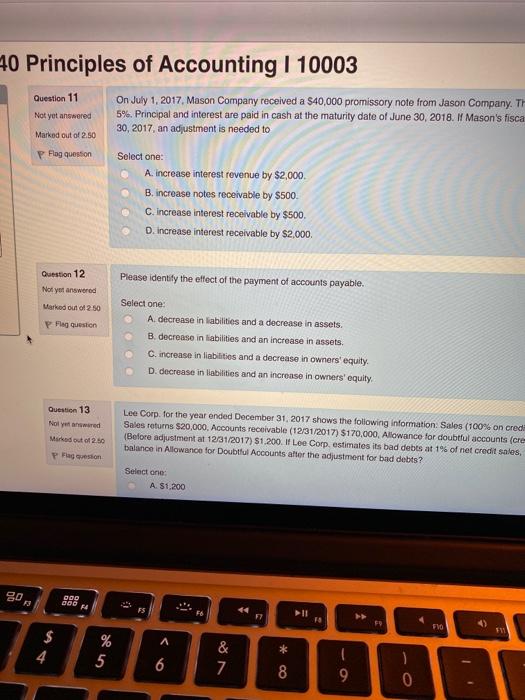

40 Principles of Accounting | 10003 Question 11 Not yet answered On July 1, 2017 Mason Company received a $40,000 promissory note from Jason Company. TH 5%. Principal and interest are paid in cash at the maturity date of June 30, 2018. I Mason's fisca 30,2017, an adjustment is needed to Marked out of 2.50 Flog question Select one: A. Increase interest revenue by $2,000 B. increase notes receivable by $500 C. Increase interest receivable by $500 D. Increase interest receivable by $2,000 Question 12 Please identify the effect of the payment of accounts payable. Not yet answered Marked out of 250 P Flag question Select one: A. decrease in liabilities and a decrease in assets. B. decrease in liabilities and an increase in assets. C. increase in liabilities and a decrease in owners' equity D. decrease in liabilities and an increase in owners' equity Question 13 Not yet red Marked out of 2.50 Lee Corp. for the year ended December 31, 2017 shows the following information Sales (100% on cred Sales returns $20,000, Accounts receivable (12/31/2017) $170,000. Allowance for doubtful accounts (cre (Before adjustment at 12/31/2017) $1.200. IF Lee Corp. estimates its bad debts at 1% of net credit sales, balance in Allowance for Doubtful Accounts after the adjustment for bad debts? Pasion Select one: A $1,200 go 000 14 n 9 F10 A % 5 * 4 6 & 7 8 9 0 40 Principles of Accounting | 10003 Question 11 Not yet answered On July 1, 2017 Mason Company received a $40,000 promissory note from Jason Company. TH 5%. Principal and interest are paid in cash at the maturity date of June 30, 2018. I Mason's fisca 30,2017, an adjustment is needed to Marked out of 2.50 Flog question Select one: A. Increase interest revenue by $2,000 B. increase notes receivable by $500 C. Increase interest receivable by $500 D. Increase interest receivable by $2,000 Question 12 Please identify the effect of the payment of accounts payable. Not yet answered Marked out of 250 P Flag question Select one: A. decrease in liabilities and a decrease in assets. B. decrease in liabilities and an increase in assets. C. increase in liabilities and a decrease in owners' equity D. decrease in liabilities and an increase in owners' equity Question 13 Not yet red Marked out of 2.50 Lee Corp. for the year ended December 31, 2017 shows the following information Sales (100% on cred Sales returns $20,000, Accounts receivable (12/31/2017) $170,000. Allowance for doubtful accounts (cre (Before adjustment at 12/31/2017) $1.200. IF Lee Corp. estimates its bad debts at 1% of net credit sales, balance in Allowance for Doubtful Accounts after the adjustment for bad debts? Pasion Select one: A $1,200 go 000 14 n 9 F10 A % 5 * 4 6 & 7 8 9 0