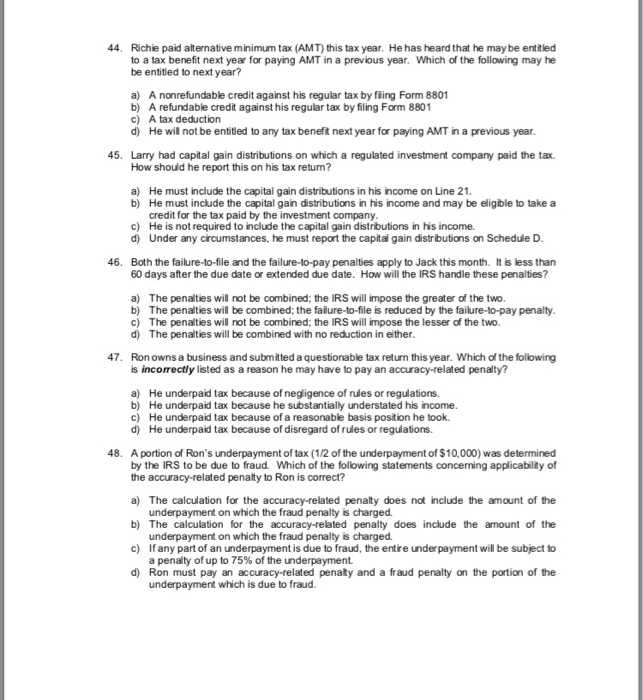

44 Richie paid alternative minimum tax (AMT) this tax year. to a tax benefit next year for paying AMT in a previous year. Which of the following may he be entitled to next year? He has heard that he may be entitled A nonrefundable credit against his regular tax by fling Form 8801 b) a) A refundable credit against his regular tax by filing Form 8801 A tax deduction c) d) He wil not be entitled to any tax beneft next year for paying AMT in a previous year 45 Lary had capital gain distributions on which a regulated investment company paid the tax. How shouid he report this on his tax return? a) He must include the capital gain distributions in his income on Line 21. b) He must include the capital gain distributions in his income and may be eligible to take a credit for the tax paid by the investment company c) He is not required to include the capital gain distributions in his income. d) Under any circumstances, he must report the capital gain distributions on Schedule D 46. Both the failure-to-file and the failure-lo-pay penalties apply to Jack this month. It is less than 60 days after the due date or extended due date. How will the IRS handle these penalties? a) The penalties will not be combined: the IRS will impose the greater of the two. b) The penalties will be combined; the falure-to-file is reduced by the failure-to-pay penalty c) The penalties will not be combined; the IRS will impose the lesser of the two. d) The penalties will be combined with no reduction in either 47. Ronowns a business and submitted a questionable tax return this year. Which of the following is incorrectly listed as a reason he may have to pay an accuracy-related penalty? a) He underpaid tax because of negligence of rules or regulations. b) He underpaid tax because he substantially understated his income. c) He underpaid tax because of a reasonable basis position he took. d) He underpaid tax because of disregard of rules or regulations. 48. A portion of Ron's underpayment of tax (1/2 of the underpayment of $10,000) was determined by the IRS to be due to fraud Which of the following statements concerning applicability of the accuracy-related penalty to Ron is correct? a) The calculation for the accuracy-related penalty does not include the amount of the b) The calculation for the accuracy-related penalty does include the amount of the c) Ifany part of an underpayment is due to fraud the entre underpayment will be subject to d) Ron must pay an accuracy-related penaty and a fraud penalty on the portion of the underpayment on which the fraud penalty is charged underpayment on which the fraud penalty is charged a penalty of up to 75% of the underpayment. underpayment which is due to fraud