Question: 4&5 A new CNC machine would cost $35,000 and has an estimated life of four years. You would pay $15,000 today and $20,000 in one

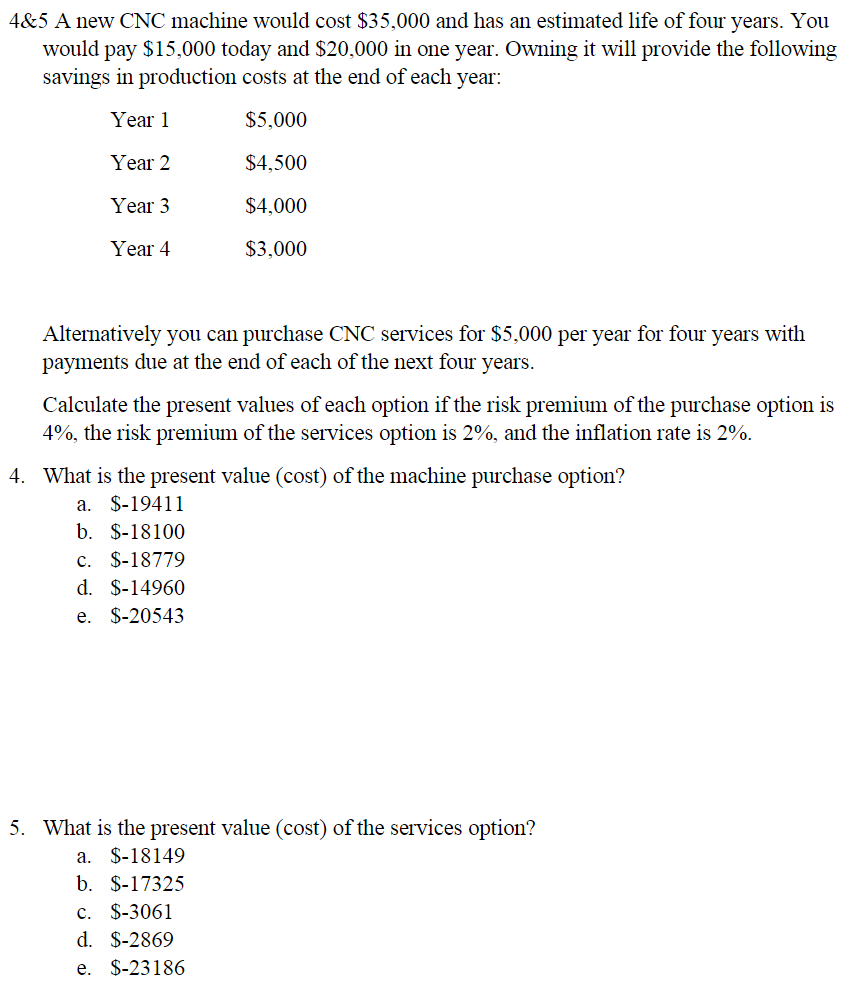

4&5 A new CNC machine would cost $35,000 and has an estimated life of four years. You would pay $15,000 today and $20,000 in one year. Owning it will provide the following savings in production costs at the end of each year: Year 1 $5,000 Year 2 $4,500 Year 3 $4,000 Year 4 $3,000 Alternatively you can purchase CNC services for $5,000 per year for four years with payments due at the end of each of the next four years. Calculate the present values of each option if the risk premium of the purchase option is 4%, the risk premium of the services option is 2%, and the inflation rate is 2%. 4. What is the present value (cost) of the machine purchase option? a. $-19411 b. $-18100 c. $-18779 d. $-14960 $-20543 e. 5. What is the present value (cost) of the services option? a. $-18149 b. $-17325 c. $-3061 d. $-2869 e. $-23186

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts