Question: What risks does mike have that need to be considered? Based on how much mike needs to save and what you have gathered from the

- What risks does mike have that need to be considered?

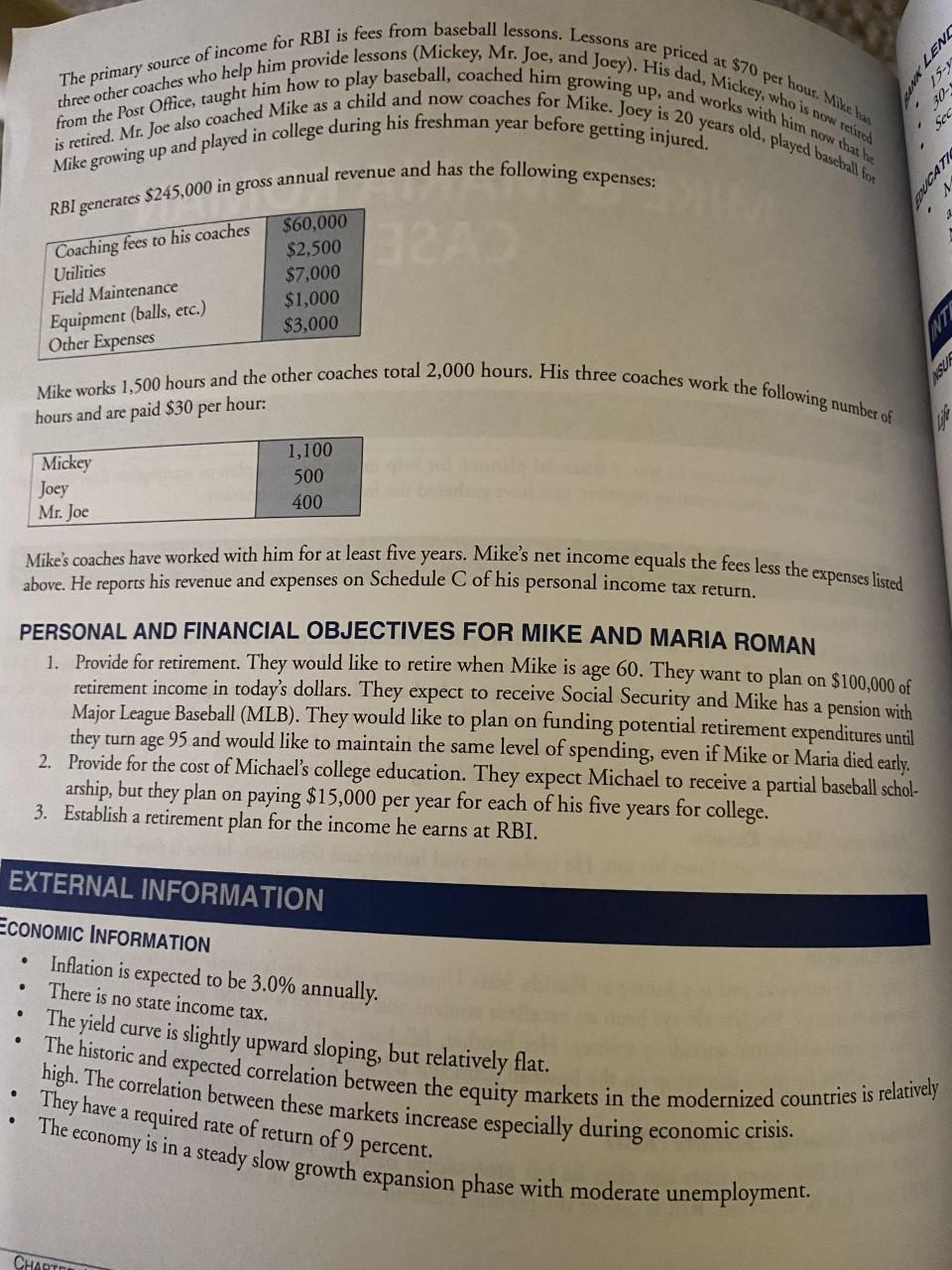

- Based on how much mike needs to save and what you have gathered from the case, what type of retirement plan would you recommend, if any at all? Justify your answer.

- Assume mike adopts a SEP and contributes 25% for all three coaches.

- What is the impact on his tax situation

- How much can he contribute to the SEP for himself?

- How does the impact his discretionary cash flow?

- What are the advantages of this approach?

- What are the disadvantages of this approach?

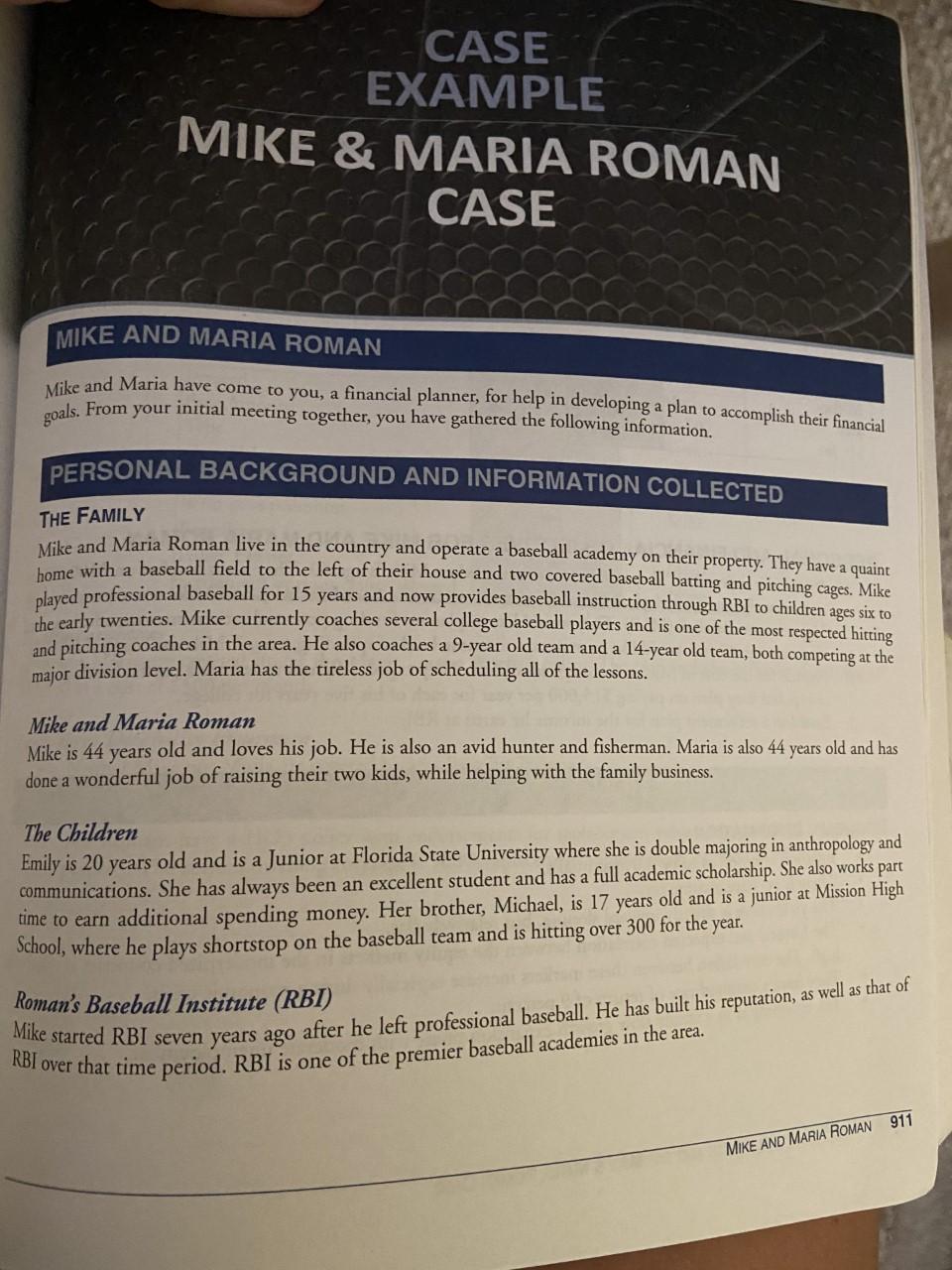

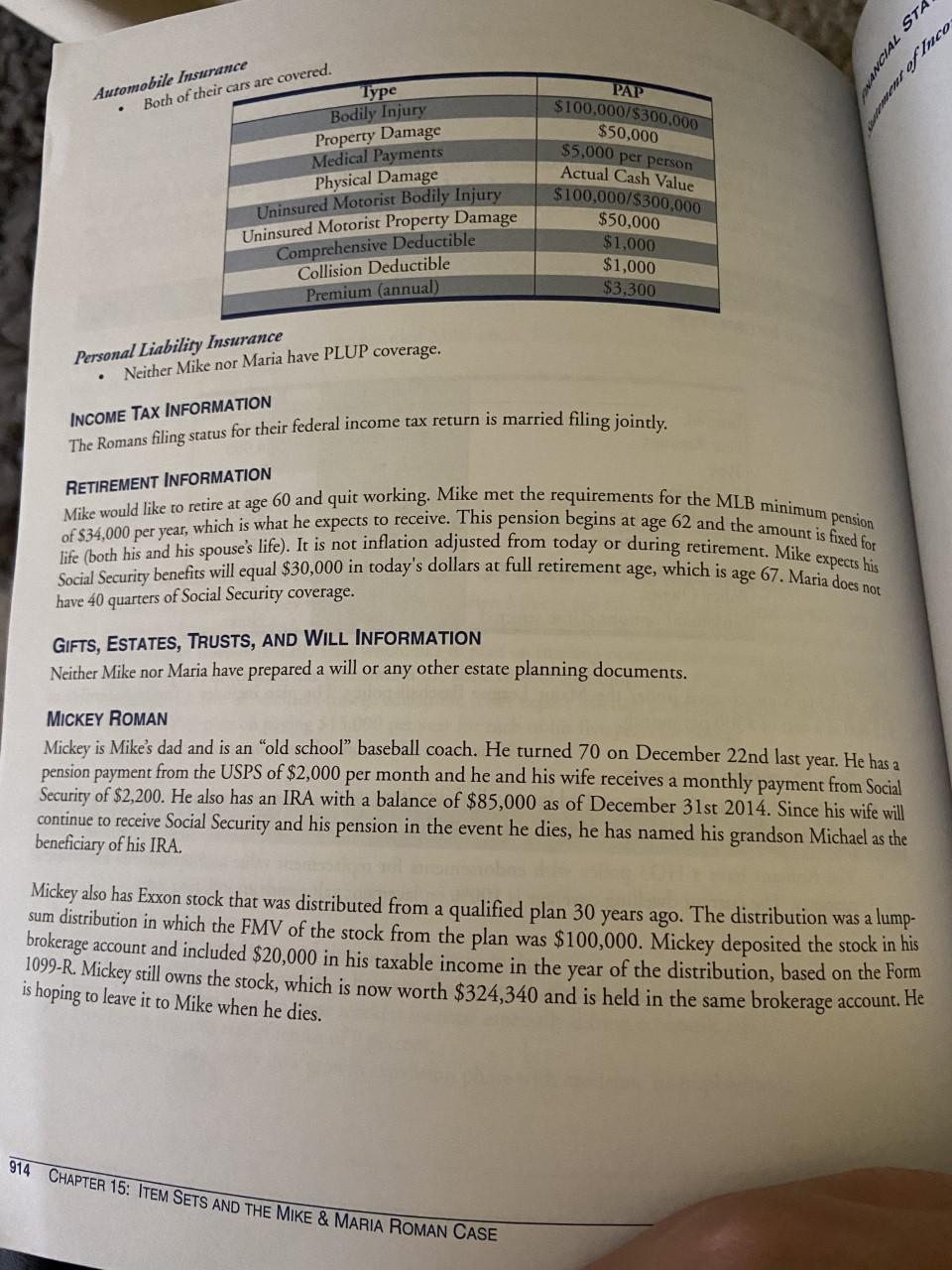

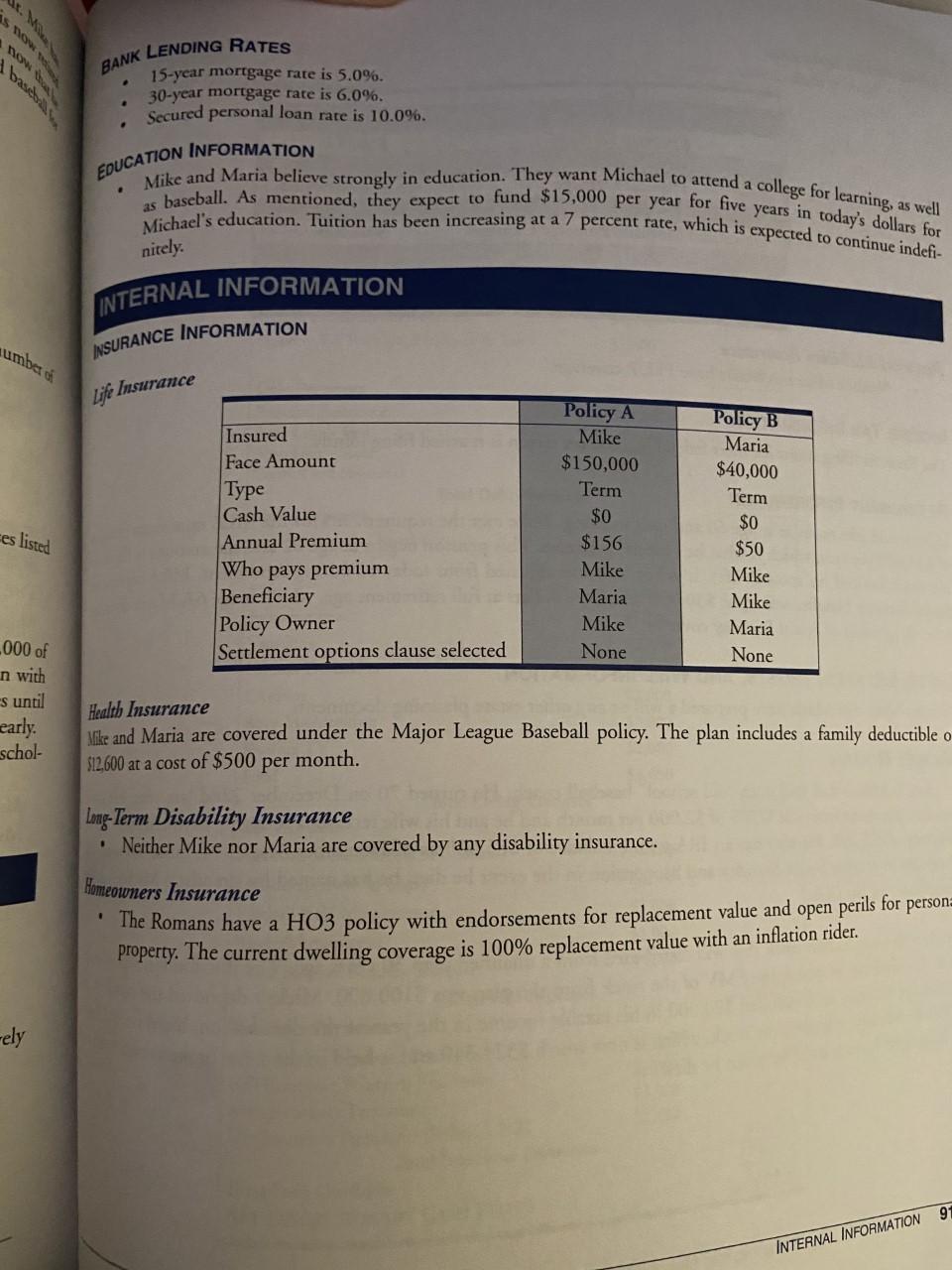

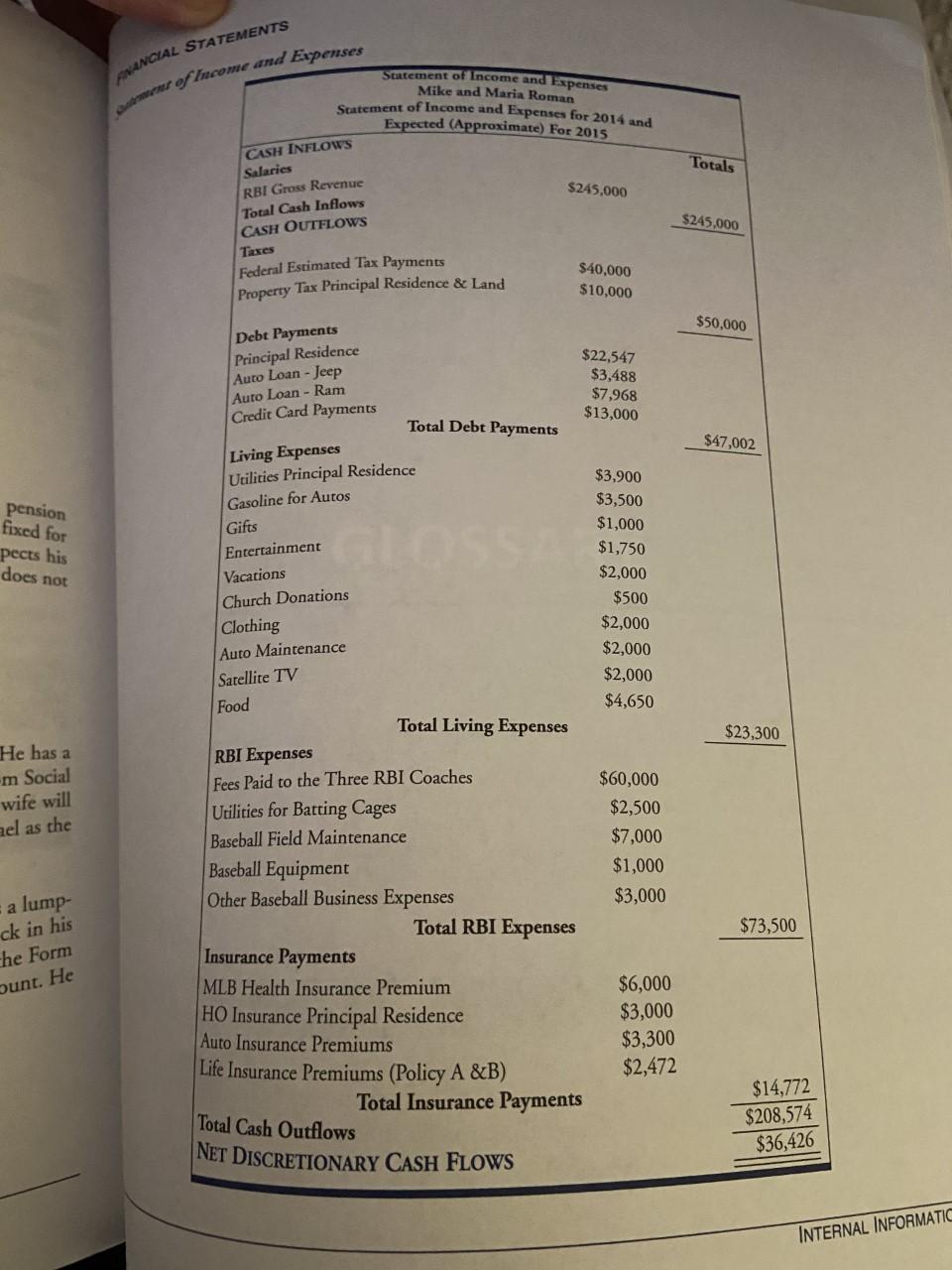

CASE EXAMPLE MIKE & MARIA ROMAN CASE MIKE AND MARIA ROMAN Vike and Maria have come to you, a financial planner, for help in developing a plan to accomplish their financial oals. From your initial meeting together, you have gathered the following information. PERSONAL BACKGROUND AND INFORMATION COLLECTED THE FAMILY Vike and Maria Roman live in the country and operate a baseball academy on their property. They have a quainr Mke rh a baseball field to the left of their house and two covered baseball batting and pitching cages. Mike laved professional baseball for 15 years and now provides baseball instruction through RBI to children ages six to he carly twenties. Mike currently coaches several college baseball players and is one of the most respected hitting and pitching coaches in the area. He also coaches a 9-year old team and a 14-year old team, both competing at the major division level. Maria has the tireless job of scheduling all of the lessons. Mike and Maria Roman Mike is 44 years old and loves his job. He is also an avid hunter and fisherman. Maria is also 44 years old and has done a wonderful job of raising their two kids, while helping with the family business. The Children Emily is 20 years old and is a Junior at Florida State University where she is double majoring in anthropology and communications. She has always been an excellent student and has a full academic scholarship. She also works part time to earn additional spending money. Her brother, Michael, is 17 years old and is a junior at Mission High School, where he plays shortstop on the baseball team and is hitting over 300 for the year. Roman's Baseball Institute (RBI) DRr started RBI seven years ago after he left professional baseball. He has built his reputation, as well as that of MIKE AND MARIA ROMAN 911

Step by Step Solution

3.33 Rating (156 Votes )

There are 3 Steps involved in it

1 The risks that Mike has that need to be considered include inflation longevity investment risk and taxes the potential for his income to vary from y... View full answer

Get step-by-step solutions from verified subject matter experts