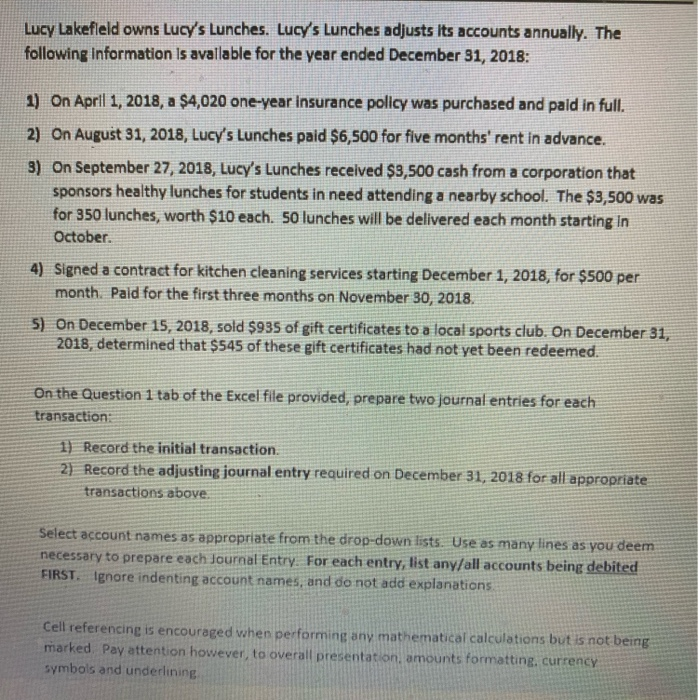

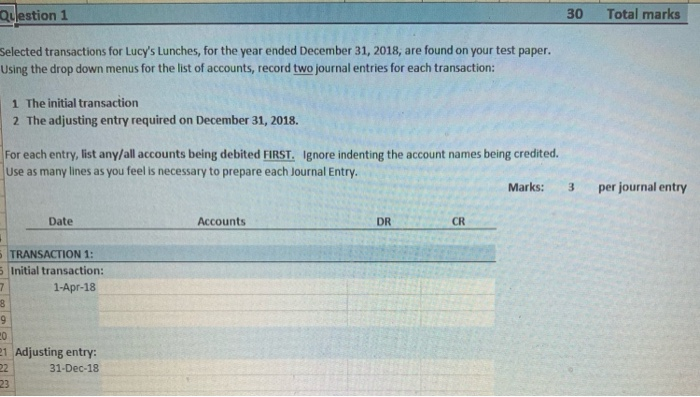

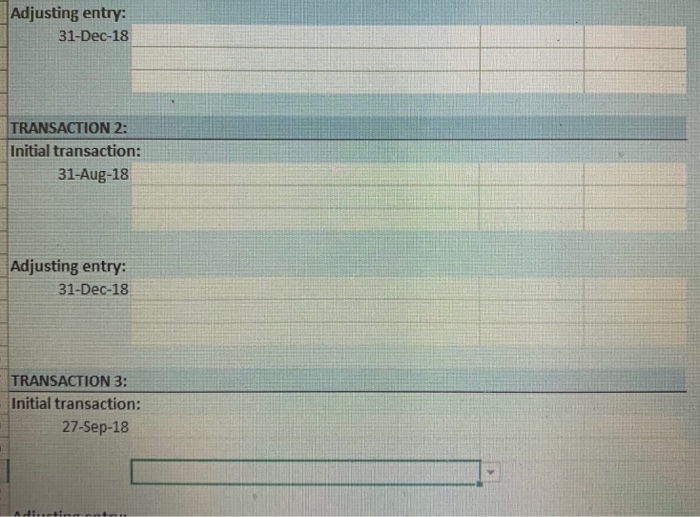

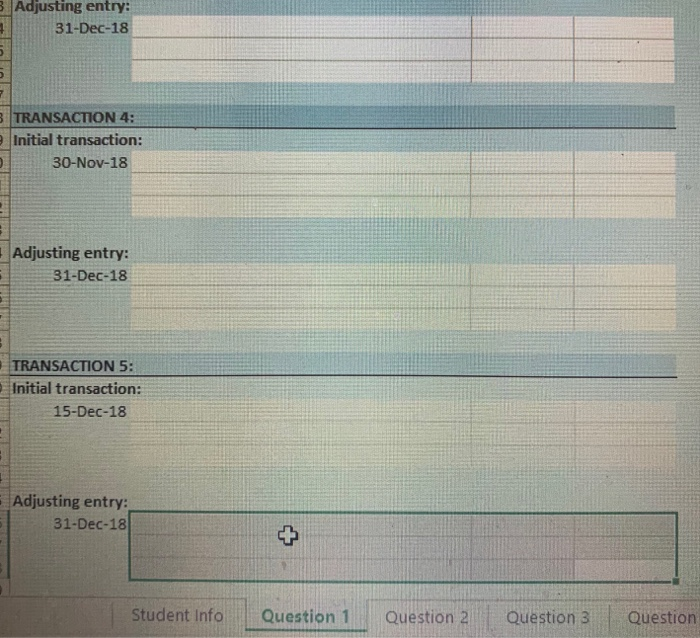

Lucy Lakefield owns Lucy's Lunches. Lucy's Lunches adjusts Its accounts annually. The following Information is available for the year ended December 31, 2018: 1) On April 1, 2018, a $4,020 one-year Insurance policy was purchased and paid in full. 2) On August 31, 2018, Lucy's Lunches paid $6,500 for five months' rent in advance. 3) On September 27, 2018, Lucy's Lunches received $3,500 cash from a corporation that sponsors healthy lunches for students in need attending a nearby school. The $3,500 was for 350 lunches, worth $10 each. 50 lunches will be delivered each month starting In October 4) Signed a contract for kitchen cleaning services starting December 1, 2018, for $500 per month. Pald for the first three months on November 30, 2018. 5) On December 15, 2018, sold $935 of gift certificates to a local sports club. On December 31, 2018, determined that $545 of these gift certificates had not yet been redeemed. On the Question 1 tab of the Excel file provided, prepare two journal entries for each transaction: 1) Record the initial transaction. 2) Record the adjusting journal entry required on December 31, 2018 for all appropriate transactions above Select account names as appropriate from the drop-down lists. Use as many lines as you deem necessary to prepare each Journal Entry. For each entry, list any/all accounts being debited FIRST. Ignore indenting account names, and do not add explanations Cell referencing is encouraged when performing any mathematical calculations but is not being marked Pay attention however, to overall presentation amounts formatting, currency symbols and underlining Question 1 30 Total marks Selected transactions for Lucy's Lunches, for the year ended December 31, 2018, are found on your test paper. Using the drop down menus for the list of accounts, record two journal entries for each transaction: 1 The initial transaction 2 The adjusting entry required on December 31, 2018. For each entry, list any/all accounts being debited FIRST. Ignore indenting the account names being credited. Use as many lines as you feel is necessary to prepare each Journal Entry. Marks: 3 per journal entry Date Accounts DR CR TRANSACTION 1: 5 Initial transaction: 1-Apr-18 8 9 20 21 Adjusting entry: 22 31-Dec-18 22 Adjusting entry: 31-Dec-18 TRANSACTION 2: Initial transaction: 31-Aug-18 Adjusting entry: 31-Dec-18 TRANSACTION 3: Initial transaction: 27-Sep-18 Adjusting entry: 31-Dec-18 7 TRANSACTION 4: Initial transaction: 30-Nov-18 Adjusting entry: 31-Dec-18 TRANSACTION 5: Initial transaction: 15-Dec-18 Adjusting entry: 31-Dec-18 Student Info Question 1 Question 2 Question 3