Answered step by step

Verified Expert Solution

Question

1 Approved Answer

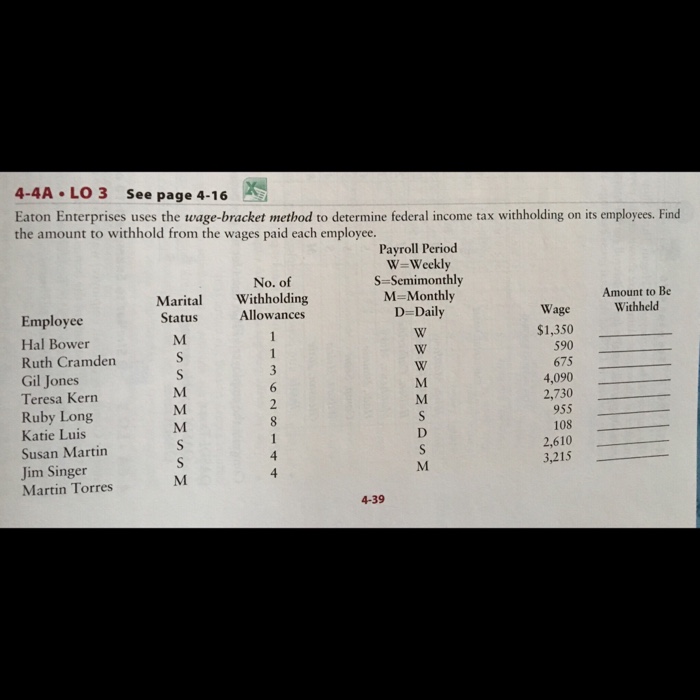

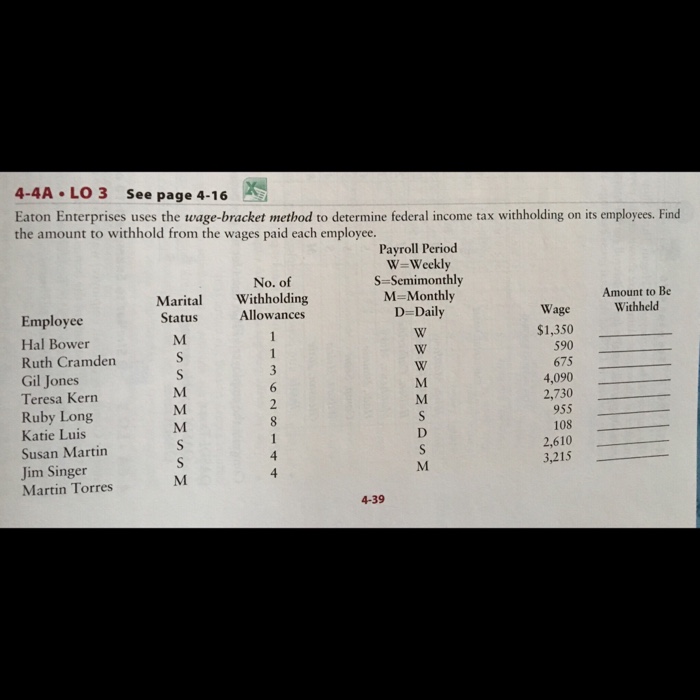

4-4A LO 3 See page 4-16 Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to

4-4A LO 3 See page 4-16 Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee No. of Withholding Allowances Payroll Period W-Weekly S-Semimonthly M-Monthly D-Daily Marital Status Amount to Be Withheld Wage $1,350 Employee Hal Bower Ruth Cramden Gil Jones Teresa Kern Ruby Long Katie Luis Susan Martin Jim Singer Martin Torres 590- 675 4,090 2,730 955 2,610 3,215 4-39

4-4A LO 3 See page 4-16 Eaton Enterprises uses the wage-bracket method to determine federal income tax withholding on its employees. Find the amount to withhold from the wages paid each employee No. of Withholding Allowances Payroll Period W-Weekly S-Semimonthly M-Monthly D-Daily Marital Status Amount to Be Withheld Wage $1,350 Employee Hal Bower Ruth Cramden Gil Jones Teresa Kern Ruby Long Katie Luis Susan Martin Jim Singer Martin Torres 590- 675 4,090 2,730 955 2,610 3,215 4-39

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started