Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4.1 CRITICAL THINKING AND CONCEPTS REVIEW Present Value. The basic present value equation has four parts. What are they? Lo 4.1 4.2 Compounding. What is

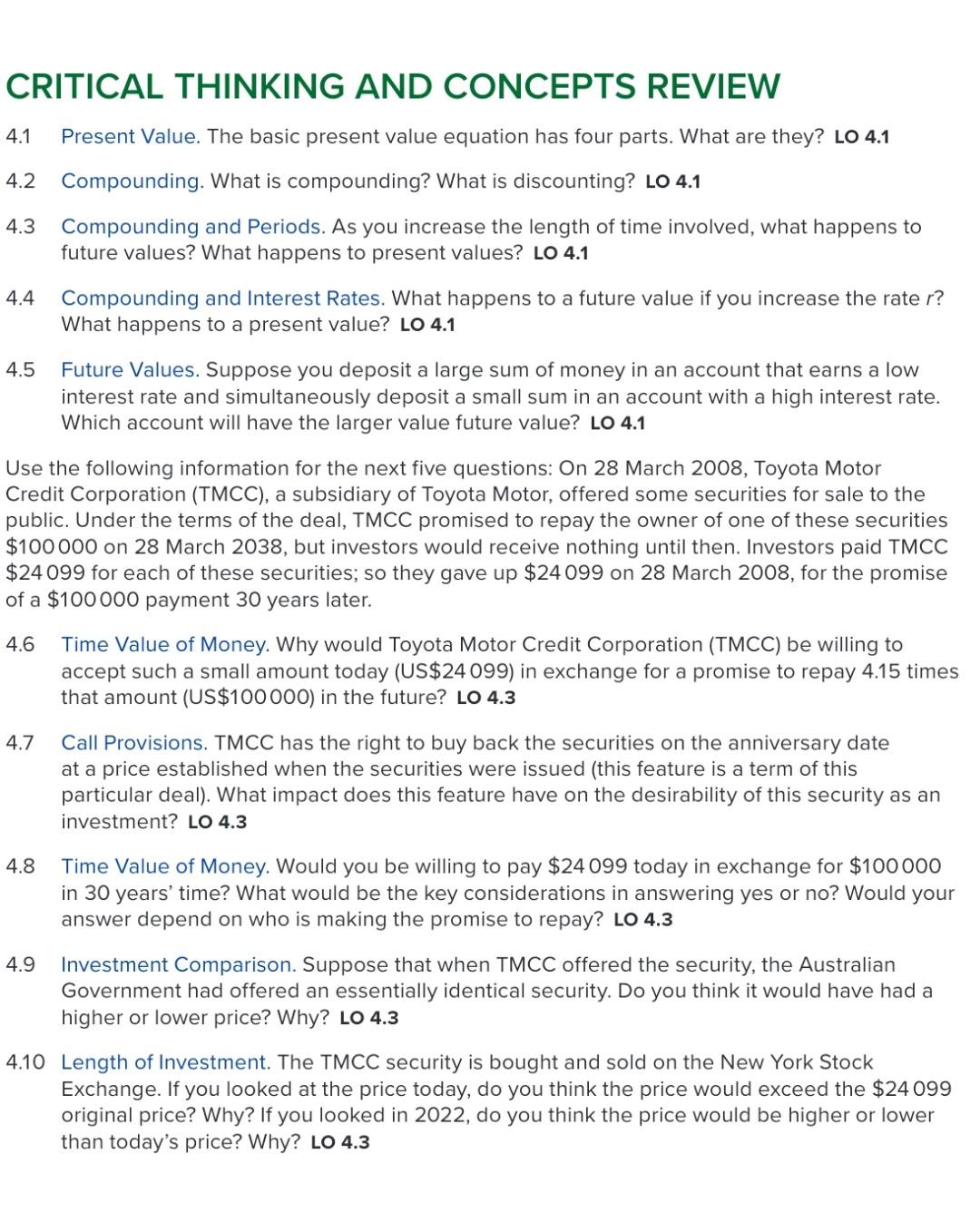

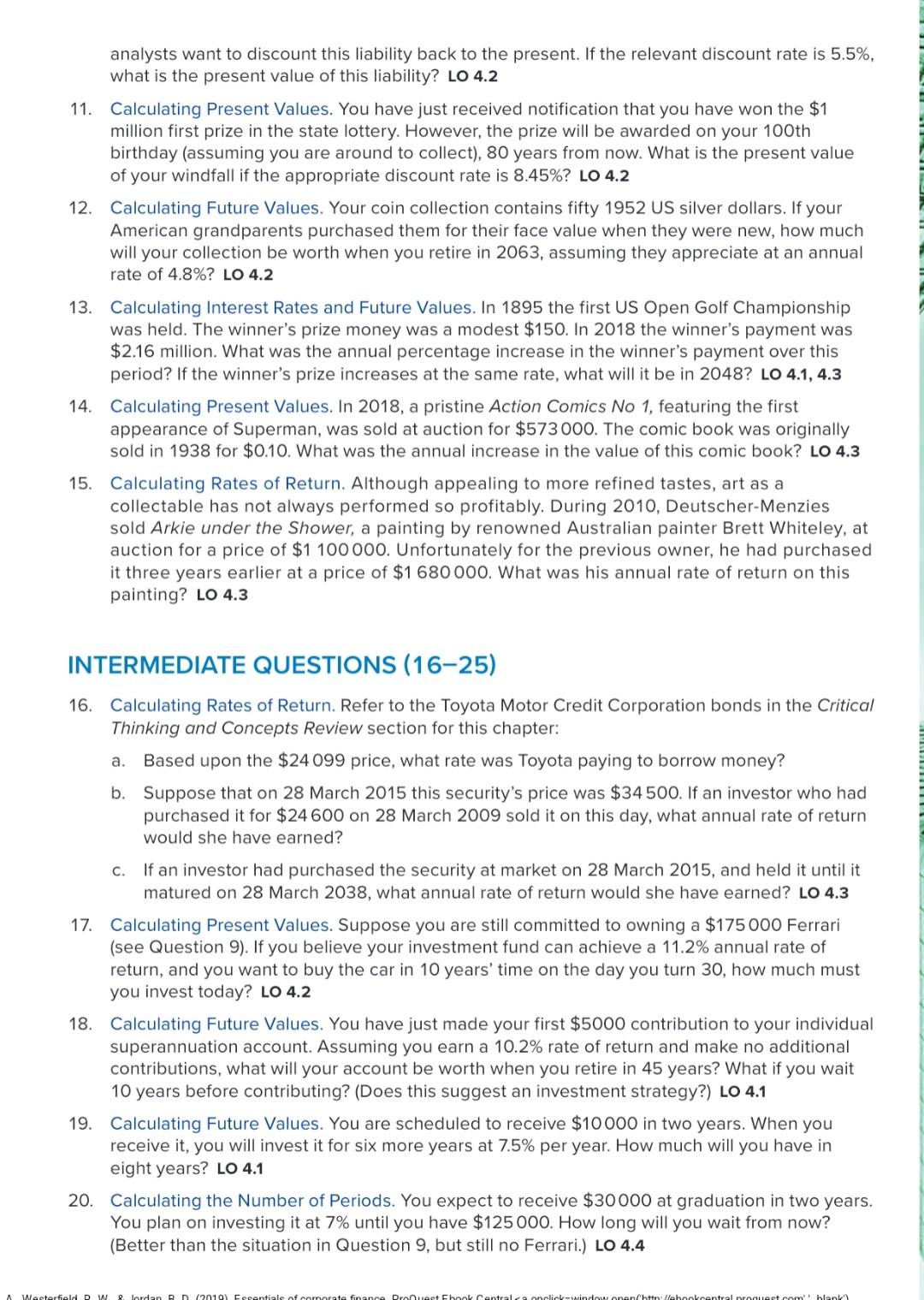

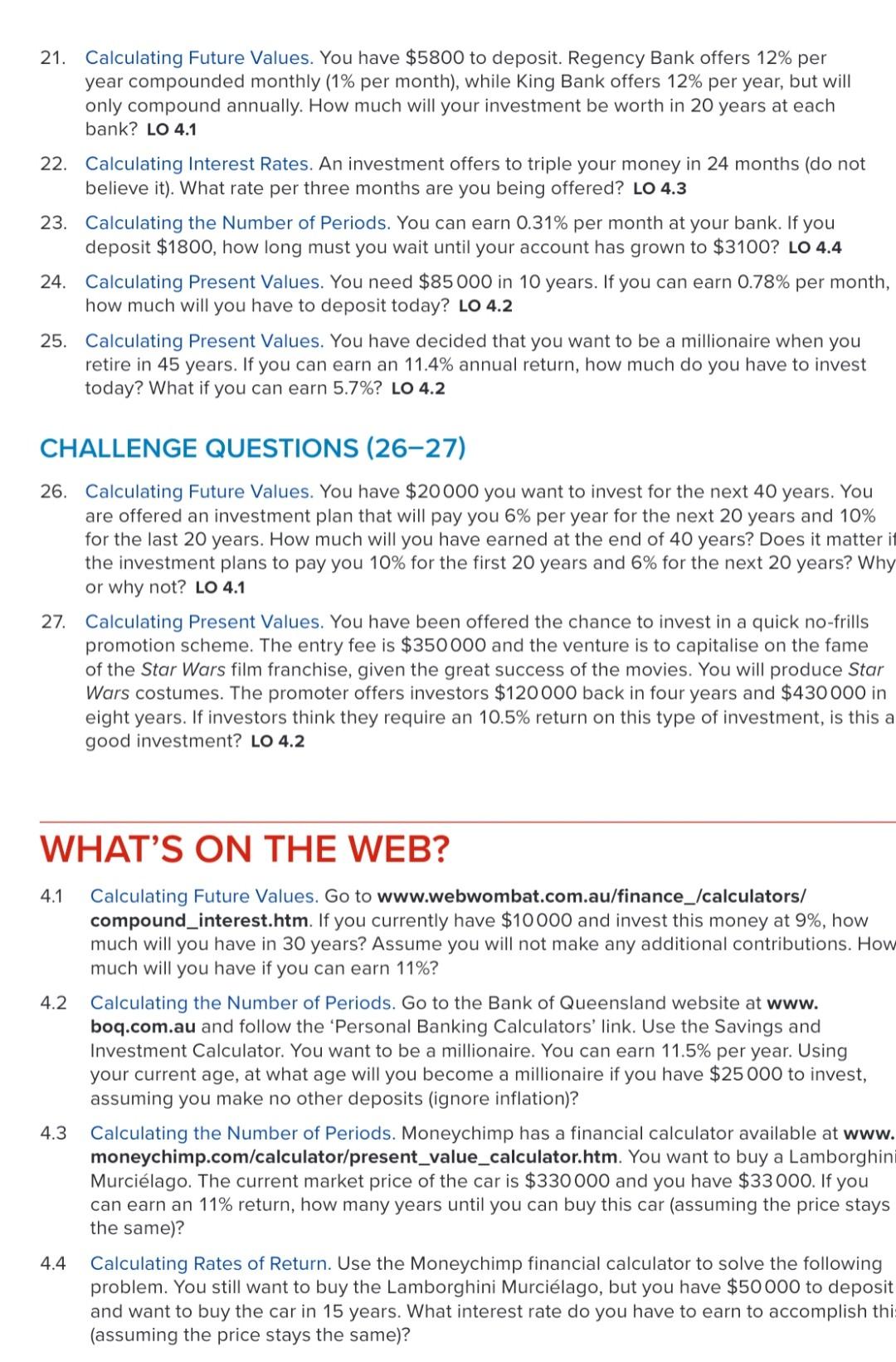

4.1 CRITICAL THINKING AND CONCEPTS REVIEW Present Value. The basic present value equation has four parts. What are they? Lo 4.1 4.2 Compounding. What is compounding? What is discounting? LO 4.1 4.3 Compounding and Periods. As you increase the length of time involved, what happens to future values? What happens to present values? LO 4.1 4.4 Compounding and Interest Rates. What happens to a future value if you increase the rate r? What happens to a present value? LO 4.1 4.5 Future Values. Suppose you deposit a large sum of money in an account that earns a low interest rate and simultaneously deposit a small sum in an account with a high interest rate. Which account will have the larger value future value? LO 4.1 Use the following information for the next five questions: On 28 March 2008, Toyota Motor Credit Corporation (TMCC), a subsidiary of Toyota Motor, offered some securities for sale to the public. Under the terms of the deal, TMCC promised to repay the owner of one of these securities $100 000 on 28 March 2038, but investors would receive nothing until then. Investors paid TMCC $24099 for each of these securities; so they gave up $24099 on 28 March 2008, for the promise of a $100 000 payment 30 years later. 4.6 Time Value of Money. Why would Toyota Motor Credit Corporation (TMCC) be willing to accept such a small amount today (US$24 099) in exchange for a promise to repay 4.15 times that amount (US$100000) in the future? LO 4.3 Call Provisions. TMCC has the right to buy back the securities on the anniversary date at a price established when the securities were issued (this feature is a term of this particular deal). What impact does this feature have on the desirability of this security as an investment? LO 4.3 4.7 4.8 Time Value of Money. Would you be willing to pay $24 099 today in exchange for $100000 in 30 years' time? What would be the key considerations in answering yes or no? Would your answer depend on who is making the promise to repay? LO 4.3 4.9 Investment Comparison. Suppose that when TMCC offered the security, the Australian Government had offered an essentially identical security. Do you think it would have had a higher or lower price? Why? LO 4.3 4.10 Length of Investment. The TMCC security is bought and sold on the New York Stock Exchange. If you looked at the price today, do you think the price would exceed the $24099 original price? Why? If you looked in 2022, do you think the price would be higher or lower than today's price? Why? LO 4.3 analysts want to discount this liability back to the present. If the relevant discount rate is 5.5%, what is the present value of this liability? LO 4.2 11. Calculating Present Values. You have just received notification that you have won the $1 million first prize in the state lottery. However, the prize will be awarded on your 100th birthday (assuming you are around to collect), 80 years from now. What is the present value of your windfall if the appropriate discount rate is 8.45%? LO 4.2 12. Calculating Future Values. Your coin collection contains fifty 1952 US silver dollars. If your American grandparents purchased them for their face value when they were new, how much will your collection be worth when you retire in 2063, assuming they appreciate at an annual rate of 4.8%? LO 4.2 13. Calculating Interest Rates and Future Values. In 1895 the first US Open Golf Championship was held. The winner's prize money was a modest $150. In 2018 the winner's payment was $2.16 million. What was the annual percentage increase in the winner's payment over this period? If the winner's prize increases at the same rate, what will it be in 2048? LO 4.1, 4.3 14. Calculating Present Values. In 2018, a pristine Action Comics No 1, featuring the first appearance of Superman, was sold at auction for $573000. The comic book was originally sold in 1938 for $0.10. What was the annual increase in the value of this comic book? LO 4.3 15. Calculating Rates of Return. Although appealing to more refined tastes, art as a collectable has not always performed so profitably. During 2010, Deutscher-Menzies sold Arkie under the Shower, a painting by renowned Australian painter Brett Whiteley, at auction for a price of $1 100 000. Unfortunately for the previous owner, he had purchased it three years earlier at a price of $1680 000. What was his annual rate of return on this painting? LO 4.3 INTERMEDIATE QUESTIONS (16-25) 16. Calculating Rates of Return. Refer to the Toyota Motor Credit Corporation bonds in the Critical Thinking and Concepts Review section for this chapter: a. Based upon the $24 099 price, what rate was Toyota paying to borrow money? b. Suppose that on 28 March 2015 this security's price was $34 500. If an investor who had purchased it for $24600 on 28 March 2009 sold it on this day, what annual rate of return would she have earned? c. If an investor had purchased the security at market on 28 March 2015, and held it until it matured on 28 March 2038, what annual rate of return would she have earned? LO 4.3 17. Calculating Present Values. Suppose you are still committed to owning a $175 000 Ferrari (see Question 9). If you believe your investment fund can achieve a 11.2% annual rate of return, and you want to buy the car in 10 years' time on the day you turn 30, how much must you invest today? LO 4.2 18. Calculating Future Values. You have just made your first $5000 contribution to your individual superannuation account. Assuming you earn a 10.2% rate of return and make no additional contributions, what will your account be worth when you retire in 45 years? What if you wait 10 years before contributing? (Does this suggest an investment strategy?) LO 4.1 19. Calculating Future Values. You are scheduled to receive $10000 in two years. When you receive it, you will invest it for six more years at 7.5% per year. How much will you have in eight years? LO 4.1 20. Calculating the Number of Periods. You expect to receive $30000 at graduation in two years. You plan on investing it at 7% until you have $125 000. How long will you wait from now? (Better than the situation in Question 9, but still no Ferrari.) LO 4.4 A Westerfield DWRlardan BD (2010) Escentials of Dronnect Ebook Centralancic act.com' blank 21. Calculating Future Values. You have $5800 to deposit. Regency Bank offers 12% per year compounded monthly (1% per month), while King Bank offers 12% per year, but will only compound annually. How much will your investment be worth in 20 years at each bank? LO 4.1 22. Calculating Interest Rates. An investment offers to triple your money in 24 months (do not believe it). What rate per three months are you being offered? LO 4.3 23. Calculating the Number of Periods. You can earn 0.31% per month at your bank. If you deposit $1800, how long must you wait until your account has grown to $3100? LO 4.4 24. Calculating Present Values. You need $85000 in 10 years. If you can earn 0.78% per month, how much will you have to deposit today? Lo 4.2 25. Calculating Present Values. You have decided that you want to be a millionaire when you retire in 45 years. If you can earn an 11.4% annual return, how much do you have to invest today? What if you can earn 5.7%? LO 4.2 CHALLENGE QUESTIONS (26-27) 26. Calculating Future Values. You have $20000 you want to invest for the next 40 years. You are offered an investment plan that will pay you 6% per year for the next 20 years and 10% for the last 20 years. How much will you have earned at the end of 40 years? Does it matter it the investment plans to pay you 10% for the first 20 years and 6% for the next 20 years? Why or why not? LO 4.1 27. Calculating Present Values. You have been offered the chance to invest in a quick no-frills promotion scheme. The entry fee is $350 000 and the venture is to capitalise on the fame of the Star Wars film franchise, given the great success of the movies. You will produce Star Wars costumes. The promoter offers investors $120000 back in four years and $430 000 in eight years. If investors think they require an 10.5% return on this type of investment, is this a good investment? LO 4.2 WHAT'S ON THE WEB? 4.1 Calculating Future Values. Go to www.webwombat.com.au/finance_/calculators/ compound_interest.htm. If you currently have $10000 and invest this money at 9%, how much will you have in 30 years? Assume you will not make any additional contributions. How much will you have if you can earn 11%? 4.2 Calculating the Number of Periods. Go to the Bank of Queensland website at www. boq.com.au and follow the Personal Banking Calculators' link. Use the Savings and Investment Calculator. You want to be a millionaire. You can earn 11.5% per year. Using your current age, at what age will you become a millionaire if you have $25000 to invest, assuming you make no other deposits (ignore inflation)? 4.3 Calculating the Number of Periods. Moneychimp has a financial calculator available at www. moneychimp.com/calculator/present_value_calculator.htm. You want to buy a Lamborghini Murcilago. The current market price of the car is $330000 and you have $33000. If you can earn an 11% return, how many years until you can buy this car (assuming the price stays the same)? 4.4 Calculating Rates of Return. Use the Moneychimp financial calculator to solve the following problem. You still want to buy the Lamborghini Murcilago, but you have $50000 to deposit and want to buy the car in 15 years. What interest rate do you have to earn to accomplish thi (assuming the price stays the same)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started