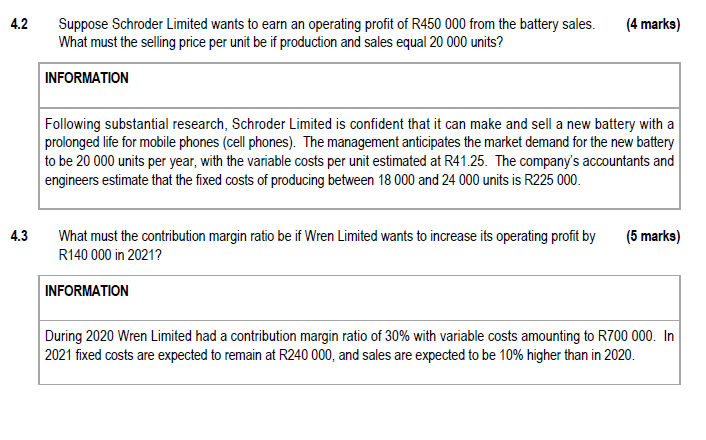

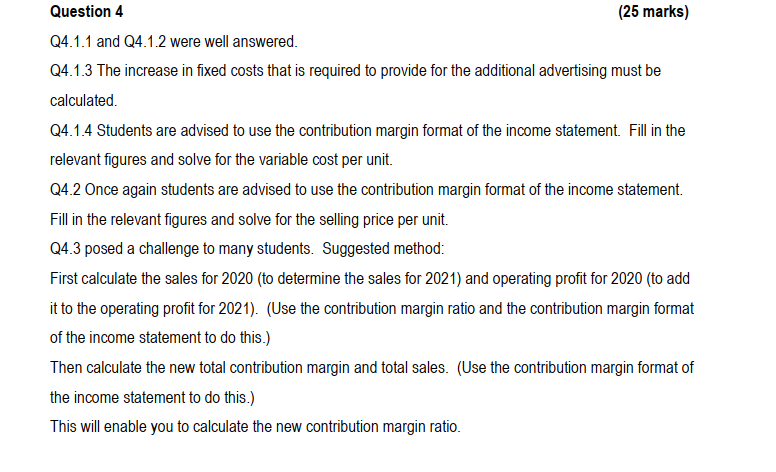

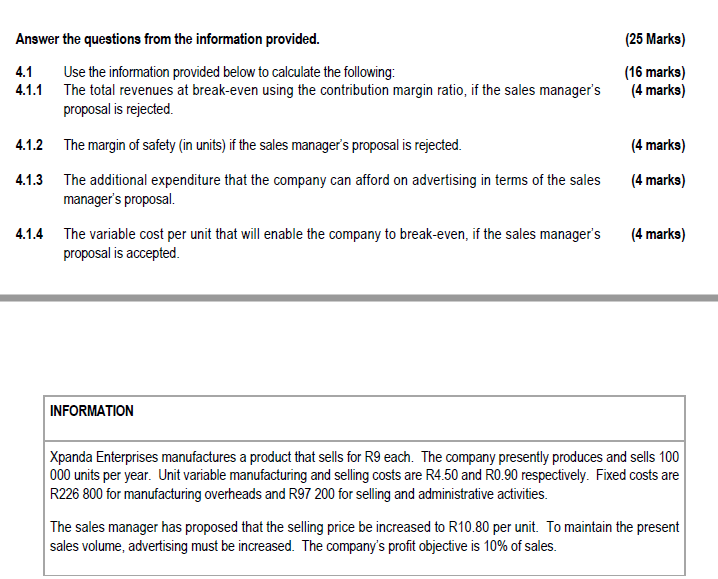

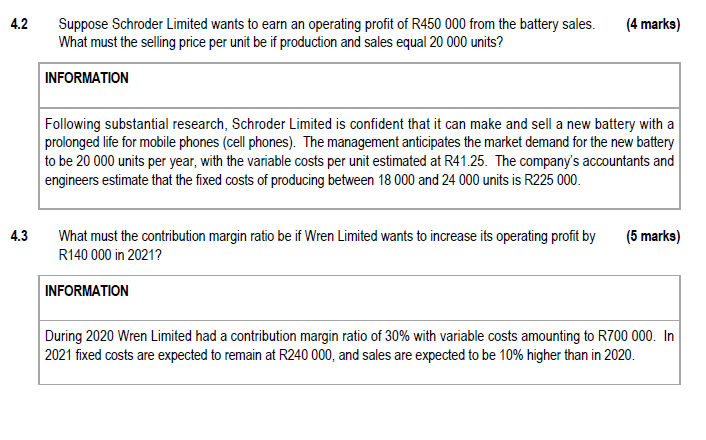

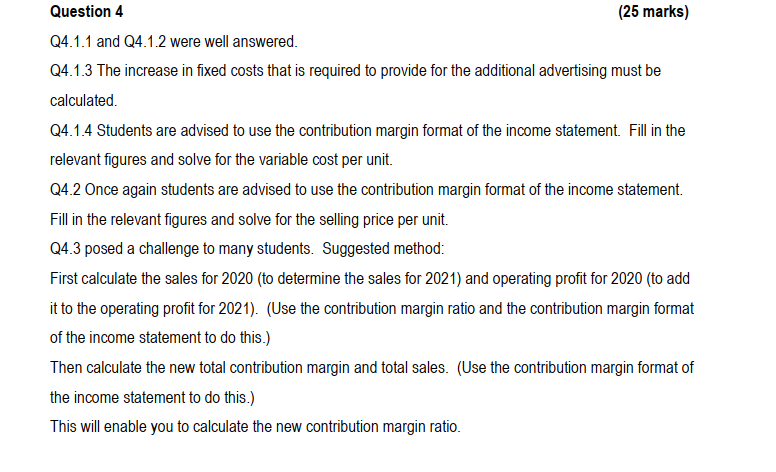

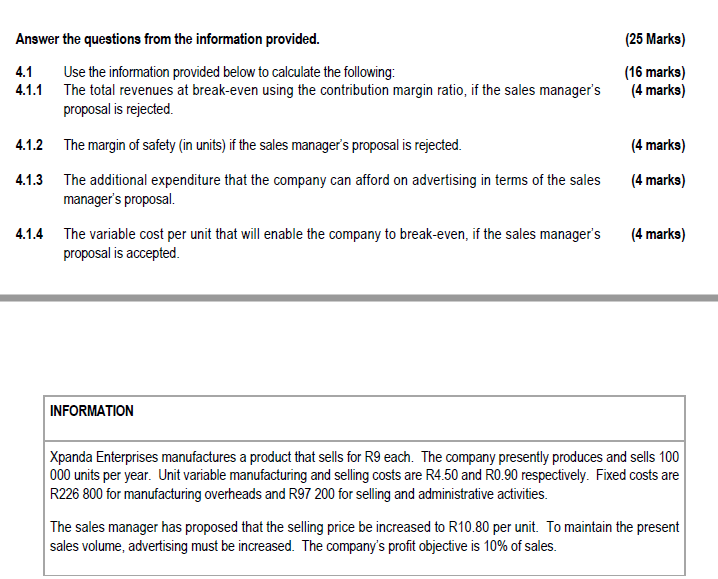

4.2 (4 marks) Suppose Schroder Limited wants to earn an operating profit of R450 000 from the battery sales. What must the selling price per unit be if production and sales equal 20 000 units? INFORMATION Following substantial research, Schroder Limited is confident that it can make and sell a new battery with a prolonged life for mobile phones (cell phones). The management anticipates the market demand for the new battery to be 20 000 units per year, with the variable costs per unit estimated at R41.25. The company's accountants and engineers estimate that the fixed costs of producing between 18 000 and 24 000 units is R225 000. 4.3 What must the contribution margin ratio be if Wren Limited wants to increase its operating profit by R140 000 in 2021? (5 marks) INFORMATION During 2020 Wren Limited had a contribution margin ratio of 30% with variable costs amounting to R700 000. In 2021 fixed costs are expected to remain at R240 000, and sales are expected to be 10% higher than in 2020. Question 4 (25 marks) Q4.1.1 and Q4.1.2 were well answered. Q4.1.3 The increase in fixed costs that is required to provide for the additional advertising must be calculated. Q4.1.4 Students are advised to use the contribution margin format of the income statement. Fill in the relevant figures and solve for the variable cost per unit. Q4.2 Once again students are advised to use the contribution margin format of the income statement. Fill in the relevant figures and solve for the selling price per unit. Q4.3 posed a challenge to many students. Suggested method: First calculate the sales for 2020 (to determine the sales for 2021) and operating profit for 2020 (to add it to the operating profit for 2021). (Use the contribution margin ratio and the contribution margin format of the income statement to do this.) Then calculate the new total contribution margin and total sales. (Use the contribution margin format of the income statement to do this.) This will enable you to calculate the new contribution margin ratio. 4.1 (25 Marks) (16 marks) (4 marks) Answer the questions from the information provided. Use the information provided below to calculate the following: 4.1.1 The total revenues at break-even using the contribution margin ratio, if the sales manager's proposal is rejected. 4.1.2 The margin of safety (in units) if the sales manager's proposal is rejected. 4.1.3 The additional expenditure that the company can afford on advertising in terms of the sales manager's proposal. 4.1.4 The variable cost per unit that will enable the company to break-even if the sales manager's proposal is accepted (4 marks) (4 marks) (4 marks) INFORMATION Xpanda Enterprises manufactures a product that sells for R9 each. The company presently produces and sells 100 000 units per year. Unit variable manufacturing and selling costs are R4.50 and R0.90 respectively. Fixed costs are R226 800 for manufacturing overheads and R97 200 for selling and administrative activities. The sales manager has proposed that the selling price be increased to R10.80 per unit. To maintain the present sales volume, advertising must be increased. The company's profit objective is 10% of sales