Question

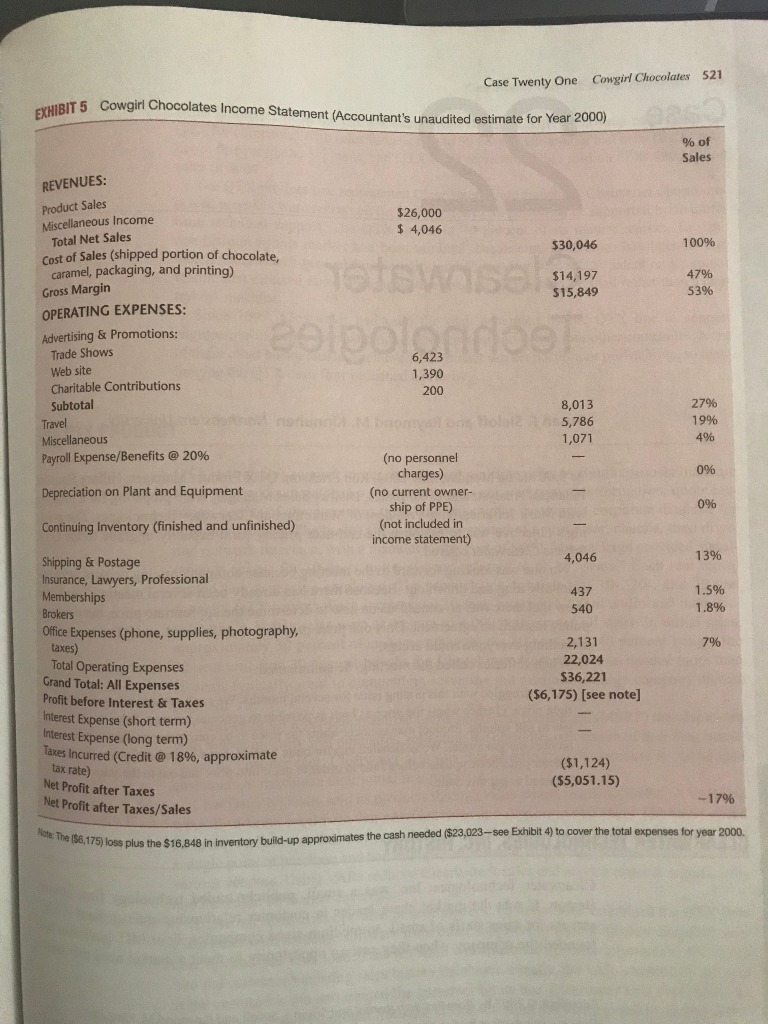

4. Use information in Exhibit 5, attempt to compute the breakeven revenue for three different conditions: (1) assumes Marilyn wants to cover only the annual

4. Use information in Exhibit 5, attempt to compute the breakeven revenue for three different conditions: (1) assumes Marilyn wants to cover only the annual fixed costs through operations, and without paying a salary for herself; (2) assumes Marilyn wants to cover the annual fixed costs, and charges a modest $30,000 in salary and benefits, to cover her cost of inventory, her previous years loss and some other personal expenses; (3) assumes Marilyn can manage to cut the Cost of Sales by 10%, and she wants to cover the annual fixed costs and charges a modest $30,000 in salary and benefits. (20 points)

4. Use information in Exhibit 5, attempt to compute the breakeven revenue for three different conditions: (1) assumes Marilyn wants to cover only the annual fixed costs through operations, and without paying a salary for herself; (2) assumes Marilyn wants to cover the annual fixed costs, and charges a modest $30,000 in salary and benefits, to cover her cost of inventory, her previous years loss and some other personal expenses; (3) assumes Marilyn can manage to cut the Cost of Sales by 10%, and she wants to cover the annual fixed costs and charges a modest $30,000 in salary and benefits. (20 points)

Hints: The key is to identify fixed and variable costs from Exhibit 5, because

Breakeven Sales Revenue = Fixed Operating Costs/ 1 - (Variable Costs/Net Sales)

You may opt to provide detailed explanations, justifications and computation step by step. This will help you to earn partial points.

5. Please attempt a percentage of sales pro forma analysis and conduct a Cowgirl Chocolates Financial Forecasts. (20 points)

Marilyn has two proposals (A and B) for her business expansion in 2001. Proposal A is a modest one. The numbers in column 1 and column 2 of Table 1 can be rationalized by simply assuming that Marilyn is successful in obtaining a large regional or national distributor contract that would yield $140,300 in sales. Please study the % numbers and the $ values carefully to understand the rationale and inter-relationship among these numbers. Then, try to finish the unknown ?%s and $?s for Proposal B in column 3 and column 4, for which Marilyn is attempting to achieve an ambitious $300,000 in sales.

After you finish your computation, just replace the ?%s and $?s in the table with your answer. During the process, please make your reasonable assumptions. It is recommended to think about some basic ?%s, define them first, and then finish the computation for the $?s. Your recommendation will help Marilyn to make the final decision for business development. For your ease, some numbers are provided already.

Hints: Besides filling the unknowns, you may opt to provide additional explanations, justifications and computations to me in writing. This will help you to earn partial points.

Table 1. Cowgirl Chocolates Financial Forecast with Assumed National Contract and in Operating Improvements in Operating Cost Percentages

| Revenue | 2001 | % Of | 2001 | % Of |

| Proposal A | Sales | Proposal B | Sales | |

| Column 1 | Column 2 | Column 3 | Column 4 | |

| Product Sales | $122,000 | 85% | $255,000 | 85% |

| Miscellaneous Income | $18,300 | 15% | $? | 15% |

| Total Net Sales | $140,300 | 100% | $300,000 | 100% |

| Cost of Sales (shipped portion of Choc,Caramel, Packaging, and Printing) | $56,120 | 40% | $? | ?% |

| Gross Margin | $84, 180 | $? | ||

| (% Gross Margin) | 60% | ?% | ||

| Operating Expenses | ||||

| Advertising/Promotion | ||||

| Trade Shows | $7,500 | $? | ||

| Web site | $1,500 | $? | ||

| Subtotal, Advertising And Promotion | $9,000 | 6.40% | $? | ?% |

| Travel | $14,030 | 10.00% | $? | ?% |

| Miscellaneous | $2,806 | 2.00% | $? | ?% |

| Payroll Expense/Benefits (@20%) | $23,000 | Marilyn's salary | $30,000 | Marilyn's salary |

| Shipping and Postage | $18,300 | 15% of product sales | $? | 15% of product sales |

| Insurance, Lawyers, Prof. Memberships | $2,525 | 1.80% | $5,400 | 1.80% |

| Brokers | $4,209 | 3.00% | $6,000 | 2.00% |

| Office Expenses (phone, supplies, photography, taxes) | $4,209 | 3.00% | $9,000 | 3.00% |

| Total Operating Expenses | $78,079 | $? | ||

| Grand Total All Expenses | $134,199 | $? | ||

| Profit Before Interest and Taxes | $6,101 | $? | ||

| Taxes Incurred (Credit @18% -approx tax rate) | $1,098 | $? | ||

| Net Profit After Taxes | $5,002 | $? | ||

| (Net Profit After Taxes / Sales) | 3.57% | $? |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started