Answered step by step

Verified Expert Solution

Question

1 Approved Answer

( 4 ) Use the file hw 2 . xls for this question. The file contains the expected excess returns E ( r ) -

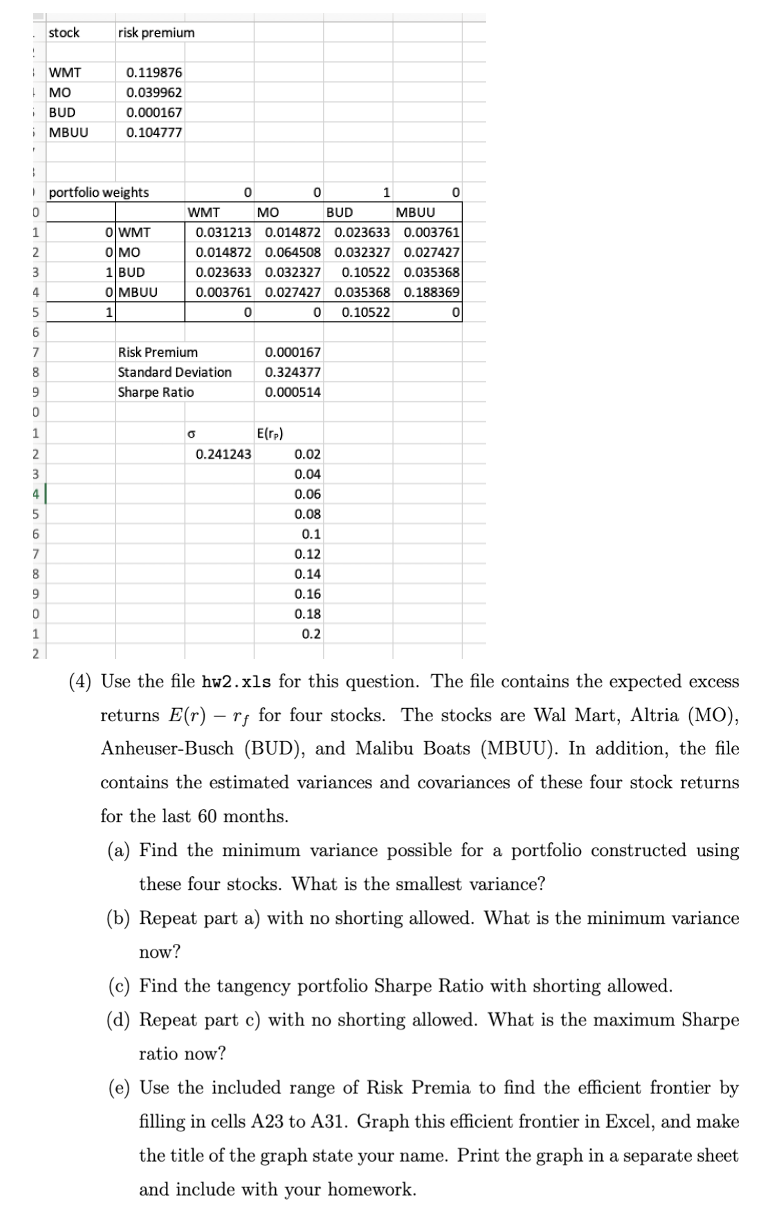

Use the file hwxls for this question. The file contains the expected excess

returns for four stocks. The stocks are Wal Mart, Altria MO

AnheuserBusch BUD and Malibu Boats MBUU In addition, the file

contains the estimated variances and covariances of these four stock returns

for the last months.

a Find the minimum variance possible for a portfolio constructed using

these four stocks. What is the smallest variance?

b Repeat part a with no shorting allowed. What is the minimum variance

now?

c Find the tangency portfolio Sharpe Ratio with shorting allowed.

d Repeat part c with no shorting allowed. What is the maximum Sharpe

ratio now?

e Use the included range of Risk Premia to find the efficient frontier by

filling in cells A to A Graph this efficient frontier in Excel, and make

the title of the graph state your name. Print the graph in a separate sheet

and include with your homework.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started