Answered step by step

Verified Expert Solution

Question

1 Approved Answer

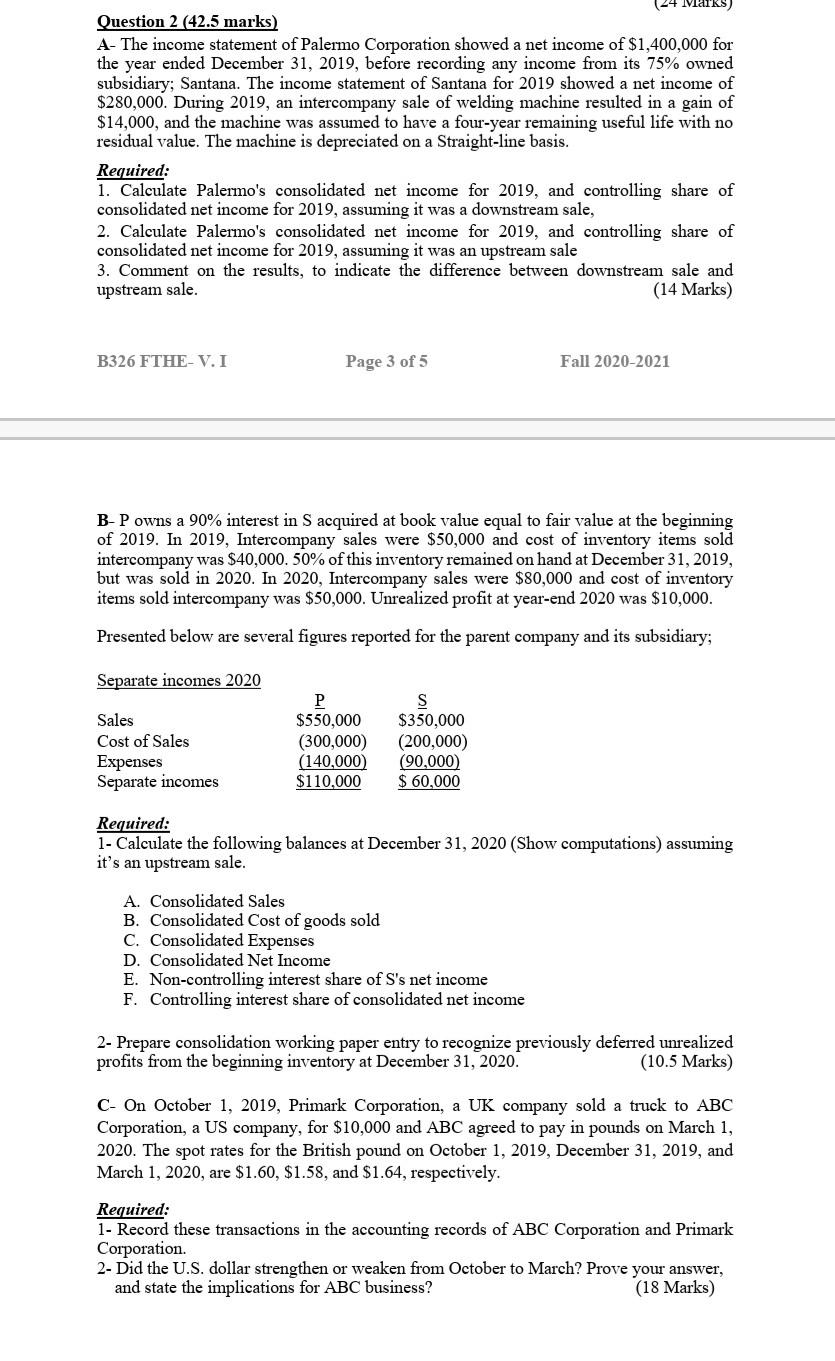

(44 Walks Question 2 (42.5 marks) A- The income statement of Palermo Corporation showed a net income of $1,400,000 for the year ended December 31,

(44 Walks Question 2 (42.5 marks) A- The income statement of Palermo Corporation showed a net income of $1,400,000 for the year ended December 31, 2019, before recording any income from its 75% owned subsidiary; Santana. The income statement of Santana for 2019 showed a net income of $280,000. During 2019, an intercompany sale of welding machine resulted in a gain of $14,000, and the machine was assumed to have a four-year remaining useful life with no residual value. The machine is depreciated on a Straight-line basis. Required: 1. Calculate Palermo's consolidated net income for 2019, and controlling share of consolidated net income for 2019, assuming it was a downstream sale, 2. Calculate Palermo's consolidated net income for 2019, and controlling share of consolidated net income for 2019, assuming it was an upstream sale 3. Comment on the results, to indicate the difference between downstream sale and upstream sale. (14 Marks) B326 FTHE-V.I Page 3 of 5 Fall 2020-2021 B-P owns a 90% interest in S acquired at book value equal to fair value at the beginning of 2019. In 2019, Intercompany sales were $50,000 and cost of inventory items sold intercompany was $40,000. 50% of this inventory remained on hand at December 31, 2019, but was sold in 2020. In 2020, Intercompany sales were $80,000 and cost of inventory items sold intercompany was $50,000. Unrealized profit at year-end 2020 was $10,000. Presented below are several figures reported for the parent company and its subsidiary; Separate incomes 2020 Sales Cost of Sales Expenses Separate incomes P $550,000 (300,000) (140,000) $110,000 S $350,000 (200,000) (90,000) $ 60,000 Required: 1- Calculate the following balances at December 31, 2020 (Show computations) assuming it's an upstream sale. A. Consolidated Sales B. Consolidated Cost of goods sold C. Consolidated Expenses D. Consolidated Net Income E. Non-controlling interest share of S's net income F. Controlling interest share of consolidated net income 2- Prepare consolidation working paper entry to recognize previously deferred unrealized profits from the beginning inventory at December 31, 2020. (10.5 Marks) C- On October 1, 2019, Primark Corporation, a UK company sold a truck to ABC Corporation, a US company, for $10,000 and ABC agreed to pay in pounds on March 1, 2020. The spot rates for the British pound on October 1, 2019, December 31, 2019, and March 1, 2020, are $1.60, $1.58, and $1.64, respectively. Required: 1- Record these transactions in the accounting records of ABC Corporation and Primark Corporation. 2- Did the U.S. dollar strengthen or weaken from October to March? Prove your answer, and state the implications for ABC business (18 Marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started