Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4. You observe a convertible bond issued by BetaCorp trading at $875. It has four years until maturity, an annual coupon rate of 2% (assume

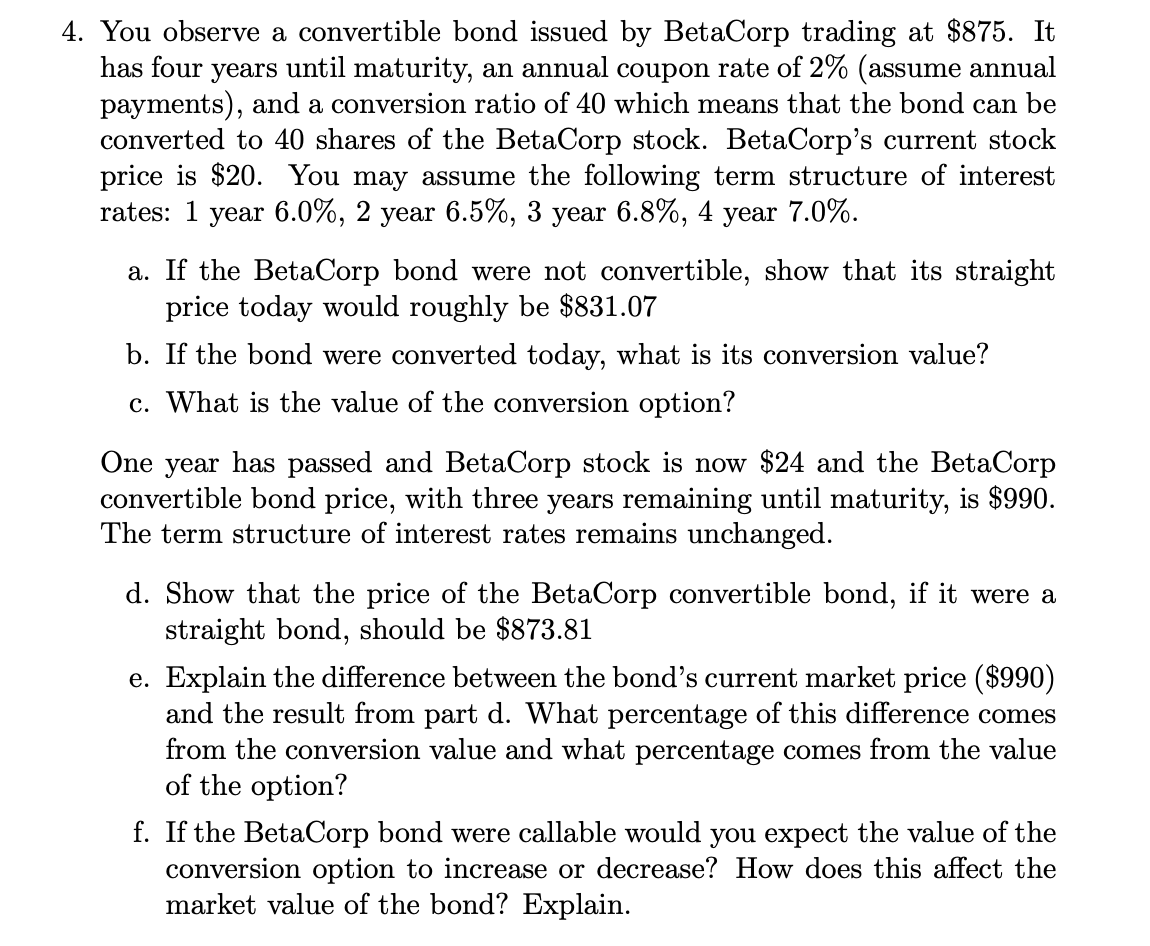

4. You observe a convertible bond issued by BetaCorp trading at $875. It has four years until maturity, an annual coupon rate of 2% (assume annual payments), and a conversion ratio of 40 which means that the bond can be converted to 40 shares of the BetaCorp stock. BetaCorp's current stock price is $20. You may assume the following term structure of interest rates: 1 year 6.0%,2 year 6.5%,3 year 6.8%,4 year 7.0%. a. If the BetaCorp bond were not convertible, show that its straight price today would roughly be $831.07 b. If the bond were converted today, what is its conversion value? c. What is the value of the conversion option? One year has passed and BetaCorp stock is now $24 and the BetaCorp convertible bond price, with three years remaining until maturity, is $990. The term structure of interest rates remains unchanged. d. Show that the price of the BetaCorp convertible bond, if it were a straight bond, should be $873.81 e. Explain the difference between the bond's current market price ($990) and the result from part d. What percentage of this difference comes from the conversion value and what percentage comes from the value of the option? f. If the BetaCorp bond were callable would you expect the value of the conversion option to increase or decrease? How does this affect the market value of the bond? Explain

4. You observe a convertible bond issued by BetaCorp trading at $875. It has four years until maturity, an annual coupon rate of 2% (assume annual payments), and a conversion ratio of 40 which means that the bond can be converted to 40 shares of the BetaCorp stock. BetaCorp's current stock price is $20. You may assume the following term structure of interest rates: 1 year 6.0%,2 year 6.5%,3 year 6.8%,4 year 7.0%. a. If the BetaCorp bond were not convertible, show that its straight price today would roughly be $831.07 b. If the bond were converted today, what is its conversion value? c. What is the value of the conversion option? One year has passed and BetaCorp stock is now $24 and the BetaCorp convertible bond price, with three years remaining until maturity, is $990. The term structure of interest rates remains unchanged. d. Show that the price of the BetaCorp convertible bond, if it were a straight bond, should be $873.81 e. Explain the difference between the bond's current market price ($990) and the result from part d. What percentage of this difference comes from the conversion value and what percentage comes from the value of the option? f. If the BetaCorp bond were callable would you expect the value of the conversion option to increase or decrease? How does this affect the market value of the bond? Explain Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started