Answered step by step

Verified Expert Solution

Question

1 Approved Answer

40 million Sh etual preferred stock outs 9-6 PREFERRED STOCK VALUATION Farley Inc. has perpetual pref sells for $30 a share and pays a dividend

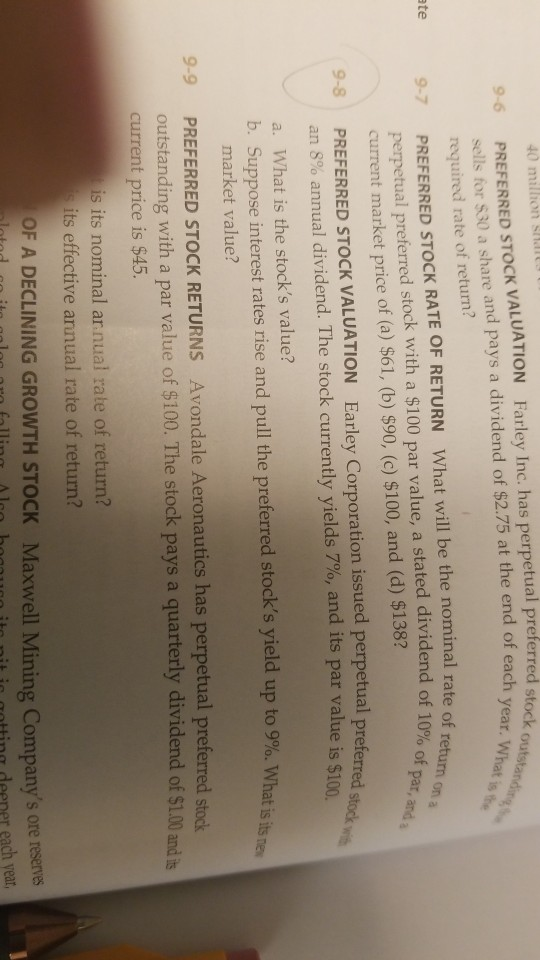

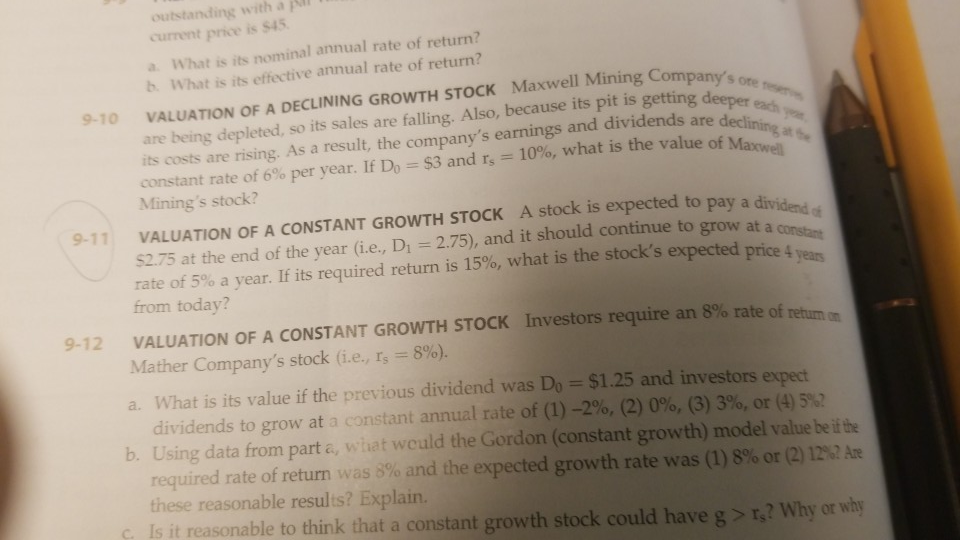

40 million Sh etual preferred stock outs 9-6 PREFERRED STOCK VALUATION Farley Inc. has perpetual pref sells for $30 a share and pays a dividend of $2.75 at the end of each year. What required rate of return? e 9-7 PREFERRED STOCK RATE OF RETURN What will be the nominal rate of return perpetual preferred stock with a $100 par value, a stated dividend of 10% of current market price of (a) $61, (b) $90, (c) $100, and (d) $138? 9-8 PREFERRED STOCK VALUATION Earley Corporation issued perpetual preferred an 8% annual dividend. The stock currently yields 7%, and its par value is $100. a. What is the stock's value? b. Suppose interest rates rise and pull the preferred stock's yield up to 9%, what is market value? 9-9 PREFERRED STOCK RETURNS Avondale Aeronautics has perpetual p standing with a par value of $100. The stock pays a quarterly dividend of S100 and is current price is $45 is its nominal ar nual rate of return? its effective annual rate of return? OF A DECLINING GROWTH STOCK Maxwell Mining Company's ore reserves outstanding with a jp current price is $45 a. What is its nominal annual rate of return? b. What is its effective annual rate of return? are being depleted, so its sales are falling. Also, because its pit is getting deeper its costs are rising. As a result, the company's earnings and dividends are declini constant rate of 6% per year. If Do-53 and rs-1000, what is the value of Mao Mining's stock? 9-10 VALUATION OF A DECLINING GROWTH STOCK Maxwell Mining Company's each y xwell 9-11 VALUATION OF A CONSTANT GROWTH STOCK A stock is expected to pay a divide grow at a constamt what is the stock's expected price 4 years S2.75 at the end of the year (i.e, Di 2.75), and it should continue to rate of 5% a year. If its required return is 15%, from today? Investors require an 8% rate of return VALUATION OF A CONSTANT GROWTH STOCK Mather Company's stock (i.e., rs 9-12 8%). a. What is its value if the previous dividend was Do $1.25 and investors expect b. Using data from part a, what weuld the Gordon (constant growth) model value be ifthe c Is it reasonable to think that a constant growth stock could have g >r,? Why or why dividends to grow at a constant annual rate of (1)-2%, (2) 0%, (3) 3%, or (4) 50 required rate of return was 5% and the expected growth rate was (1) 8% or (2) 12.2 Are these reasonable results? Explain

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started