Answered step by step

Verified Expert Solution

Question

1 Approved Answer

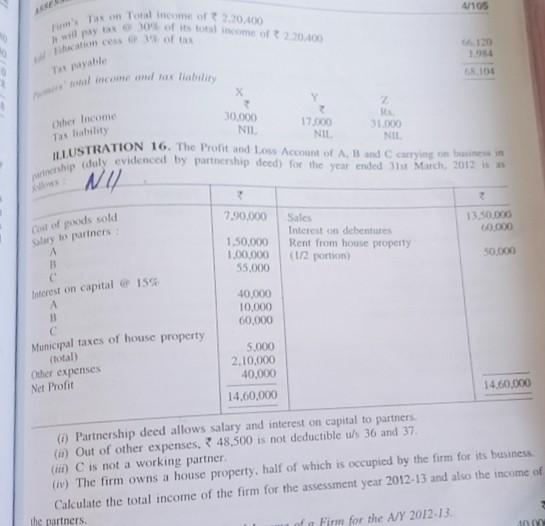

4/105 Tato Total inco20,400 way as of esota Table X Other Income 2 10.000 17.000 31000 NIL NIL NIL ILLUSTRATION 16. The Profilo Account of

4/105 Tato Total inco20,400 way as of esota Table X Other Income 2 10.000 17.000 31000 NIL NIL NIL ILLUSTRATION 16. The Profilo Account of AB and ca ership duly evidenced by the ship deed) for the year ended March 2012 7,90.000 13.50 000 Sales Interest on debent Rent from houve property (2 portion 1.50,000 1.00.000 55.000 Car of gods sold ay partners A B C Interest on capital 15 A 50.000 40.000 10,000 60,000 Municipal taxes of house property (total) Other expenses Net Profit 5.000 2.10,000 40,000 14.60.000 14.60,000 (1) Partnership deed allows salary and interest on capital to partners (1) Out of other expenses, 48,500 is not deductible u 36 and 37 (it) C is not a working partner () The firm owns a house property, half of which is occupied by the firm for its business Calculate the total income of the firm for the assessment year 2012-13 and also the income of the partners Firme for the NY 2012-13

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started