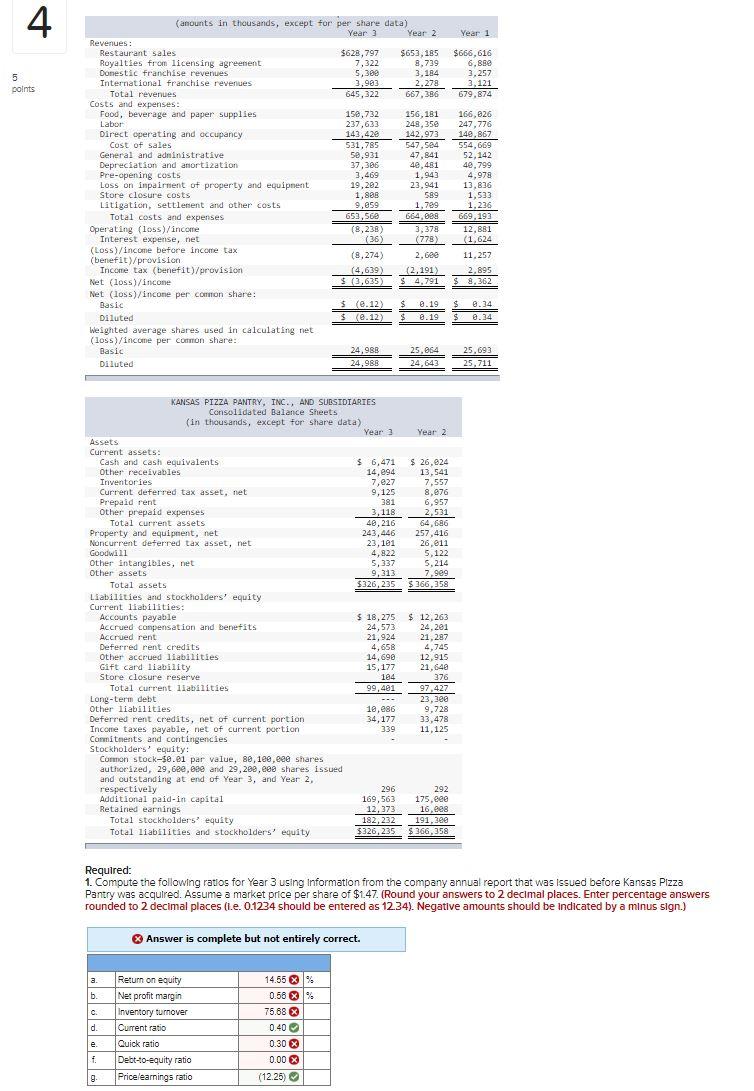

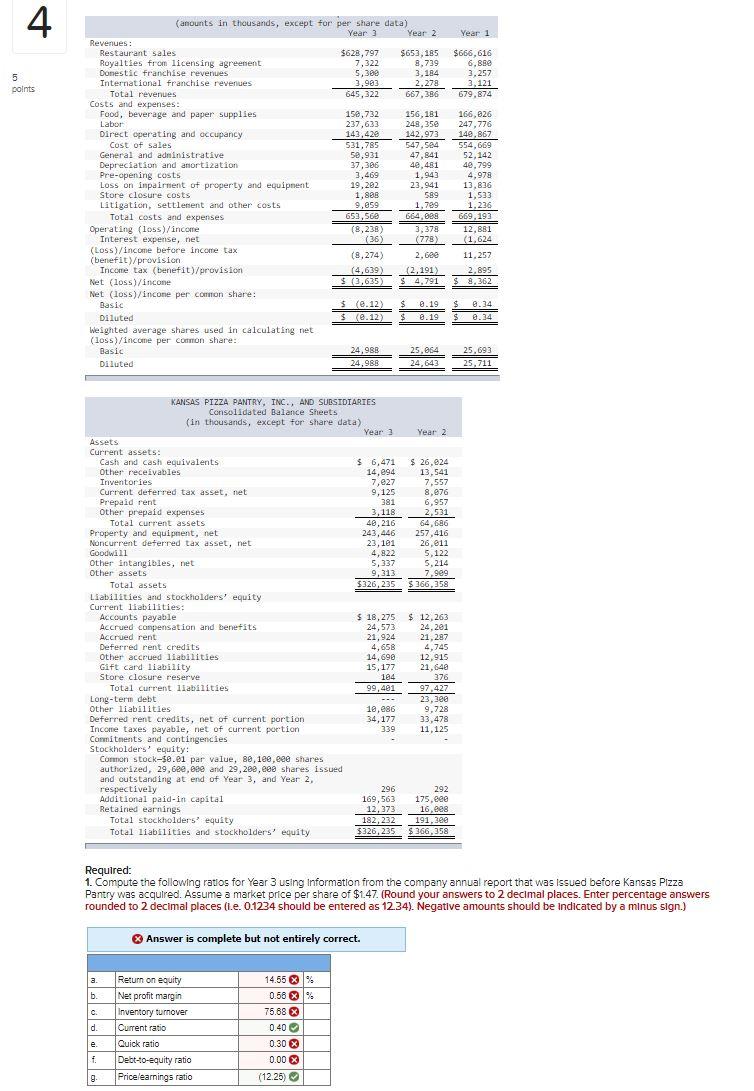

4 Year 1 5 points $666,616 6.880 3.257 3,121 679,874 (amounts in thousands, except for per share data) Year 3 Year 2 Revenues : Restaurant sales $628,797 $653,185 Royalties from licensing agreement 7,322 8.739 Domestic franchise revenues 5,380 3.184 International franchise revenues 3,983 2.278 Total revenues 645, 322 667,386 Costs and expenses: Food, beverage and paper supplies 158,732 156,181 Labor 237,633 248,350 Direct operating and occupancy 143,428 142,973 Cost of sales 531,785 547.524 General and administrative 50,931 47,841 Depreciation and anortization 37,386 40,481 Pre-opening costs 3,469 1.943 Loss on impairment of property and equipment 19,202 23.941 Store closure costs 1,885 589 Litigation, settlement and other costs 9,859 1,789 Total costs and expenses 653,560 664,888 Operating (loss)/income (8,238) 3.378 Interest expense, net (36) (778) (Loss)/income before income tax (8,274) 2.600 (benefit/provision Income tax (benefit/provision (4,639) (2.191) Net (loss)/income $ (3,635 S 4.791 ) $ Net (loss)/incone per common share: Basic $ (9.12) $ 0.19 Diluted $ (@.12) $ 8.19 Weighted average shares used in calculating net (loss) /income per common share: Basic 24,988 25.064 Diluted 24,988 24,643 166,026 247,776 149,867 554,669 52,142 40.799 4,978 13.836 1,533 1,236 669,193 12,881 (1,624 11.257 2,895 $ 8.362 $ $ 0.34 0.34 25.693 25,711 KANSAS PIZZA PANTRY, INC., AND SUBSIDIARIES Consolidated Balance Sheets (in thousands, except for share data) Year 3 Year 2 Assets Current assets: Cash and cash equivalents $ 6,471 $ 26.024 Other receivables 14,094 13,541 Inventories 7,627 7.557 Current deferred tax asset, net 9,125 8,076 Prepaid rent 381 6,957 Other prepaid expenses 3,118 2,531 Total current assets 48,216 64,686 Property and equipment, net 243, 446 257,416 Noncurrent deferred tax asset, net 23,101 26.011 Goodwill 4,822 5.122 Other intangibles, net 5,337 5,214 Other assets 9,313 7.909 Total assets $326, 235 $366, 358 $ Liabilities and stockholders' equity Current liabilities: Accounts payable $ 18,275 $ 12,263 24,573 24,201 Accrued Pensation and benefits 21,924 21,287 Deferred rent credits 4,658 4,745 Other accrued liabilities 14.690 12,915 Gift card liability 15,177 21,640 Store closure reserve 184 376 Total current liabilities 99,481 97,427 Long-term debt --- 23,388 Other liabilities 12,086 9.728 Deferred rent credits, net of current portion 34,177 33,478 Income taxes payable, net of current portion 339 11,125 Commitments and contingencies Stockholders' equity: Comon stock-se.e1 par value, 80,1ee, eee shares authorized, 29,688,889 and 29, 280,000 shares issued and outstanding at end of Year 3, and Year 2, 296 292 Additional paid in capital 169,563 175.ee Retained earnings 12, 373 16,08 Total stockholders' equity 182,232 191,300 Total liabilities and stockholders' equity $326,235 $366,358 respectively Required: 1. Compute the following ratios for Year 3 using Information from the company annual report that was issued before Kansas Pizza Pantry was acquired. Assume a market price per share of $1.47. (Round your answers to 2 decimal places. Enter percentage answers rounded to 2 decimal places (i.e. 0.1234 should be entered as 12.34). Negative amounts should be indicated by a minus sign.) Answer is complete but not entirely correct. a. b. c. d. Return on equity Net profit margin Inventory turnover Current ratio Quick ratio Debt-to-equity ratio Pricelearnings ratio 14.55 % 0.56 % 75.68 0.40 0.30 % 0.00 (12.25) e. . 9