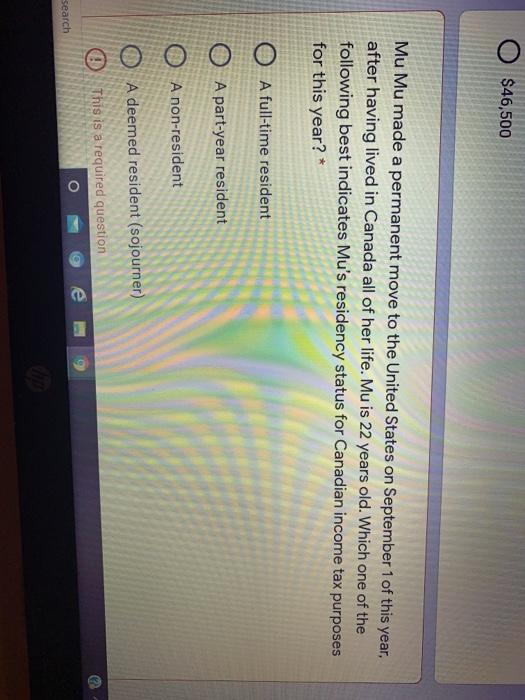

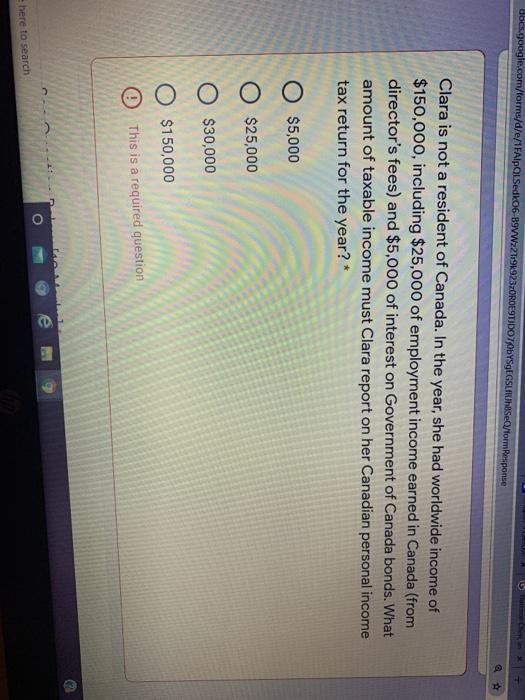

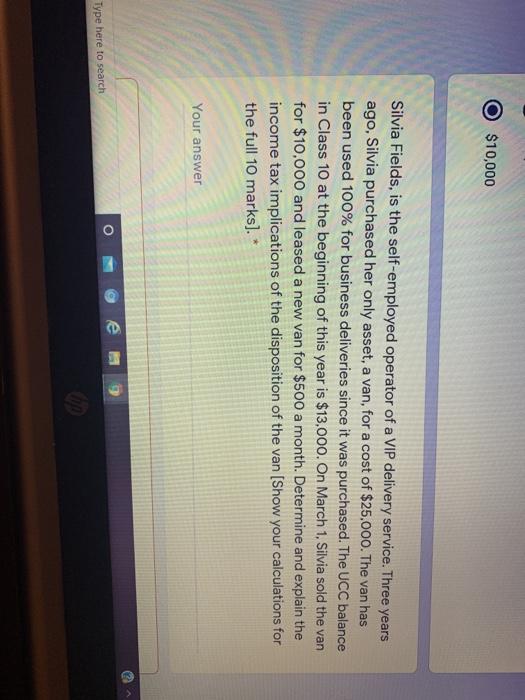

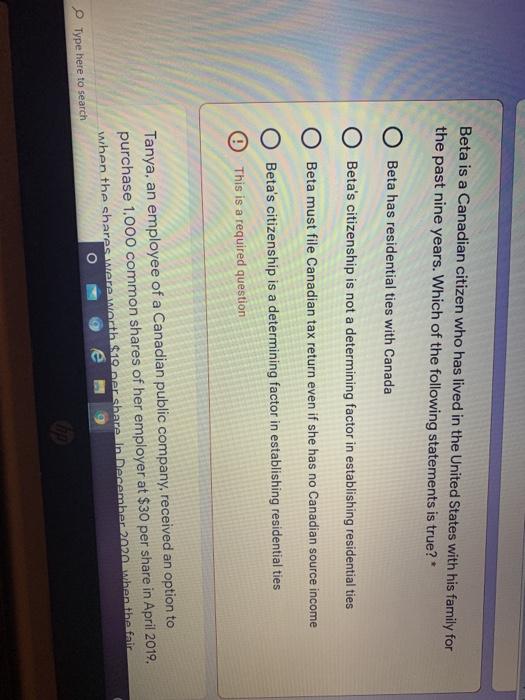

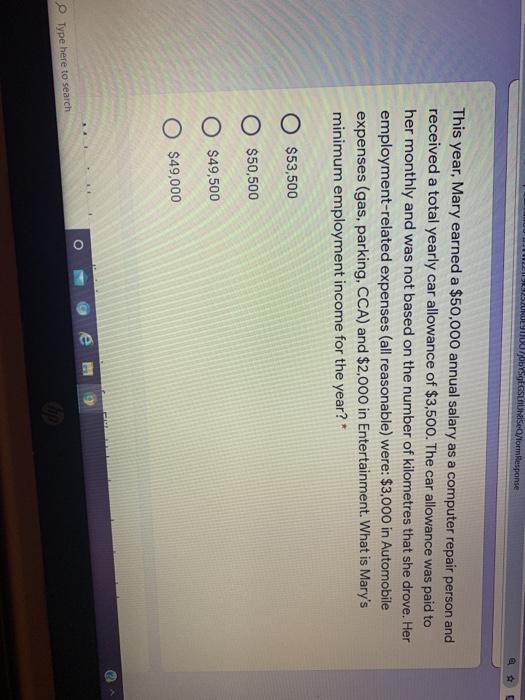

$46,500 Mu Mu made a permanent move to the United States on September 1 of this year, after having lived in Canada all of her life. Mu is 22 years old. Which one of the following best indicates Mu's residency status for Canadian income tax purposes for this year? * O A full-time resident O A part-year resident O A non-resident O A deemed resident (sojourner) This is a required question e 2 1 O search docs.google.com/forms/d/e/1FAIpQLSedk06-B9VW:21-91923-ORDE9TIDOTODYSGEGSLUMSeQ/formResponse @ Clara is not a resident of Canada. In the year, she had worldwide income of $150,000, including $25,000 of employment income earned in Canada (from director's fees) and $5,000 of interest on Government of Canada bonds. What amount of taxable income must Clara report on her Canadian personal income tax return for the year?* O $5,000 O $25,000 $30,000 O $150,000 This is a required question 9 O here to search O $10,000 Silvia Fields, is the self-employed operator of a VIP delivery service. Three years ago, Silvia purchased her only asset, a van, for a cost of $25,000. The van has been used 100% for business deliveries since it was purchased. The UCC balance in Class 10 at the beginning of this year is $13,000. On March 1, Silvia sold the van for $10,000 and leased a new van for $500 a month. Determine and explain the income tax implications of the disposition of the van [Show your calculations for the full 10 marks]. * Your answer o e 1 Type here to search Beta is a Canadian citizen who has lived in the United States with his family for the past nine years. Which of the following statements is true? Beta has residential ties with Canada Beta's citizenship is not a determining factor in establishing residential ties O Beta must file Canadian tax return even if she has no Canadian source income O Beta's citizenship is a determining factor in establishing residential ties This is a required question Tanya, an employee of a Canadian public company, received an option to purchase 1.000 common shares of her employer at $30 per share in April 2019. when the shares were orth $10 mar share in December 2020 when the fait Type here to search bYSGEGSUSO/formResponse This year, Mary earned a $50,000 annual salary as a computer repair person and received a total yearly car allowance of $3,500. The car allowance was paid to her monthly and was not based on the number of kilometres that she drove. Her employment-related expenses (all reasonable) were: $3,000 in Automobile expenses (gas, parking, CCA) and $2,000 in Entertainment. What is Mary's minimum employment income for the year?* O $53,500 O $50,500 O $49,500 O $49,000 O 7 Type here to search