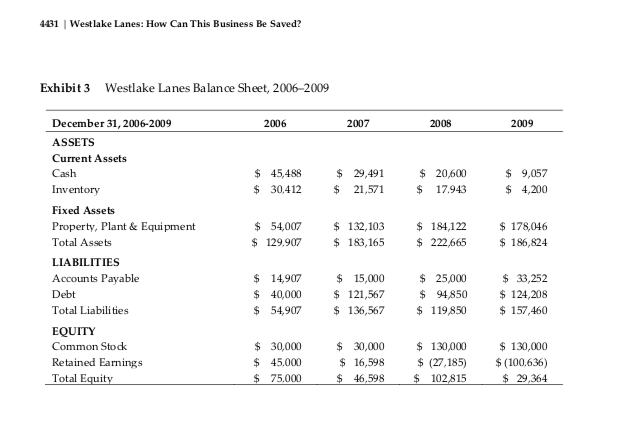

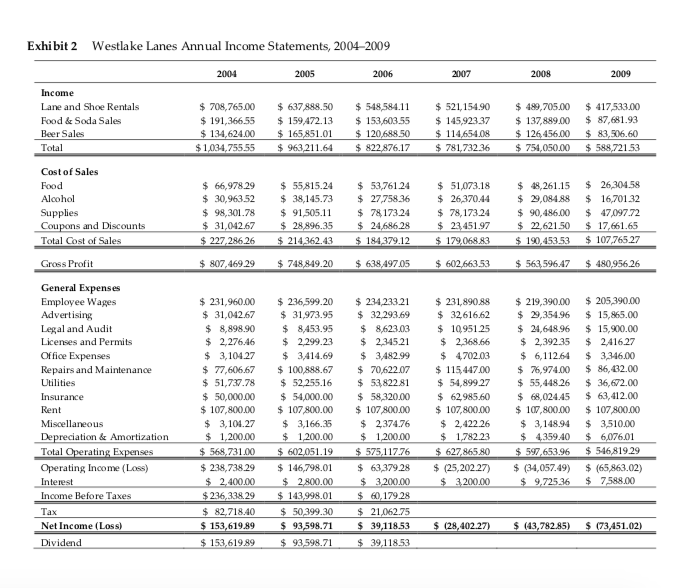

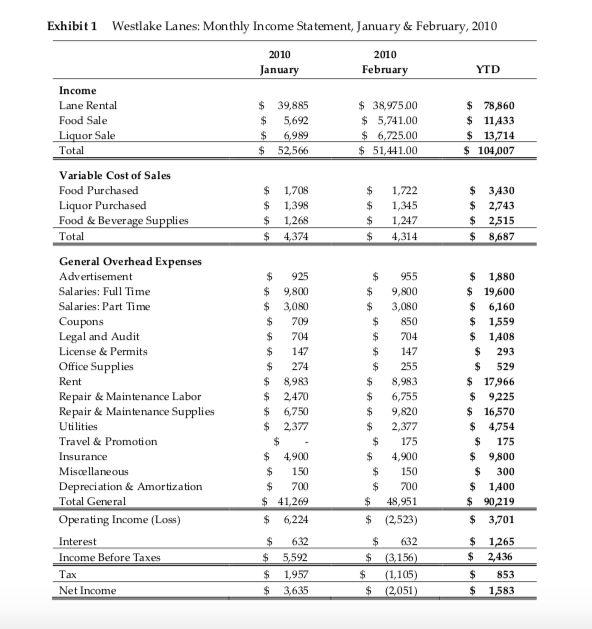

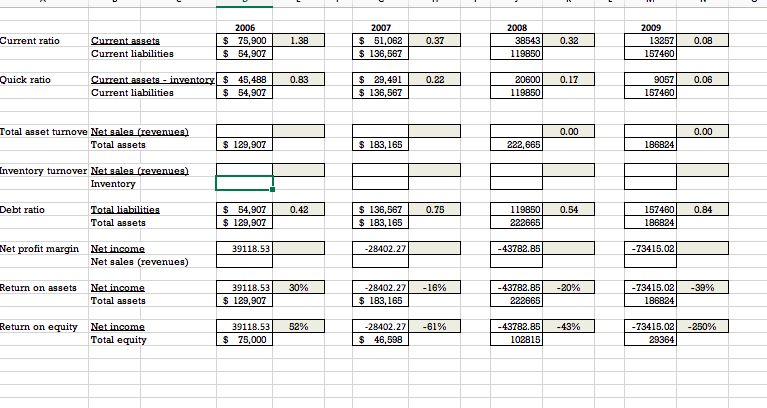

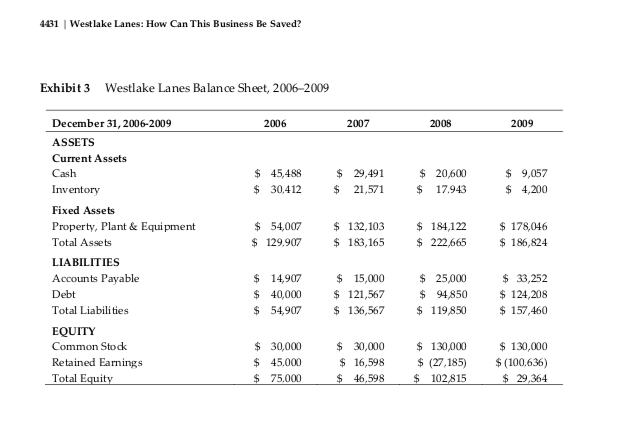

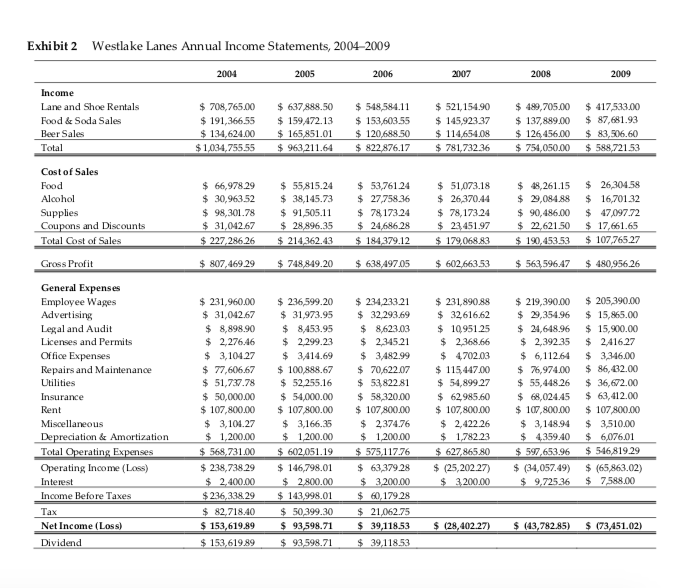

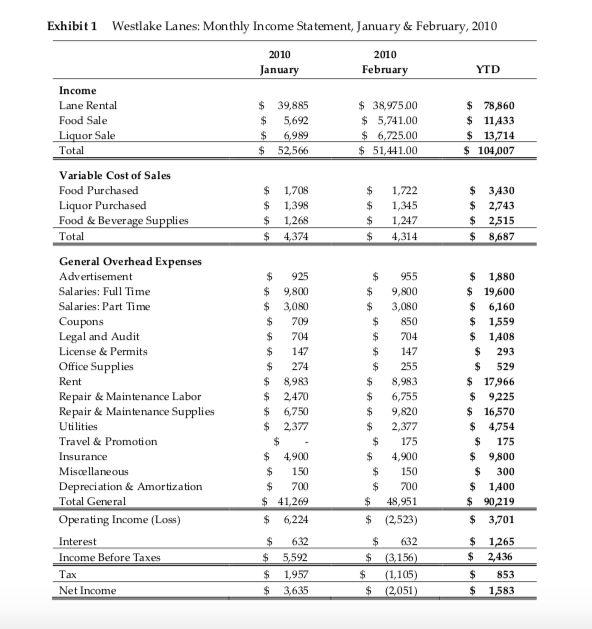

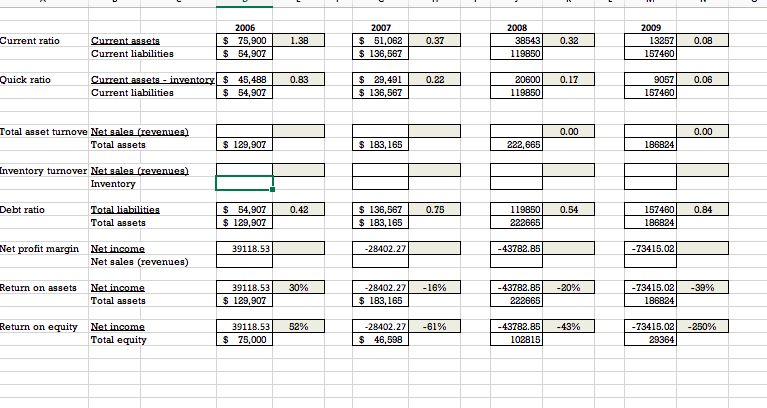

4431 West lake Lanes: How Can This Business Be Saved? Exhibit 3 Westlake Lanes Balance Sheet, 2006-2009 December 31,2006-2009 2007 2008 2009 2006 ASSETS Current Assets Cash 45,488 $ 30.412 29,491 20600 9,057 Inventory 21,571 17.943 4,200 Fixed Assets $ 132,103 Property, Plant & Equipment 54,007 184,122 178,046 222,665 Total Assets 129,907 183,165 $186,824 LIABILITIES Accounts Payable 14,907 15,000 25,000 33,252 $ 40,000 Debt 121,567 94,850 124,208 Total Liabilities 54,907 $136,567 119,850 157,460 EQUITY $ 30,000 Common Stock 30,000 130,000 130,000 Retained Earnings $ 45,000 (27,185) 16,598 (100.636) Total Equity 46,598 75,000 102,815 29,364 Exhibit 2 Westlake Lanes Annual Income Statements, 2004-2009 2004 2005 2006 2007 2008 2009 Income 637 888,50 Lane and Shoe Rentals 708,765.00 $548.584.11 521,154.90 $489,705.00 $417533.00 $87,681.93 $ 83,506.60 588,721 53 Food & Soda Sales $191,366.55 $159,472.13 $ 165851.01 153,603.55 $ 120.688.50 145,92337 137,889.00 $114.654.08 Beer Sales 134,624.00 126456.00 $1,034,755.55 754,050,00 Total $963.211.64 822876.17 781,732.36 Cost of Sales $ 48,261.15 $ 29,08488 55,815.24 $53,761.24 $27,758.36 26304.58 Food 66,978.29 $51,073.18 $ 26370.44 Alcohol 30,963.52 38,145.73 16.70132 98,301.78 Supplies Coupons and Discounts 91505.11 $78173.24 $78,173.24 $90,486.00 47,097.72 31,042.67 28,896.35 24,686.28 $23,451.97 22,621.50 17,661.65 $ 227,286.26 $ 214,362.43 $ 184379.12 $ 179,068.83 Total Cost of Sales 107,765.27 $190,453,53 Gross Profit 807,46929 748,849.20 638,497.05 602,663.53 563,59647 480,956.26 General Expens es $236,599.20 231,89088 205390,00 Employee Wages Advertising 231,960.00 234,233.21 219,390.00 31,973.95 32.293.69 29,354.96 31,042.67 $32616.62 15,865.00 $ 8,623.03 $ 234521 Legal and Audit 8,898.90 8,453.95 $10951.25 $24,648.96 15,900.00 Licenses and Permits 2,276.46 2,299.23 2368.66 2,39235 $2,416.27 Office Expenses Repairs and Maintenance 3,104.27 3,414.69 3,482.99 4702.03 6,112.64 3346.00 77,60667 86,432.00 100,888.67 $70,622.07 $115447.00 76,974.00 $ 36.672.00 Utilities 51,737.78 $52,255.16 53822.81 $54,899.27 $55,448.26 63,412.00 Insurance 50,000.00 54,000.00 58,320.00 62985.60 $ 107.800.00 68,024.45 $107,800.00 Rent 107,800.00 $107800.00 $107,800.00 107800.00 3,166.35 $ 2,422.26 Miscellaneous 3,104.27 2374.76 $3,148.94 $3510.00 Depreciation & Amortization 1,200.00 $1200.00 1,200.00 1,782.23 4359.40 6,076.01 Total Operating Expenses 546,819.29 $568,731.00 $602,051.19 575,117.76 627,865.80 597,653.96 238,738.29 63,37928 (65,863.02) Operating Income (Loss) 146,798.01 (25,202.27) (34,057.49) 2,800.00 $ 9,72536 7588.00 Interest 2,400.00 3,200.00 3200.00 $ 60,179.28 Income Before Taxes $236,338.29 $143,998.01 Tax 82,718.40 $50399.30 21.062.75 $ (43,782.85) $ (73,451.02) S 39,118.53 Net Income (Loss) $153,619.89 93,598.71 (28,402.27) $ 153,619.89 $93598.71 Dividend 39,118.53 Exhibit 1 Westlake Lanes: Monthly Income Statement, January & February, 2010 2010 2010 January February YTD Income $ 78,860 $ 11433 $ 13,714 Lane Rental $ 39,885 38,975.00 5,741.00 Food Sale $ 5,692 6,725.00 Liquor Sale 6,989 Total 52,566 51,441.00 104,007 Variable Cost of Sales Food Purchased 1,708 1,398 1,268 $ 1,722 3A30 Liquor Purchased Food&Beverage Supplies 1,345 2,743 1,247 2,515 Total 4,374 $ 4,314 8,687 General Overhead Expenses Advertisement 925 $ 955 1,880 $ 19,600 Salaries: Full Time 9,800 3,080 9,800 Salaries: Part Time 3,080 6,160 Coupons Legal and Audit 709 850 1559 704 704 1408 License & Permits 147 147 293 Office Supplies 274 255 529 $ 17,966 $9,225 $ 16,570 Rent $ 8,983 8,983 Repair& Maintenance Labor Repair & Maintenance Supplies 2,470 $ 6,755 6,750 $ 9,820 2,377 Utilities 2,377 4,754 Travel & Promotion 175 175 Insurance 4,900 $ 4,900 9,800 Miscellaneous 150 150 300 Depreciation& Amortization Total General 700 700 1400 41,269 48,951 90,219 Operating Income (Los) 6,224 $ (2,523) 3,701 Interest $ 632 $ 632 1265 $ 2,436 Income Before Taxes 5,592 (3,156) (1,105) Tax 1,957 853 Net Income 3,635 $ (2,051) 1583 2007 2006 2008 2009 $ 51,062 0,08 Current ratio Current assets 75.900 1.38 0.37 38543 0.32 13257 Current liabilities 54,907 136,567 119850 157460 Current assets- inventory$ 45,488 $ 29,491 Quick ratio 0.83 0.22 20600 0.17 9057 0,06 Current liabilities 54,907 136,567 119850 157460 Total asset turnove Net sales (revenues) 0,00 0,00 $ 183.165 Total assets 129,907 222,665 186824 Inventory turnover Net sales (revenues) Inventory Debt ratio Total liabilities Total assets 54,907 0.42 $136,567 0.75 119850 0.54 157460 0.84 129,907 $183,165 222665 186824 Net income 39118.53 Net profit marqin -28402.27 -43782.85 -73415,02 Net sales (revenues) Return on assets Net income 39118.53 30% -28402.27 -16% -43782.85 -20% -73415.02 186824 -39% Total assets 129,907 183,165 222665 Return on equity Net income Total equity -250% 39118.53 52% -28402.27 -61% -43782.85 -43% -73415.02 $ 75,000 $ 46,598 102815 29364