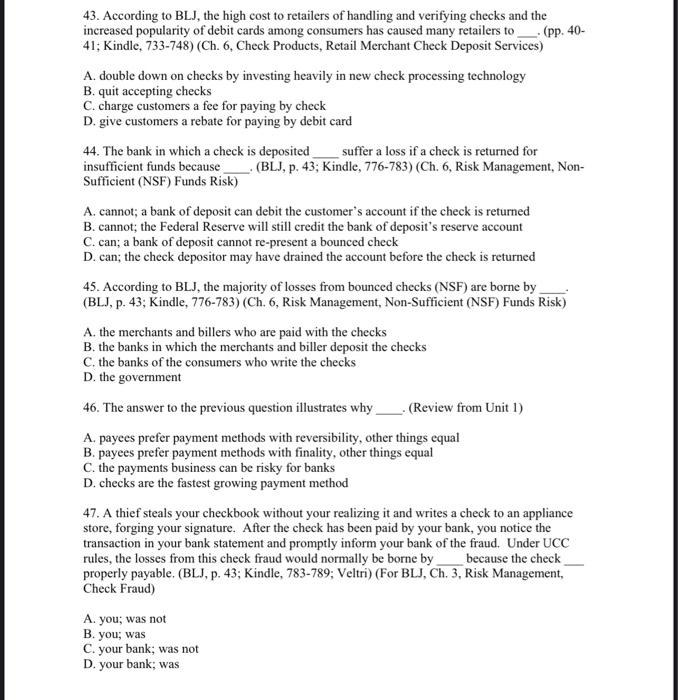

43. According to BLJ, the high cost to retailers of handling and verifying checks and the increased popularity of debit cards among consumers has caused many retailers to _. (pp. 4041; Kindle, 733-748) (Ch. 6, Check Products, Retail Merchant Check Deposit Services) A. double down on checks by investing heavily in new check processing technology B. quit accepting checks C. charge customers a fee for paying by check D. give customers a rebate for paying by debit card 44. The bank in which a check is deposited ___ suffer a loss if a check is returned for insufficient funds because Sufficient (NSF) Funds Risk) (BLJ, p. 43; Kindle, 776-783) (Ch. 6, Risk Management, Non- A. cannot; a bank of deposit can debit the customer's account if the check is returned B. cannot; the Federal Reserve will still credit the bank of deposit's reserve account C. can; a bank of deposit cannot re-present a bounced check D. can; the check depositor may have drained the account before the check is returned 45. According to BLJ, the majority of losses from bounced checks (NSF) are borne by (BLJ, p. 43; Kindle, 776-783) (Ch. 6, Risk Management, Non-Sufficient (NSF) Funds Risk) A. the merchants and billers who are paid with the checks B. the banks in which the merchants and biller deposit the checks C. the banks of the consumers who write the checks D. the government 46. The answer to the previous question illustrates why (Review from Unit 1) A. payees prefer payment methods with reversibility, other things equal B. payees prefer payment methods with finality, other things equal C. the payments business can be risky for banks D. checks are the fastest growing payment method 47. A thief steals your checkbook without your realizing it and writes a check to an appliance store, forging your signature. After the check has been paid by your bank, you notice the transaction in your bank statement and promptly inform your bank of the fraud. Under UCC rules, the losses from this check fraud would normally be borne by because the check properly payable. (BLJ, p. 43; Kindle, 783-789; Veltri) (For BLJ, Ch. 3, Risk Management, Check Fraud) A. you; was not B. you; was C. your bank; was not D. your bank; was