financial statements issued by New York City. For each item described, identify the fund used by New York City. 3. "This fund, required by State legislation ... into which payments of real estate taxes and other revenues are deposited in advance of debt service payment dates. Debt service on all City ... bonds is paid from this fund." 4. These funds account for assets held on behalf of the City's employees to pay pension benefits. (Nature of governmental-type funds) State whether the following sentences are true or false regarding the nature and uses of governmentaltype funds. If the sentence is false, state why. 1. Capital outlays are never made from the Gencral Fund. 2. Special Revenue Funds are used if the law restricts one or more specific sourees of revenue, rather than general tax revenues, for specific purposes. 3. Special Revenue Funds cannot be used if a portion of the revenues are derived from transfers from the General Fund. 4. Capital Projects Funds are used to account for and report on all capital assets, whether they are financed from the proceeds of general obligation bonds or from revenue bonds sold by proprictary 5. Debt Service Funds are used to accumulate resources for paying debt service in the current year, but funds. not in future years. 37. (Measurement focus and basis of accounting in governmental-type funds) State whether the following sentences are true or false regarding accounting measurements within governmental-type funds. If the sentence is false, state why. 1. Capital assets are recognized as assets and depreciated over their estimated useful lives. 2. Repayments of bond principal are recorded as expenditures. 3. Liabilities for employee vacation days earned are not accrued unless they are required to be liquidated with current financial resources. 4. As a general rule, property taxes are recognized as revenue in the year for which the taxes are levied, regardless of when they are expected to be collected. 2-38. (Nature of proprietary type funds and measurements within them) State whether the following sentences are true or falve regarding proprietary rype funds and the accounting measurements made within them. If the sentence is false, state why, 1. Enterprise Funds are used when a govemmental entity sells products of services primarily to external parties (such as the general public) for a fee or user charge: 2. An Enterprise Fund may not be used if the entity, such as a provider of mass transit services, receives. subsidies from the General Fund. 3. To ascertain the amount of capital assets acquired by an Enterprise Fund during the year, you should read the statement of revenue, expenses, and changes in net position. 4. When Enterprise Funds are used, expenses are acerued only if they are expected to be paid within 5. When Enterprise Funds are used, revenues are recognized in the period they are eamed, even if eash 60 days after the end of the year. has not been received. 60 days after the end of the year. 5. When Enterprise Funds are used, revenues are recognized in the period they are eamed, even if cash has not been received. (Nature of fiduciary type funds and measurements within them) State whether the following sentences are true or false regarding the nature of fiduciary finds and the accounting measurements within them. If the sentence is false, state why. 1. Governments may aceess the resources of fiduciary funds to help support their own programs. 2. When a government sponsors an Investment Trust Fund, the portion that belongs to other govemments is reported as assets of the Fund, but the portion belonging to the sponsoring govemment is not. (E. (Effect of different measurement focuses and bases of accounting) Following are some of Friendly Village's transactions during the calendar year 2021. For each transaction, state (a) the amount the Village would report as expenditures for the year 2021 if the transuction occurred in a governmental-type fund and (b) the amount it would report as expenses for the year if the transaction occurred in an Enterprise Fund. 1. Friendly paid $600,000 in salaries during the year, In addition, during the last pay period, Friendly's employees earned $5,000 by Deeember 31 , but that amount was not paid until the first week of January, 2022. 2. Friendly used the proceeds of long-term bonds to buy a sanitation truck. The truck was delivered on July 1, 2021, and immediately placed into service. The truck cost $100,000 and had an estimated useful life of 10 years. 3. Friendly had agreed to pay off the $100.000 used to buy the sanitation truck (see previous transaction) over a 5-year period, starting December 31, 2021. On that date, Friendly paid the first install. ment on the debt, $10,000 in principal and $3,000 in interest. 41. (Effect of different measurement focuses and bases of accounting) Following are some of Vista Village's events during calendar year 2021. For cach event, state (a) the amount the Village would report as expenditures if the event occurred in a governmental-type fund and (b) the amount it would report as expenses if the event occurred in an Enterprise Fund. 1. An invoice in the amount of $26,000 for electricity services for the month of Deeember was received and paid in January, 2022. 2. The amount owed to employees for vacation and sick leave increased from $720,000 to $765,000 during the year. Employees are permitted to receive payment for unused vacation and sick leave days when they retire; at year-end, however, none of the employees had retired. 3. At December 31, 2021 interest accrued on outstanding long-term debt amounted to $63,000. The interest was due to be paid on May 1, 2022. 2-42. (Matching-use of funds) Using the following codes, indicate which listed fund best fits each description by placing the appropriate code in the space provided. GF General Fund SRF Special Revenue Fund CPF Capital Projects Fund DSF Debt Service Fund EF Enterprise Fund ISF Internal Service Fund 1. Services are provided to the general public, and the costs of providing the services are financed by user charges. 2. Resources are aceumulated to pay principal and interest on general long-term debt. 3. Salaries are paid to police officers, fire fighters, and other penonnel of the operating departments. 4. Goods or services are fumished to other segments of the govemment on a user charge basis. 5. Specific revenue sources are dedicated to a particular purpose other than capital projects of debt service. 6. Expenditures are made by the city's streets department. 7. An "operating income" figure is computed