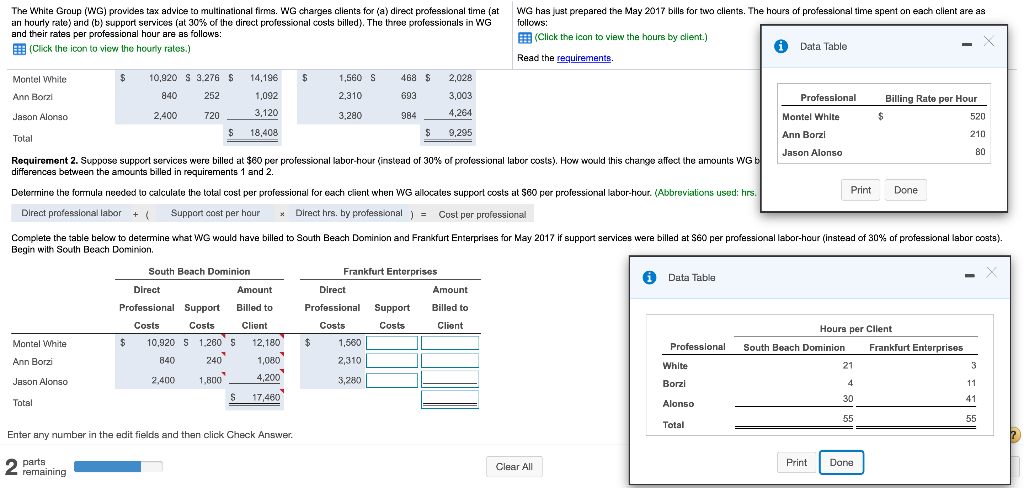

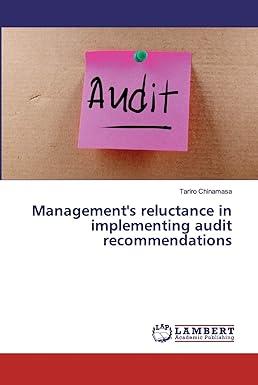

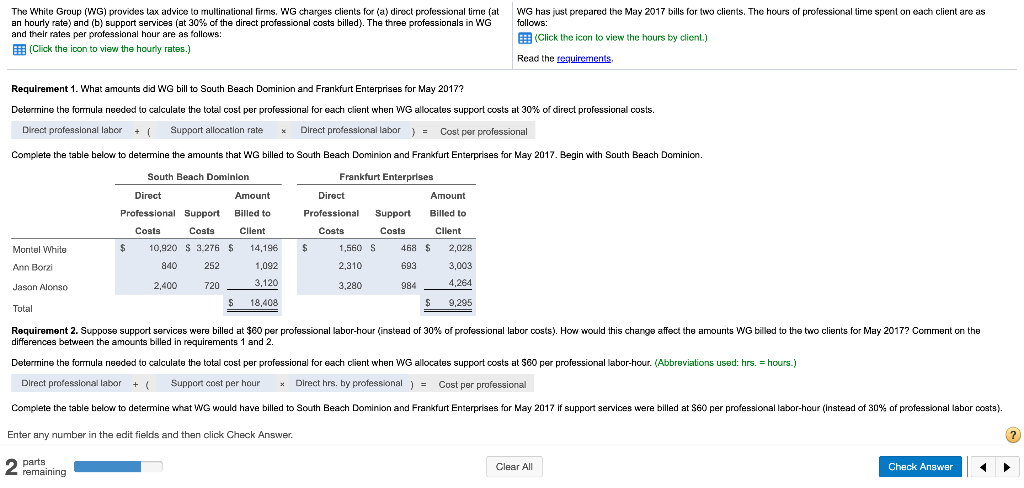

4,264 The White Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at WG has just prepared the May 2017 bills for two clients. The hours of professional time spent on each client are as an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in WG follows: and their rates per professional hour are as follows: (Click the icon to view the hours by client.) (Click the icon to view the hourly rates.) * Data Table Read the requirements, Montel White $ 10,920 S 3.276 $ 14.196 $ 1,560 S 468 $ 2,028 Ann Borzi 840 252 1,092 2,310 693 3,003 Professional Billing Rato per Hour Jason Alonso 2.400 720 3,120 3,280 984 Montel White $ $ 520 s 18.408 Total $ $ 9,295 Ann Borzi 210 Requirement 2. Suppose support services were billed at $60 per professional labor-hour (instead of 30% of professional labor costs). How would this change affect the amounts WG Jason Alonso 80 differences between the amounts billed in requirements 1 and 2. Determine the formula needed to calculate the total cost per professional for each client when WG allocates support costs at $60 per professional labor-hour. (Abbreviations used: hrs. Print Done Direct professional labor + Support cost per hour * Direct hrs, by professional ) = Cost per professional Complete the table below to determine what WG would have billed to South Beach Dominion and Frankfurt Enterprises for May 2017 if support services were billed at S60 per professional labor-hour (instead of 30% of professional labor costs). Begin with South Beach Dominion i Data Table South Beach Dominion Direct Amount Professional Support Billed to Costs Costs Client $ 10,920 S 1.260 S 12,180 840 240 1,080 Frankfurt Enterprises Direct Amount Professional Support Billed to Costs Client $ 1,500 Costs Montel White Hours per Client South Beach Dominion Frankfurt Enterprises Professional Ann Borzi 2,310 21 3 Jason Alonso White Borzi 2,400 1,800 3,280 4 11 4,200 $ 17,460 Total 30 41 Alonso 55 55 Total Enter any number in the edit fields and then click Check Answer. parts 2 remaining Print Clear All Done The White Group (WG) provides tax advice to multinational firms. WG charges clients for (a) direct professional time (at an hourly rate) and (b) support services (at 30% of the direct professional costs billed). The three professionals in WG and their rates per professional hour are as follows: (Click the icon to view the hourly rates.) WG has just prepared the May 2017 bills for two clients. The hours of professional time spent on each client are as follows: (Click the icon to view the hours by client.) Read the requirements Requirement 1. What amounts did WG bill to South Beach Dominion and Frankfurt Enterprises for May 2017? Determine the formula needed to calculate the total cost per professional for each client when WG allocates support costs at 30% of direct professional costs. Direct professional labor + Support allocation rate x * Direct professional labor ) = Cost per professional Complete the table below to determine the amounts that WG billed to South Beach Dominion and Frankfurt Enterprises for May 2017. Begin with South Beach Dominion South Beach Dominion Direct Amount Professional Support Billed to Costs Costs Client $ $ 10,920 S 3,276 $ 14,196 840 252 1,092 Frankfurt Enterprises Direct Amount Professional Support Billed to Costs Costs Client $ 1,560 S 468 $ 2,028 2,310 693 3,003 Montel White Ann Borzi Jason Alonso 2,400 720 3,120 3,280 984 4,264 9,295 $ 18,408 Total $ $ Requirement 2. Suppose support services were billed at $60 per professional labor-hour (instead of 30% of professional labor costs). How would this change affect the amounts WG billed to the two clients for May 2017? Comment on the differences between the amounts billed in requirements 1 and 2. Determine the formula needed to calculate the total cost per professional for each client when WG allocates support costs at $60 per professional labor-hour. (Abbreviations used: hrs. = hours.) Direct professional labor + Support cost per hour * Direct hrs. by professional ) = Cost per professional Complete the table below to determine what WG would have billed to South Beach Dominion and Frankfurt Enterprises for May 2017 If support services were billed at $60 per professional labor-hour (Instead of 30% of professional labor costs). Enter any number in the edit fields and then click Check Answer. ? parts 2 remaining Clear All Check