Answered step by step

Verified Expert Solution

Question

1 Approved Answer

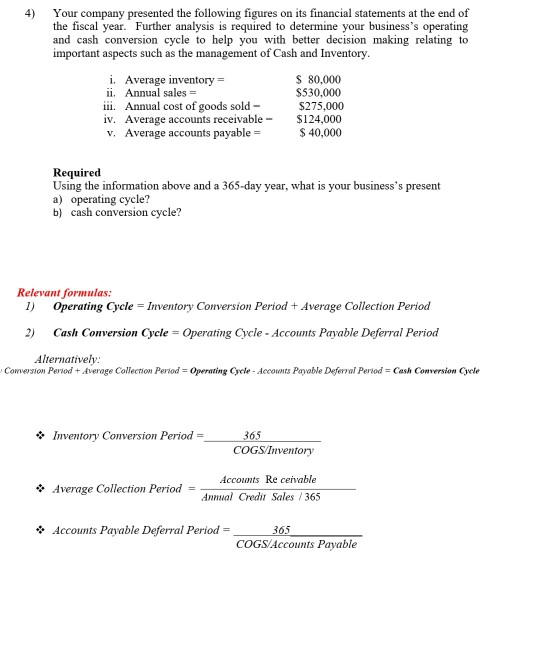

4) Your company presented the following figures on its financial statements at the end of the fiscal year. Further analysis is required to determine your

4) Your company presented the following figures on its financial statements at the end of the fiscal year. Further analysis is required to determine your business's operating and cash conversion cycle to help you with better decision making relating to important aspects such as the management of Cash and Inventory. i. Average inventory = ul. Annual sales = iii. Annual cost of goods sold - iv. Average accounts receivable - V. Average accounts payable = $ 80,000 $530,000 $275.000 $124,000 $ 40,000 Required Using the information above and a 365-day year, what is your business's present a) operating cycle? b) cash conversion cycle? Relevant formulas: 1) Operating Cycle Inventory Conversion Period + Average Collection Period 2) Cash Conversion Cycle = Operating Cycle - Accounts Payable Deferral Period Alternatively: Comasion Period + Average Collection Period = Operating Cycle - Accounts Payable Deferral Period Cash Conversion Cule Inventory Conversion Period = 365 COGS Inventory Accounts Receivable Average Collection Period = - Annual Credit Sales/365 Accounts Payable Deferral Period=_ 365 COGS Accounts Payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started