Answered step by step

Verified Expert Solution

Question

1 Approved Answer

$4500 $6300 $7850 [12 marks] Glass by Jo Inc. is a small business located in the heart of Ontario. The company is owned by the

$4500 $6300 $7850

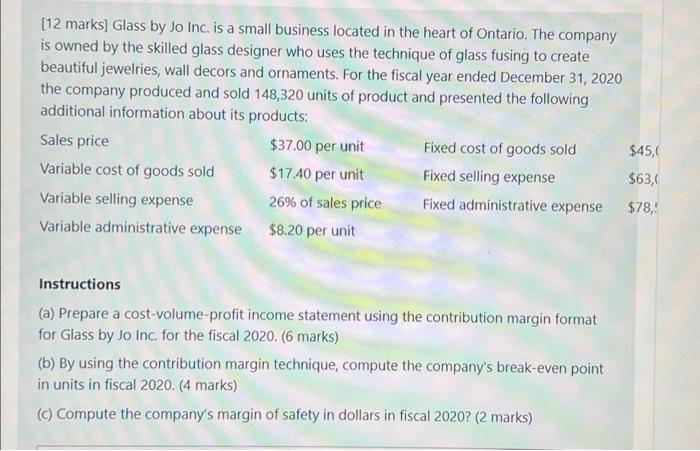

[12 marks] Glass by Jo Inc. is a small business located in the heart of Ontario. The company is owned by the skilled glass designer who uses the technique of glass fusing to create beautiful jewelries, wall decors and ornaments. For the fiscal year ended December 31, 2020 the company produced and sold 148,320 units of product and presented the following additional information about its products: Sales price $37.00 per unit Fixed cost of goods sold Variable cost of goods sold $17.40 per unit Fixed selling expense Variable selling expense 26% of sales price Fixed administrative expense Variable administrative expense $8.20 per unit $45, $63, $78, Instructions (a) Prepare a cost-volume-profit income statement using the contribution margin format for Glass by Jo Inc. for the fiscal 2020. (6 marks) (b) By using the contribution margin technique, compute the company's break-even point in units in fiscal 2020. (4 marks) (C) Compute the company's margin of safety in dollars in fiscal 2020? (2 marks) [12 marks] Glass by Jo Inc. is a small business located in the heart of Ontario. The company is owned by the skilled glass designer who uses the technique of glass fusing to create beautiful jewelries, wall decors and ornaments. For the fiscal year ended December 31, 2020 the company produced and sold 148,320 units of product and presented the following additional information about its products: Sales price $37.00 per unit Fixed cost of goods sold Variable cost of goods sold $17.40 per unit Fixed selling expense Variable selling expense 26% of sales price Fixed administrative expense Variable administrative expense $8.20 per unit $45, $63, $78, Instructions (a) Prepare a cost-volume-profit income statement using the contribution margin formare for Glass by Jo Inc. for the fiscal 2020. (6 marks) (b) By using the contribution margin technique, compute the company's break-even point in units in fiscal 2020. (4 marks) C) Compute the company's margin of safety in dollars in fiscal 2020? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started