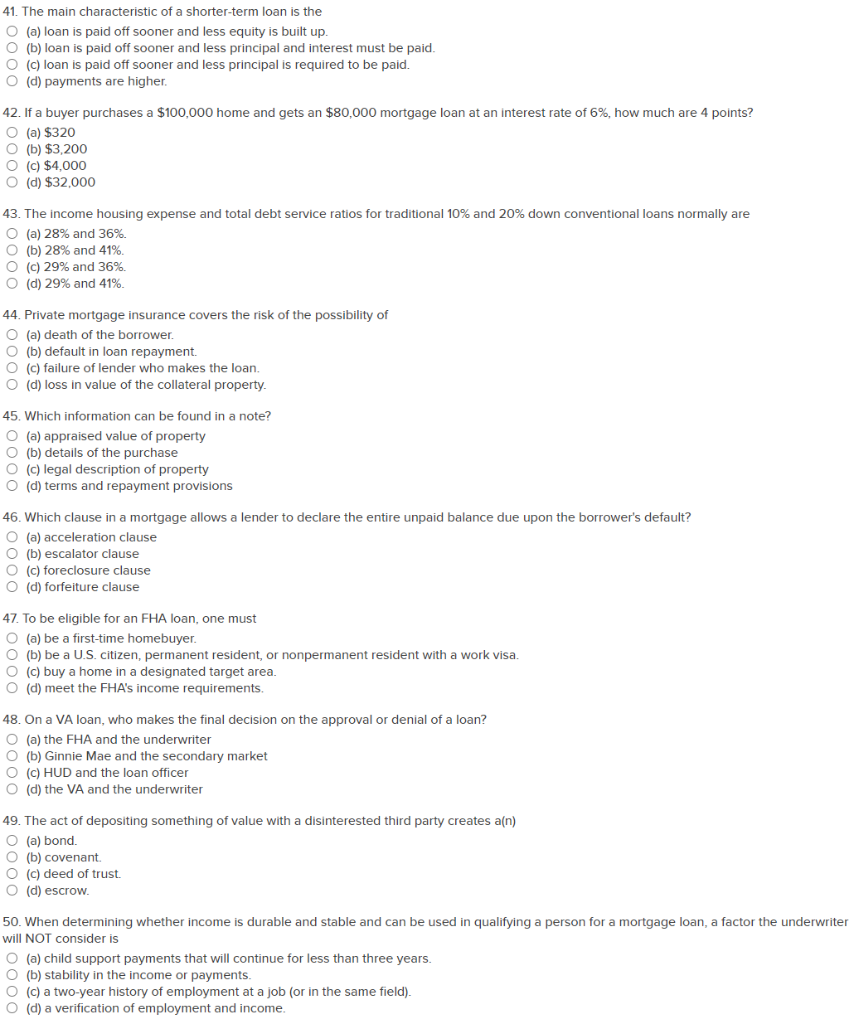

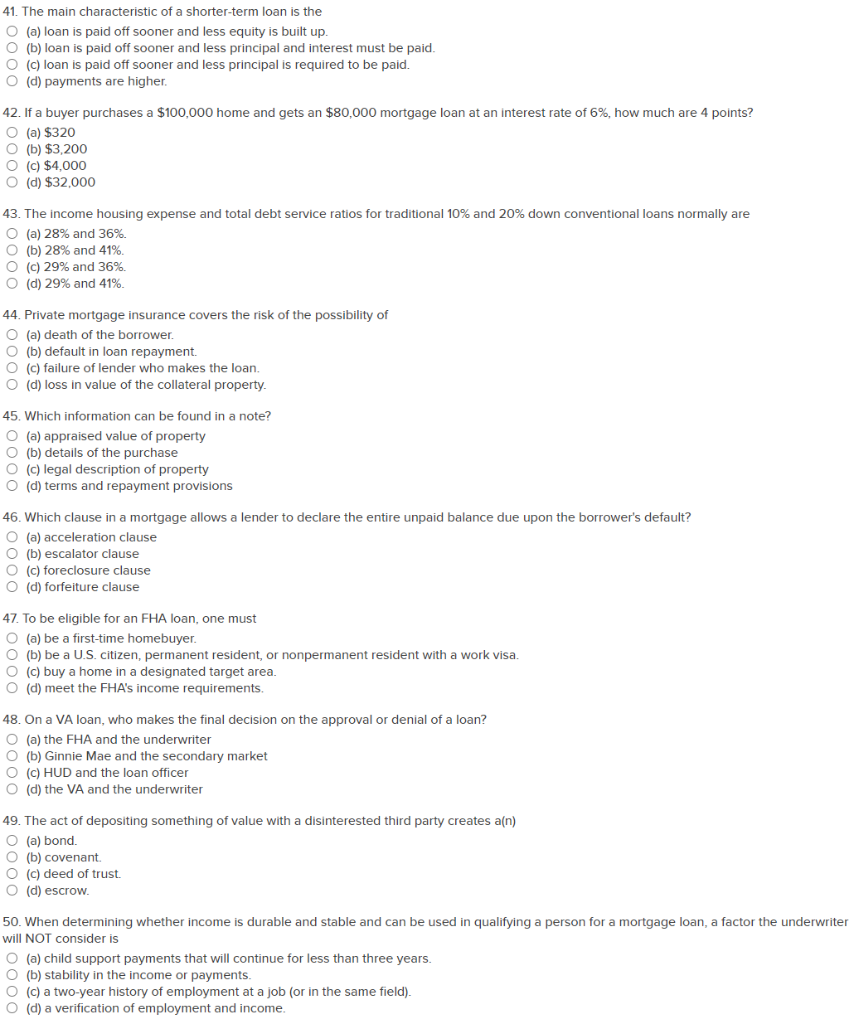

41. The main characteristic of a shorter-term loan is the O (a) loan is paid off sooner and less equity is built up. O (b) loan is paid off sooner and less principal and interest must be paid. O (C) loan is paid off sooner and less principal is required to be paid. O (d) payments are higher. 42. If a buyer purchases a $100,000 home and gets an $80,000 mortgage loan at an interest rate of 6%, how much are 4 points? O (a) $320 O (b) $3,200 O (c) $4,000 O (d) $32,000 43. The income housing expense and total debt service ratios for traditional 10% and 20% down conventional loans normally are O (a) 28% and 36%. O (b) 28% and 41% O (c) 29% and 36%. O (d) 29% and 41%. 44. Private mortgage insurance covers the risk of the possibility of (a) death of the borrower. O (b) default in loan repayment. O (c) failure of lender who makes the loan. (d) loss in value of the collateral property 45. Which information can be found in a note? O (a) appraised value of property O (b) details of the purchase O (c) legal description of property (d) terms and repayment provisions 46. Which clause in a mortgage allows a lender to declare the entire unpaid balance due upon the borrower's default? O (a) acceleration clause O (b) escalator clause 0 (c) foreclosure clause O (d) forfeiture clause 47. To be eligible for an FHA loan, one must O (a) be a first-time homebuyer. O (b) be a U.S. citizen, permanent resident, or nonpermanent resident with a work visa. O (c) buy a home in a designated target area. O (d) meet the FHA's income requirements. 48. On a VA loan, who makes the final decision on the approval or denial of a loan? O (a) the FHA and the underwriter O (b) Ginnie Mae and the secondary market O (C) HUD and the loan officer O (d) the VA and the underwriter 49. The act of depositing something of value with a disinterested third party creates an) O (a) bond. O (b) covenant O (c) deed of trust. 0 (d) escrow. 50. When determining whether income is durable and stable and can be used in qualifying a person for a mortgage loan, a factor the underwriter will NOT consider is O (a) child support payments that will continue for less than three years. O (b) stability in the income or payments. O (c) a two-year history of employment at a job or in the same field). (d) a verification of employment and income