Answered step by step

Verified Expert Solution

Question

1 Approved Answer

43. Mr. X, is a Senior Portfolio Manager at ABC Asset Management Company He expects to purchase a portfolio of shares in 90 days. However

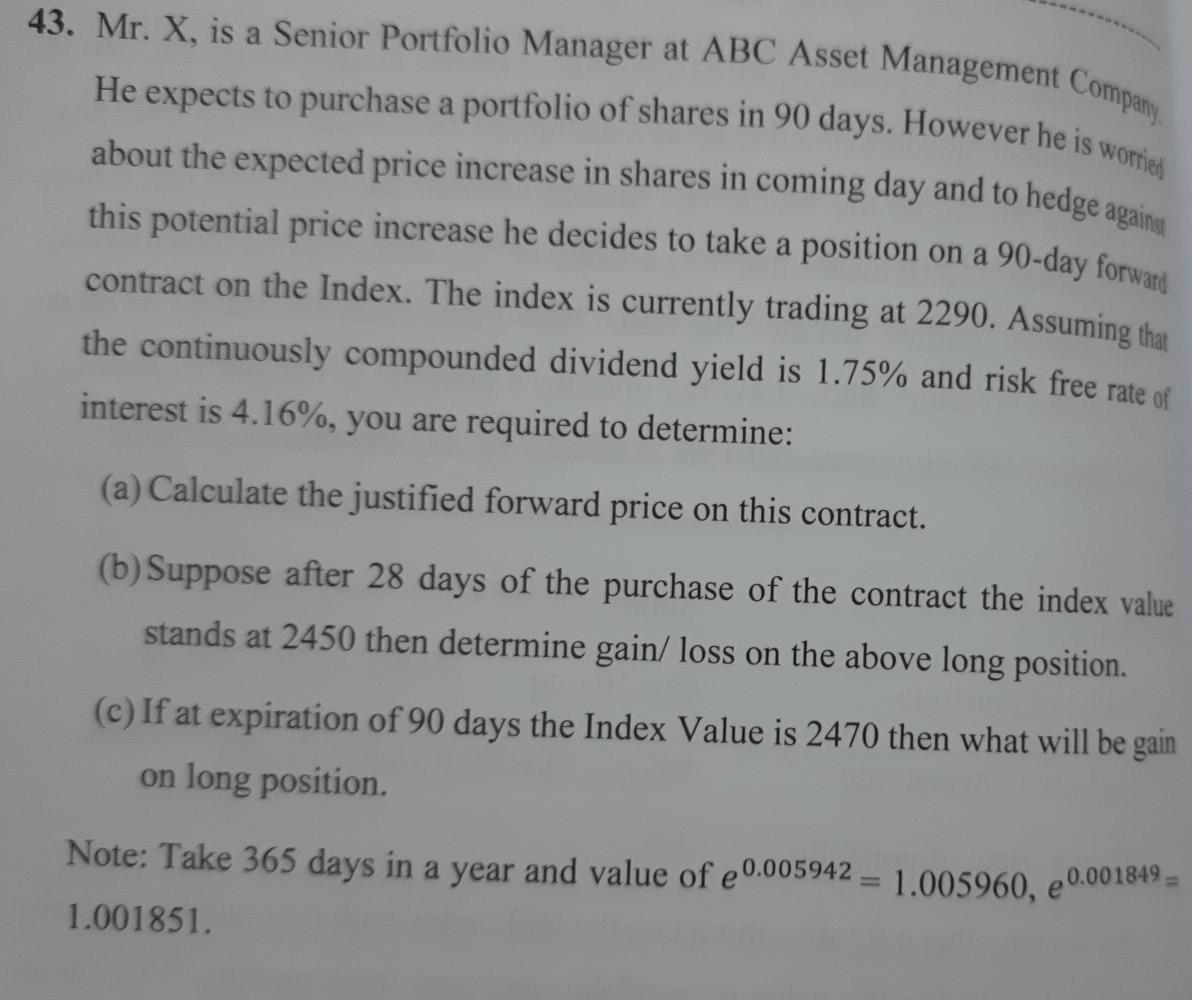

43. Mr. X, is a Senior Portfolio Manager at ABC Asset Management Company He expects to purchase a portfolio of shares in 90 days. However he is worried about the expected price increase in shares in coming day and to hedge against this potential price increase he decides to take a position on a contract on the Index. The index is currently trading at 2290. Assuming that the continuously compounded dividend yield is 1.75% and risk free rate of interest is 4.16%, you are required to determine: 90-day forward (a) Calculate the justified forward price on this contract. (b) Suppose after 28 days of the purchase of the contract the index value stands at 2450 then determine gain/ loss on the above long position. (c) If at expiration of 90 days the Index Value is 2470 then what will be gain on long position. Note: Take 365 days in a year and value of 0.005942 = 1.005960, 0.001849 = 1.001851

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started