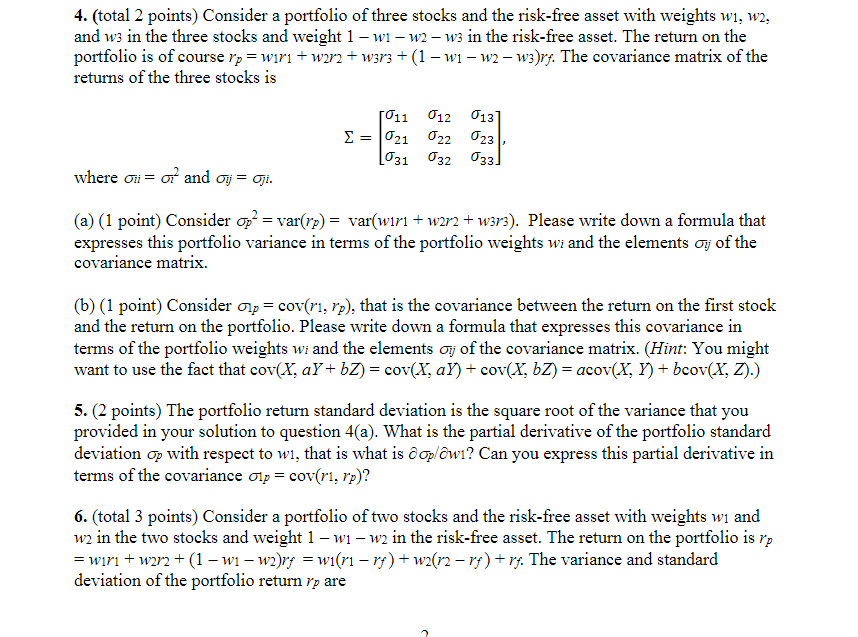

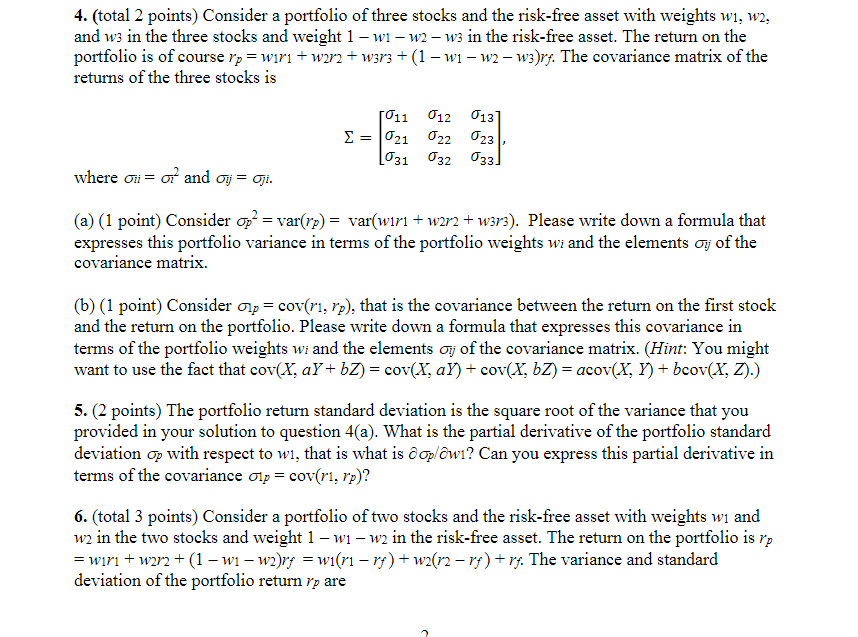

4. (total 2 points) Consider a portfolio of three stocks and the risk-free asset with weights w1, W2, and ws in the three stocks and weight 1 - wi W2 w3 in the risk-free asset. The return on the portfolio is of course rp= wiri + w2r2 + w3r3 + (1 - wi W2 w3)rf. The covariance matrix of the returns of the three stocks is 011 012 013 E = 021 022 [031 032 033) = 023 where on = of and oij = Oji. (a) (1 point) Consider op? = var(rp) = var(wiri + w2r2 + w3r3). Please write down a formula that expresses this portfolio variance in terms of the portfolio weights wi and the elements oy of the covariance matrix. (b) (1 point) Consider Olp = cov(ri, rp), that is the covariance between the return on the first stock and the return on the portfolio. Please write down a formula that expresses this covariance in terms of the portfolio weights wi and the elements Oj of the covariance matrix. (Hint: You might want to use the fact that cov(X, aY+bZ) = cov(X, aY) + cov(X, bZ) = acov(X, Y) + bcov(X, Z).) 5. (2 points) The portfolio return standard deviation is the square root of the variance that you provided in your solution to question 4(a). What is the partial derivative of the portfolio standard deviation op with respect to wi, that is what is coplwi? Can you express this partial derivative in terms of the covariance Olp = cov(ri, rp)? 6. (total 3 points) Consider a portfolio of two stocks and the risk-free asset with weights wi and w2 in the two stocks and weight 1 - W1 w2 in the risk-free asset. The return on the portfolio is rp = wir + win2 + (1 - wi Wa)ry = wiri rf) + w2(r2 rf) + rf. The variance and standard deviation of the portfolio return rp are 4. (total 2 points) Consider a portfolio of three stocks and the risk-free asset with weights w1, W2, and ws in the three stocks and weight 1 - wi W2 w3 in the risk-free asset. The return on the portfolio is of course rp= wiri + w2r2 + w3r3 + (1 - wi W2 w3)rf. The covariance matrix of the returns of the three stocks is 011 012 013 E = 021 022 [031 032 033) = 023 where on = of and oij = Oji. (a) (1 point) Consider op? = var(rp) = var(wiri + w2r2 + w3r3). Please write down a formula that expresses this portfolio variance in terms of the portfolio weights wi and the elements oy of the covariance matrix. (b) (1 point) Consider Olp = cov(ri, rp), that is the covariance between the return on the first stock and the return on the portfolio. Please write down a formula that expresses this covariance in terms of the portfolio weights wi and the elements Oj of the covariance matrix. (Hint: You might want to use the fact that cov(X, aY+bZ) = cov(X, aY) + cov(X, bZ) = acov(X, Y) + bcov(X, Z).) 5. (2 points) The portfolio return standard deviation is the square root of the variance that you provided in your solution to question 4(a). What is the partial derivative of the portfolio standard deviation op with respect to wi, that is what is coplwi? Can you express this partial derivative in terms of the covariance Olp = cov(ri, rp)? 6. (total 3 points) Consider a portfolio of two stocks and the risk-free asset with weights wi and w2 in the two stocks and weight 1 - W1 w2 in the risk-free asset. The return on the portfolio is rp = wir + win2 + (1 - wi Wa)ry = wiri rf) + w2(r2 rf) + rf. The variance and standard deviation of the portfolio return rp are