4. Which product categories should Coca-Cola India consider entering into or expanding within to become a total beverage company, and why?

thank you.

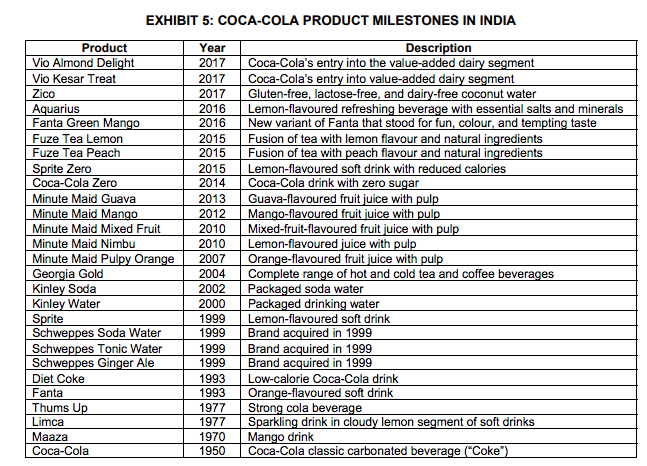

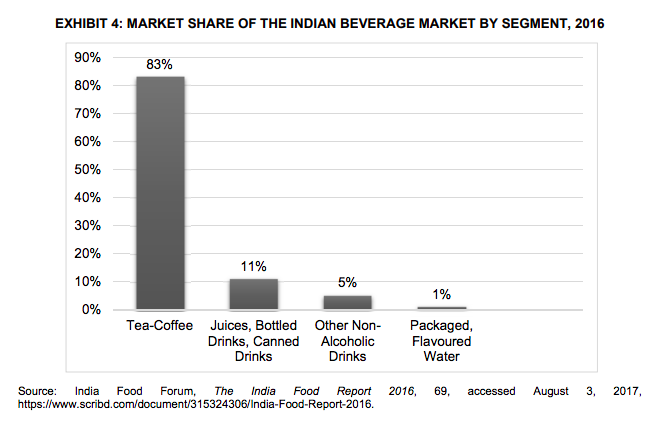

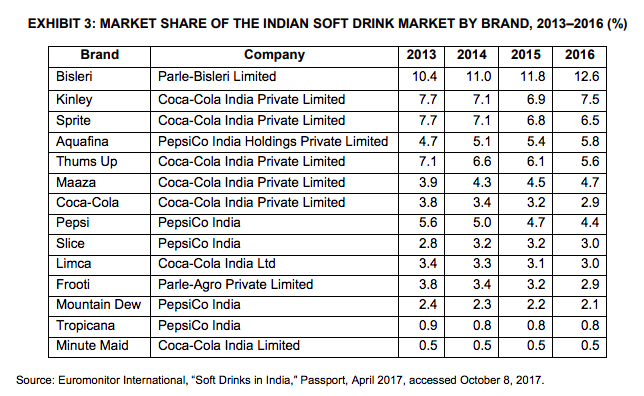

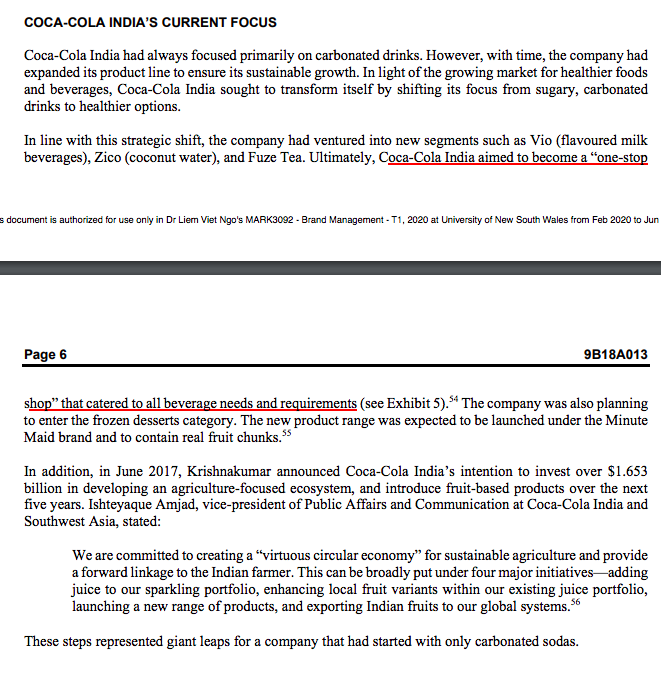

EXHIBIT 5: COCA-COLA PRODUCT MILESTONES IN INDIA Product Year Description Vio Almond Delight 2017 Coca-Cola's entry into the value-added dairy segment Vio Kesar Treat 2017 Coca-Cola's entry into value-added dairy segment Zico 2017 Gluten-free, lactose-free, and dairy-free coconut water Aquarius 2016 Lemon-flavoured refreshing beverage with essential salts and minerals Fanta Green Mango 2016 New variant of Fanta that stood for fun, colour, and tempting taste Fuze Tea Lemon 2015 Fusion of tea with lemon flavour and natural ingredients Fuze Tea Peach 2015 Fusion of tea with peach flavour and natural ingredients Sprite Zero 2015 Lemon-flavoured soft drink with reduced calories Coca-Cola Zero 2014 Coca-Cola drink with zero sugar Minute Maid Guava 2013 Guava-flavoured fruit juice with pulp Minute Maid Mango 2012 Mango-flavoured fruit juice with pulp Minute Maid Mixed Fruit 2010 Mixed-fruit-flavoured fruit juice with pulp Minute Maid Nimbu 2010 Lemon-flavoured juice with pulp Minute Maid Pulpy Orange 2007 Orange-flavoured fruit juice with pulp Georgia Gold 2004 Complete range of hot and cold tea and coffee beverages Kinley Soda 2002 Packaged soda water Kinley Water 2000 Packaged drinking water Sprite 1999 Lemon-flavoured soft drink Schweppes Soda Water 1999 Brand acquired in 1999 Schweppes Tonic Water 1999 Brand acquired in 1999 Schweppes Ginger Ale 1999 Brand acquired in 1999 Diet Coke 1993 Low-calorie Coca-Cola drink Fanta 1993 Orange-flavoured soft drink Thums Up 1977 Strong cola beverage Limca 1977 Sparkling drink in cloudy lemon segment of soft drinks Maaza 1970 Mango drink Coca-Cola 1950 Coca-Cola classic carbonated beverage ("Coke")EXHIBIT 4: MARKET SHARE OF THE INDIAN BEVERAGE MARKET BY SEGMENT, 2016 90% 83% 80% 70% 60% 50% 40% 30% 20% 11% 10% 5% 1% 0% Tea-Coffee Juices, Bottled Other Non- Packaged, Drinks, Canned Alcoholic Flavoured Drinks Drinks Water Source: India Food Forum, The India Food Report 2016, 69, accessed August 3, 2017, https://www.scribd.com/document/315324306/India-Food-Report-2016.EXHIBIT 3: MARKET SHARE OF THE INDIAN SOFT DRINK MARKET BY BRAND, 2013-2016 (%) Brand Company 2013 2014 2015 2016 Bisleri Parle-Bisleri Limited 10.4 11.0 11.8 12.6 Kinley Coca-Cola India Private Limited 7.7 7.1 6.9 7.5 Sprite Coca-Cola India Private Limited 7.7 7.1 6.8 6.5 Aquafina PepsiCo India Holdings Private Limited 4.7 5.1 5.4 5.8 Thums Up Coca-Cola India Private Limited 7.1 6.6 6.1 5.6 Maaza Coca-Cola India Private Limited 3.9 4.3 4.5 4.7 Coca-Cola Coca-Cola India Private Limited 3.8 3.4 3.2 2.9 Pepsi PepsiCo India 5.6 5.0 4.7 4.4 Slice PepsiCo India 2.8 3.2 3.2 3.0 Limca Coca-Cola India Ltd 3.4 3.3 3.1 3.0 Frooti Parle-Agro Private Limited 3.8 3.4 3.2 2.9 Mountain Dew PepsiCo India 2.4 2.3 2.2 2.1 Tropicana PepsiCo India 0.9 0.8 0.8 0.8 Minute Maid Coca-Cola India Limited 0.5 0.5 0.5 0.5 Source: Euromonitor International, "Soft Drinks in India," Passport, April 2017, accessed October 8, 2017.COCA-COLA INDIA'S CURRENT FOCUS Coca-Cola India had always focused primarily on carbonated drinks. However, with time, the company had expanded its product line to ensure its sustainable growth. In light of the growing market for healthier foods and beverages, Coca-Cola India sought to transform itself by shifting its focus from sugary, carbonated drinks to healthier options. In line with this strategic shift, the company had ventured into new segments such as Vio (flavoured milk beverages), Zico (coconut water), and Fuze Tea. Ultimately, Coca-Cola India aimed to become a "one-stop document is authorized for use only in Dr Liem Viet Ngo's MARK3092 - Brand Management - T1, 2020 at University of New South Wales from Feb 2020 to Jun Page 6 9B18A013 shop" that catered to all beverage needs and requirements (see Exhibit 5)." The company was also planning to enter the frozen desserts category. The new product range was expected to be launched under the Minute Maid brand and to contain real fruit chunks." In addition, in June 2017, Krishnakumar announced Coca-Cola India's intention to invest over $1.653 billion in developing an agriculture-focused ecosystem, and introduce fruit-based products over the next five years. Ishteyaque Amjad, vice-president of Public Affairs and Communication at Coca-Cola India and Southwest Asia, stated: We are committed to creating a "virtuous circular economy" for sustainable agriculture and provide a forward linkage to the Indian farmer. This can be broadly put under four major initiatives-adding juice to our sparkling portfolio, enhancing local fruit variants within our existing juice portfolio, launching a new range of products, and exporting Indian fruits to our global systems." These steps represented giant leaps for a company that had started with only carbonated sodas.INDIA'S EVOLVING CUSTOMERS India's economy was growing quickly, and the country was expected to be the third-largest consumer market by 2025; its consumption expenditures were predicted to rise to an estimated $4 trillion."In light of ongoing technological and lifestyle changes, Indian consumers were becoming more demanding and more value conscious."" Increasing urbanization (driven by higher salaries), a younger population, more women in the workforce, and the rapid growth and spread of the retail sector had all led to changes in Indian Consumers' buying habits." Rapid urbanization and growing affluente meant that customers were willing to spend more, and changing household structures (from joint to nuclear family groups) meant increased emphasis on keeping up with certain lifestyle trends. Estimates suggested that nuclear households would comprise around 74 per cent of Indian households by 2025. Furthermore, Internet penetration, which was expected to reach around 55 per cent of India's population by 2025, enabled greater awareness about well-being and health." These changes towards a faster-paced lifestyle in Indian society required changes in the food and beverage industry as well. More and more consumers looked for options that catered to their health and well-being and that were easy to consume. According to one survey, about 46 per cent of Indian consumers expected their food to be healthier by 2025." This expectation led to an increase in functional food and beverage market offerings in India, and the market for such products was predicted to reach $3.2 billion by 2022. Notably, functional beverages included juice, vitamin water, tea, and energy drinks-not sugary sodas."THE INDIAN SOFT DRINK MARKET At the time of Ruggiero's announcement in June 2017, India was home to 1.34 billion people with a median age of 27 years."This meant that the Indian non-alcoholic beverage industry had a huge customer base. The India Food Report 2016 valued India's beverage industry at $19.5 billion, with a growth rate of 20-23 per cent." acument is authorized for use only in Dr Liem Viet Ngo's MARK3092 - Brand Management - T1, 2020 at University of New South Wales from Feb 2020 to Jun Page 3 9B18A013 This market-which was expected to grow up to 3.5 times by 2020-was led by hot beverages; tea and coffee accounted for 83 per cent of the market share (see Exhibit 4). "Other categories in the market included powdered drinks, health drinks, juices, and mineral and flavoured water. Although almost half the soft drink market in India was dominated by carbonated drinks, juices and milk-based beverages were growing rapidly, with juices and juice-based drinks growing at a compound annual growth rate of 28 per cent between 2010 and 2015 (carbonated drinks grew just 13 per cent in the same period)." The 2016 sales figures revealed that juices and fruit drinks Real, Slice, Tropicana, Rooh Afza, and Tang had pushed Pepsi and Coke out of the top five best-selling brands in India. Moreover, local juice manufacturers like Manpasand Beverages had become extremely successful, earning revenues of $5.5 billion" in 2016, while juice and cold-pressed juice companies like Paper Boat saw fresh rounds of investment, anticipating the tremendous growth potential of juice and health drinks." Larger markets like Delhi, Madhya Pradesh, Uttar Pradesh, and Tamil Nadu also saw the emergence of local beverage manufacturers; Jayanti Beverages, Xalta, Campa Cola, and Hajoori & Sons all showed consistent growth as they carved into the market share of traditional carbonated drinks."The introduction of local flavours (e.g., jaljeera (spicy roasted cumin) and aampanna (roasted raw mango)) and an increasingly health-aware customer base were seen as key growth drivers for juices