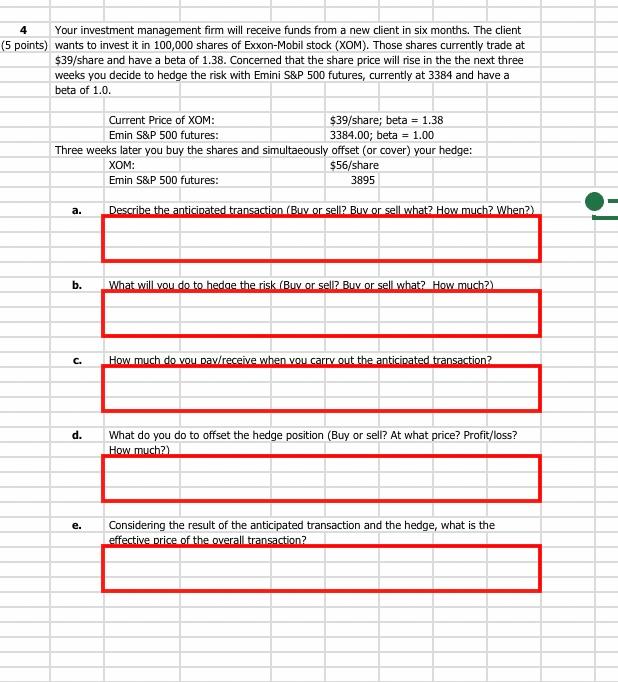

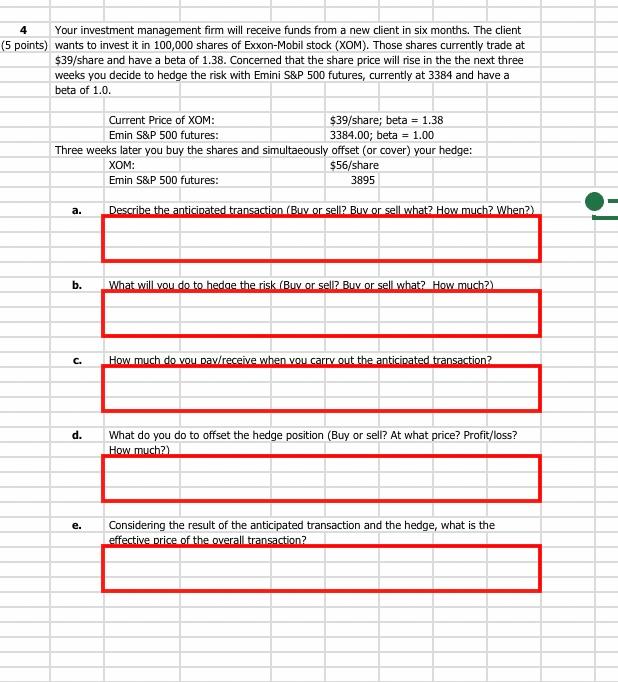

4 Your investment management firm will receive funds from a new client in six months. The client (5 points) wants to invest it in 100,000 shares of Exxon-Mobil stock (XOM). Those shares currently trade at $39/share and have a beta of 1.38. Concerned that the share price will rise in the the next three weeks you decide to hedge the risk with Emini S&P 500 futures, currently at 3384 and have a beta of 1.0. Current Price of XOM: $39/share; beta = 1.38 Emin S&P 500 futures: 3384.00; beta = 1.00 Three weeks later you buy the shares and simultaeously offset (or cover) your hedge: XOM: $56/share Emin S&P 500 futures: 3895 a. Describe the anticipated transaction (Buy or sel2 Buy or sell what? How much? When? b. What will you do to hedae the risk (Buy or sell? Buv or sell what? How much?) C. How much do vou dav/receive when you carry out the anticipated transaction? d. What do you do to offset the hedge position (Buy or sell? At what price? Profit/loss? How much?) e. Considering the result of the anticipated transaction and the hedge, what is the effective price of the overall transaction2 4 Your investment management firm will receive funds from a new client in six months. The client (5 points) wants to invest it in 100,000 shares of Exxon-Mobil stock (XOM). Those shares currently trade at $39/share and have a beta of 1.38. Concerned that the share price will rise in the the next three weeks you decide to hedge the risk with Emini S&P 500 futures, currently at 3384 and have a beta of 1.0. Current Price of XOM: $39/share; beta = 1.38 Emin S&P 500 futures: 3384.00; beta = 1.00 Three weeks later you buy the shares and simultaeously offset (or cover) your hedge: XOM: $56/share Emin S&P 500 futures: 3895 a. Describe the anticipated transaction (Buy or sel2 Buy or sell what? How much? When? b. What will you do to hedae the risk (Buy or sell? Buv or sell what? How much?) C. How much do vou dav/receive when you carry out the anticipated transaction? d. What do you do to offset the hedge position (Buy or sell? At what price? Profit/loss? How much?) e. Considering the result of the anticipated transaction and the hedge, what is the effective price of the overall transaction2