Answered step by step

Verified Expert Solution

Question

1 Approved Answer

46, Ron mailed his 2016 federal tax return on April 15, 2017, attaching only a first-class postage stamp. However, the postage should have been higher

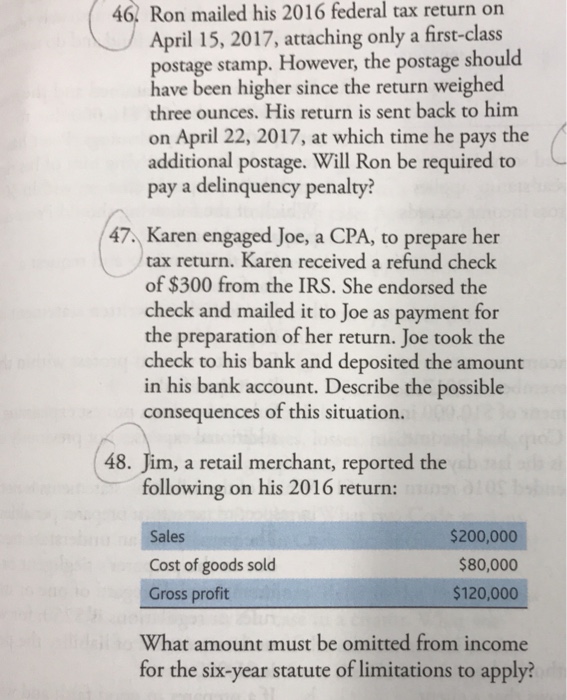

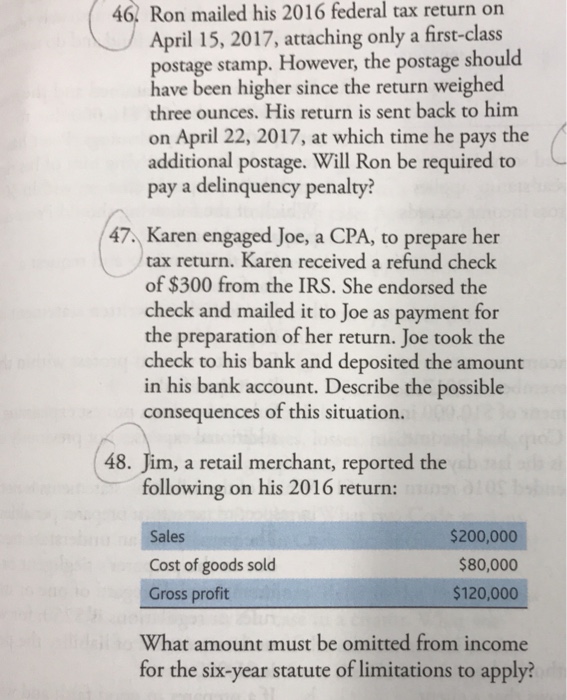

46, Ron mailed his 2016 federal tax return on April 15, 2017, attaching only a first-class postage stamp. However, the postage should have been higher since the return weighed three ounces. His return is sent back to him on April 22, 2017, at which time he pays the additional postage. Will Ron be required to pay a delinquency penalty? 47, Karen engaged Joe, a CPA, to prepare her tax return. Karen received a refund check of $300 from the IRS. She endorsed the check and mailed it to Joe as payment for the preparation of her return. Joe took the check to his bank and deposited the amount in his bank account. Describe the possible consequences of this situation. 48. Jim, a retail merchant, reported the following on his 2016 return: Sales Cost of goods sold Gross proft $200,000 $80,000 $120,000 What amount must be omitted from income for the six-year statute of limitations to apply

46, Ron mailed his 2016 federal tax return on April 15, 2017, attaching only a first-class postage stamp. However, the postage should have been higher since the return weighed three ounces. His return is sent back to him on April 22, 2017, at which time he pays the additional postage. Will Ron be required to pay a delinquency penalty? 47, Karen engaged Joe, a CPA, to prepare her tax return. Karen received a refund check of $300 from the IRS. She endorsed the check and mailed it to Joe as payment for the preparation of her return. Joe took the check to his bank and deposited the amount in his bank account. Describe the possible consequences of this situation. 48. Jim, a retail merchant, reported the following on his 2016 return: Sales Cost of goods sold Gross proft $200,000 $80,000 $120,000 What amount must be omitted from income for the six-year statute of limitations to apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started