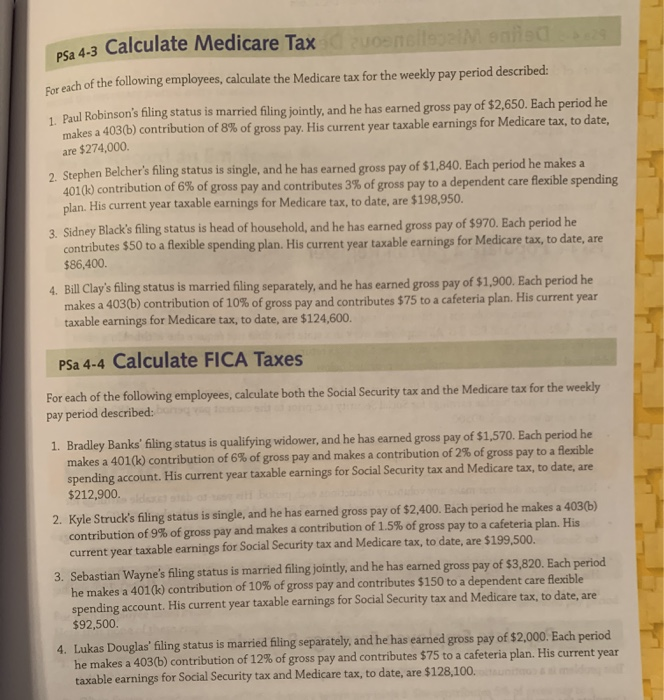

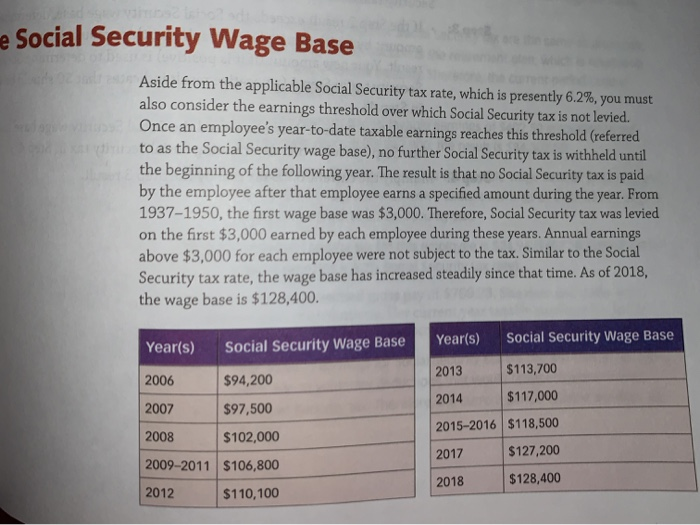

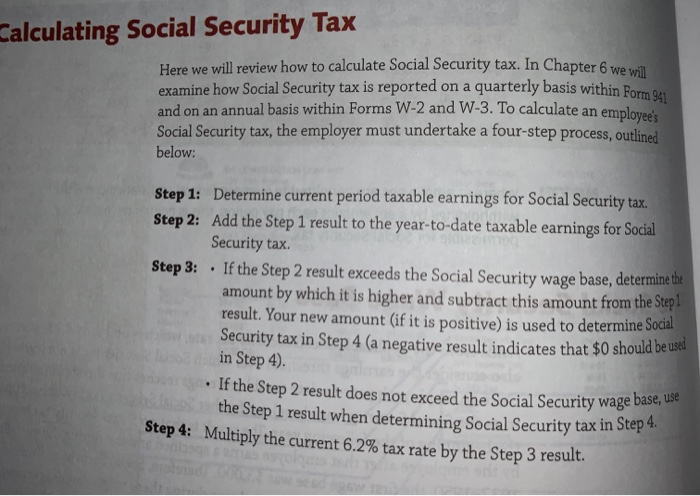

4-3 Calculate Medicare Tax n reach of the following employees, calculate the Medicare tax for the weekly pay period described: 1. Paul Robinson's filing status is married filing jointly, and he has earned gross pay of $2,650. Each period he makes a 403(b) contribution of 8% of gross pay. His current year taxable earnings for Medicare tax, to date, are $274,000 2. Stephen Belcher's filing status is single, and he has earned gross pay of $1,840. Each period he makes a 4010) contribution of 6% of gross pay and contributes 3% of gross pay to a dependent care flexible spending plan. His current year taxable earnings for Medicare tax, to date, are $198,950. 3. Sidney Black's filing status is head of household, and he has earned gross pay of $970. Each period he contributes $50 to a flexible spending plan. His current year taxable earnings for Medicare tax, to date, are $86,400 4. Bill Clay's filing status is married filing separately, and he has earned gross pay of $1,900. Each period he makes a 403(b) contribution of 10% of gross pay and contributes $75 to a cafeteria plan. His current year taxable earnings for Medicare tax, to date, are $124,600. PSa 4-4 Calculate FICA Taxes For each of the following employees, calculate both the Social Security tax and the Medicare tax for the weekly pay period described: 1. Bradley Banks' filing status is qualifying widower, and he has earned gross pay of 51,570. Each period he makes a 401(k) contribution of 6% of gross pay and makes a contribution of 2% of gross pay to a flexible spending account. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $212,900. 2. Kyle Struck's filing status is single, and he has earned gross pay of $2,400. Each period he makes a 403(b) contribution of 9% of gross pay and makes a contribution of 1.5% of gross pay to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $199,500. 3. Sebastian Wayne's filing status is married filing jointly, and he has earned gross pay of $3,820. Each period he makes a 401(k) contribution of 10% of gross pay and contributes $150 to a dependent care flexible spending account. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $92,500. 4. Lukas Douglas' filing status is married filing separately, and he has earned gross pay of $2,000. Each period he makes a 403(b) contribution of 12% of gross pay and contributes $75 to a cafeteria plan. His current year taxable earnings for Social Security tax and Medicare tax, to date, are $128.100. e Social Security Wage Base Aside from the applicable Social Security tax rate, which is presently 6.2%, you must also consider the earnings threshold over which Social Security tax is not levied. Once an employee's year-to-date taxable earnings reaches this threshold (referred to as the Social Security wage base), no further Social Security tax is withheld until the beginning of the following year. The result is that no Social Security tax is paid by the employee after that employee earns a specified amount during the year. From 1937-1950, the first wage base was $3,000. Therefore, Social Security tax was levied on the first $3,000 earned by each employee during these years. Annual earnings above $3,000 for each employee were not subject to the tax. Similar to the Social Security tax rate, the wage base has increased steadily since that time. As of 2018, the wage base is $128,400. Year(s) Social Security Wage Base Year(s) Social Security Wage Base 2006 $94,200 2007 $97,500 2008 $102,000 2009-2011 $106,800 2012 $110,100 2013 $113,700 2014 $117,000 2015-2016 $118,500 2017 $127,200 2018 $128,400 Calculating Social Security Tax Here we will review how to calculate Social Security tax. In Chapter 6 examine how Social Security tax is reported on a quarterly basis within Form and on an annual basis within Forms W-2 and W-3. To calculate an employee Social Security tax, the employer must undertake a four-step process, outlined below: Step 1: Determine current period taxable earnings for Social Security tax. Step 2: Add the Step 1 result to the year-to-date taxable earnings for Social Security tax. Step 3: . If the Step 2 result exceeds the Social Security wage base, determine the amount by which it is higher and subtract this amount from the Step result. Your new amount (if it is positive) is used to determine Soda Security tax in Step 4 (a negative result indicates that $0 should be in Step 4). . If the Step 2 result does not exceed the Social Security way the Step 1 result when determining Social Security tax in Step Step 4: Multiply the current 6.2% tax rate by the Step 3 result. eed the Social Security wage base, use