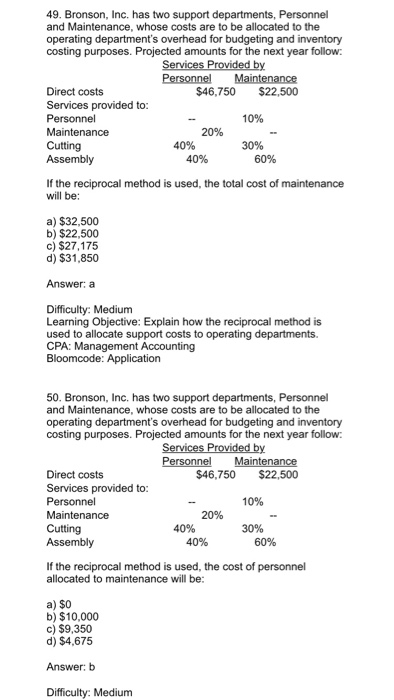

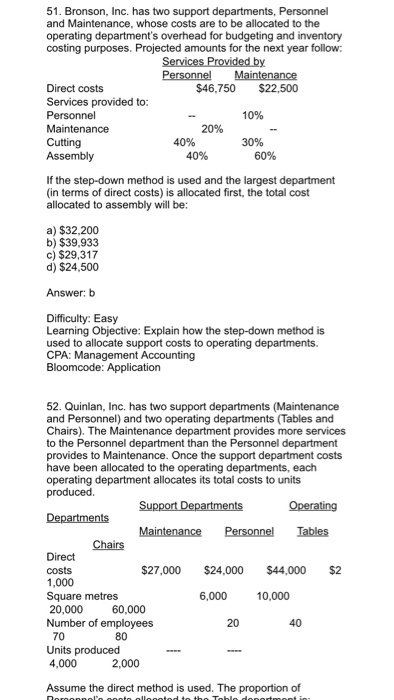

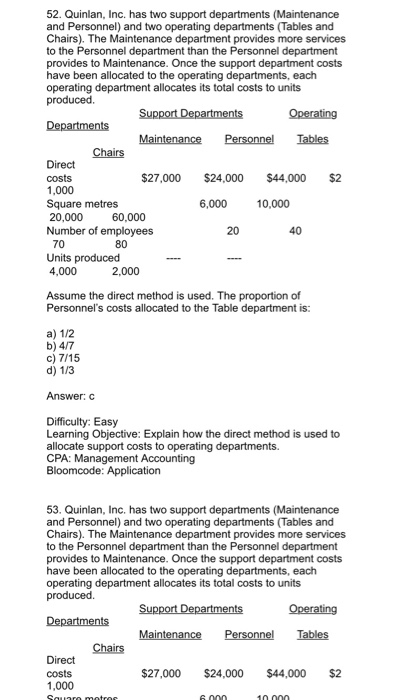

49. Bronson, Inc. has two support departments, Personnel and Maintenance, whose costs are to be allocated to the operating department's overhead for budgeting and inventory costing purposes. Projected amounts for the next year follow: Direct costs Services provided to: $46,750 $22,500 10% Cutting Assembly 30% 40% 60% If the reciprocal method is used, the total cost of maintenance will be: a) $32,500 b) $22,500 c) $27,175 d) $31,850 Answer: a Difficulty: Medium Learning Objective: Explain how the reciprocal method is used to allocate support costs to operating departments. 50. Bronson, Inc. has two support departments, Personnel and Maintenance, whose costs are to be allocated to the operating department's overhead for budgeting and inventory costing purposes. Projected amounts for the next year follow: Direct costs Services provided to: $46,750 $22,500 1096 Maintenance Cutting Assembly If the reciprocal method is used, the cost of personnel allocated to maintenance will be a) $0 b) $10,000 c) $9,350 d) $4,675 Answer: b Difficulty: Medium 51. Bronson, Inc. has two support departments, Personnel and Maintenance, whose costs are to be allocated to the operating department's overhead for budgeting and inventory costing purposes. Projected amounts for the next year follow Direct costs Services provided to: $46,750 $22,500 10% Cutting Assembly 30% 40% 60% If the step-down method is used and the largest department (in terms of direct costs) is allocated first, the total cost allocated to assembly will be a) $32,200 b) $39,933 c) $29,317 d) $24,500 Answer: b Difficulty: Easy Learning Objective: Explain how the step-down method is used to allocate support costs to operating departments. CPA: Management Accounting 52. Quinlan, Inc. has two support departments (Maintenance and Personnel) and two operating departments (Tables and Chairs). The Maintenance department provides more services to the Personnel department than the Personnel department provides to Maintenance. Once the support department costs have been allocated to the operating departments, each operating department allocates its total costs to units Maintenance Persne Tables Direct costs 1,000 Square metres 20,000 60,000 Number of employees $27,000 $24,000 $44,000 $2 6,000 10,000 20 40 70 Units produced 4,000 80 2,000 Assume the direct method is used. The proportion of 52. Quinlan, Inc. has two support departments (Maintenance and Personnel) and two operating departments (Tables and Chairs). The Maintenance department provides more services to the Personnel department than the Personnel department provides to Maintenance. Once the support department costs have been allocated to the operating departments, each operating department allocates its total costs to units produced Support Departments Maintenance Personnel Tables Chairs Direct costs 1,000 Square metres 20,000 60,000 Number of employees $27,000 $24,000 $44,000 $2 6,000 10,000 20 40 80 Units produced ,000 2.000 Assume the direct method is used. The proportion of Personnel's costs allocated to the Table department is: a) 1/2 b) 4/7 c) 7/15 d) 1/3 Answer: c Difficulty: Easy Learning Objective: Explain how the direct method is used to allocate support costs to operating departments. CPA: Management Accounting Bloomcode: Application 53. Quinlan, Inc. has two support departments (Maintenance and Personnel) and two operating departments (Tables and Chairs). The Maintenance department provides more services to the Personnel department than the Personnel department ides to Maintenance. Once the support department costs ave been allocated to the operating departments, each operating department allocates its total costs to units produced Departments Maintenance Personnel Tables Chairs Direct costs 1,000 $27,000 $24,000 $44,000 $2