Answered step by step

Verified Expert Solution

Question

1 Approved Answer

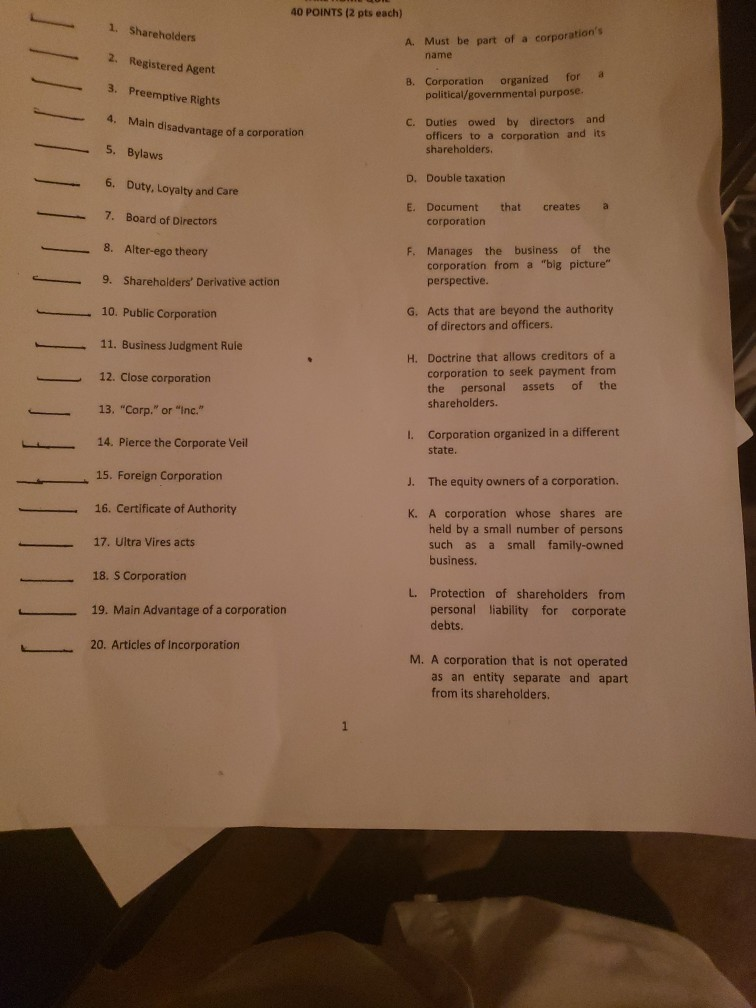

40 POINTS (2 pts each) 1. Shareholders A. Must be part of a corporation's name 2. Registered Agent a 3. Preemptive Rights B. Corporation organized

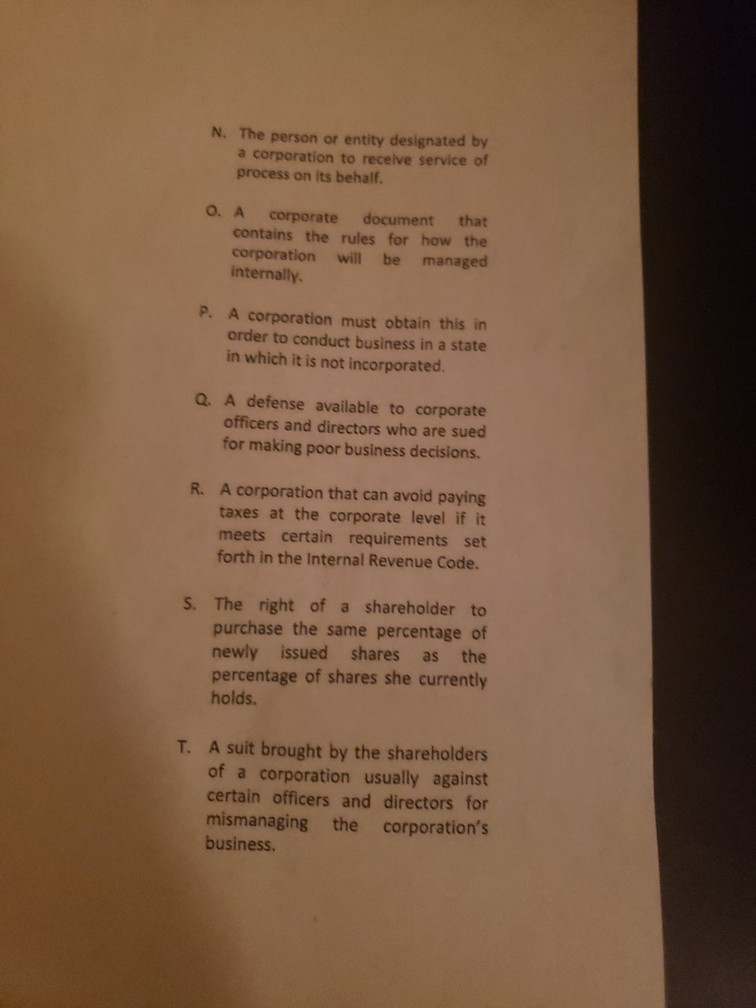

40 POINTS (2 pts each) 1. Shareholders A. Must be part of a corporation's name 2. Registered Agent a 3. Preemptive Rights B. Corporation organized for political/governmental purpose. 4. Main disadvantage of a corporation C. Duties owed by directors and officers to a corporation and its shareholders. 5. Bylaws 6. Duty. Loyalty and Care D. Double taxation E. Document corporation that creates 7. Board of Directors 8. Alter-ego theory F. Manages the business of the corporation from a "big picture" perspective. 9. Shareholders' Derivative action 10. Public Corporation G. Acts that are beyond the authority of directors and officers. 11. Business Judgment Rule 12. Close corporation H. Doctrine that allows creditors of a corporation to seek payment from the personal assets of the shareholders. 13. "Corp." or "Inc." 14. Pierce the Corporate Veil 1. Corporation organized in a different state. 15. Foreign Corporation J. The equity owners of a corporation. - 16. Certificate of Authority 17. Ultra Vires acts K. A corporation whose shares are held by a small number of persons such as a small family-owned business. 18. S Corporation 19. Main Advantage of a corporation L. Protection of shareholders from personal liability for corporate debts. 20. Articles of Incorporation M. A corporation that is not operated as an entity separate and apart from its shareholders. N. The person or entity designated by a corporation to receive service of process on its behalf. O. A corporate document that contains the rules for how the corporation will be managed internally P. A corporation must obtain this in order to conduct business in a state in which it is not incorporated Q. A defense available to corporate officers and directors who are sued for making poor business decisions. R. A corporation that can avoid paying taxes at the corporate level if it meets certain requirements set forth in the Internal Revenue Code. S. The right of a shareholder to purchase the same percentage of newly issued shares as the percentage of shares she currently holds. T. A suit brought by the shareholders of a corporation usually against certain officers and directors for mismanaging the corporation's business

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started