Answered step by step

Verified Expert Solution

Question

1 Approved Answer

4c part 2 A B C And d that is the entire question 4-C. Part 2. Special Revenue Fund Transactions Required: a. Record journal entries

4c part 2 A B C And d that is the entire question

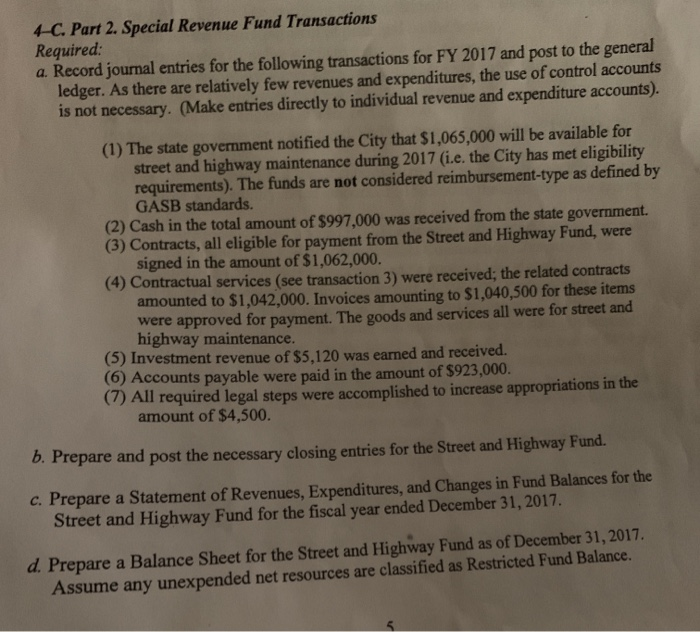

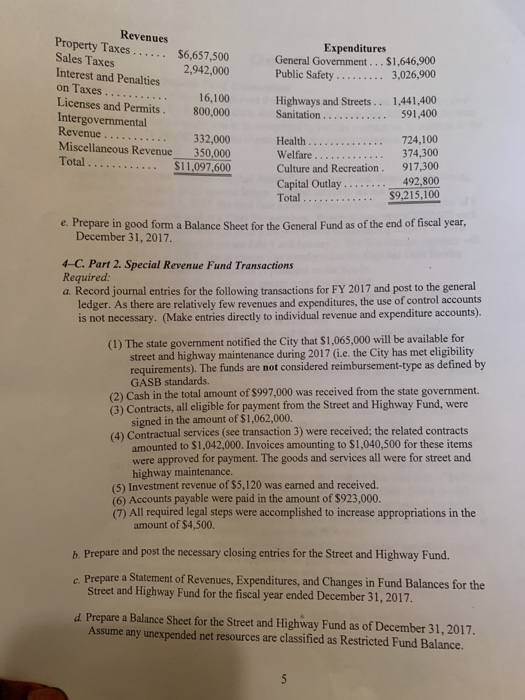

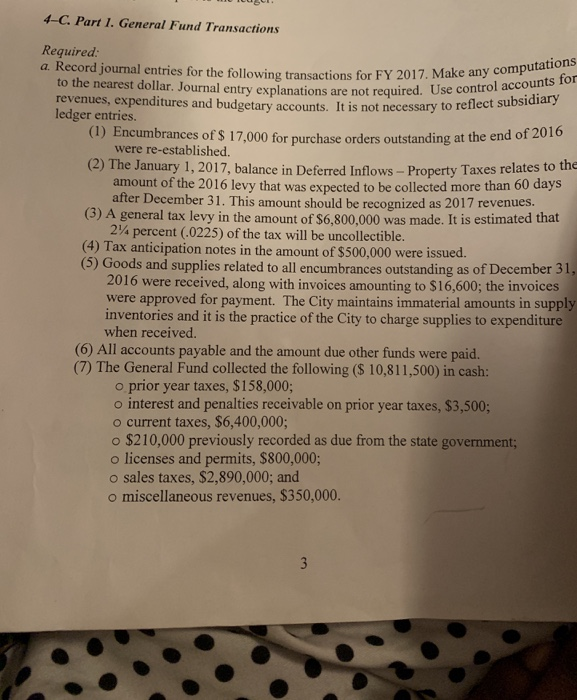

4-C. Part 2. Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions for FY 2017 and post to the general ledger. As there are relatively few revenues and expenditures, the use of control accounts is not necessary. (Make entries directly to individual revenue and expenditure accounts). (1) The state government notified the City that $1,065,000 will be available for street and highway maintenance during 2017 (i.e. the City has met eligibility requirements). The funds are not considered reimbursement-type as defined by GASB standards. (2) Cash in the total amount of $997,000 was received from the state government. (3) Contracts, all eligible for payment from the Street and Highway Fund, were signed in the amount of $1,062,000. (4) Contractual services (see transaction 3) were received; the related contracts amounted to $1,042,000. Invoices amounting to $1,040,500 for these items were approved for payment. The goods and services all were for street and highway maintenance. (5) Investment revenue of $5,120 was earned and received. (6) Accounts payable were paid in the amount of $923,000. (7) All required legal steps were accomplished to increase appropriations in the amount of $4,500. b. Prepare and post the necessary closing entries for the Street and Highway Fund. c. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the Street and Highway Fund for the fiscal year ended December 31, 2017. d. Prepare a Balance Sheet for the Street and Highway Fund as of December 31, 2017. Assume any unexpended net resources are classified as Restricted Fund Balance. Expenditures General Government ... $1,646,900 Public Safety ......... 3,026,900 2,942,000 Revenues Property Taxes . . . . . . $6,657,500 Sales Taxes Interest and Penalties on Taxes 16,100 Licenses and Permits. Intergovernmental Revenue Miscellaneous Revenue 350.000 Total . . . . . . . . . . . $11,097,600 800,000 Highways and Streets.. Sanitation ... ....... 1,441,400 591,400 332,000 Health ..... 724,100 Welfare 374,300 Culture and Recreation. 917,300 Capital Outlay ........ 492,800 Total $9,215,100 e. Prepare in good form a Balance Sheet for the General Fund as of the end of fiscal year, December 31, 2017. 4-C. Part 2. Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions for FY 2017 and post to the general ledger. As there are relatively few revenues and expenditures, the use of control accounts is not necessary. (Make entries directly to individual revenue and expenditure accounts). (1) The state government notified the City that $1,065,000 will be available for street and highway maintenance during 2017 (i.e. the City has met eligibility requirements). The funds are not considered reimbursement-type as defined by GASB standards. (2) Cash in the total amount of $997,000 was received from the state government. (3) Contracts, all eligible for payment from the Street and Highway Fund, were signed in the amount of $1,062,000. (4) Contractual services (see transaction 3) were received; the related contracts amounted to $1,042,000. Invoices amounting to $1,040,500 for these items were approved for payment. The goods and services all were for street and highway maintenance. (5) Investment revenue of $5,120 was earned and received. (6) Accounts payable were paid in the amount of $923,000. (7) All required legal steps were accomplished to increase appropriations in the amount of $4,500. b. Prepare and post the necessary closing entries for the Street and Highway Fund. c. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the Street and Highway Fund for the fiscal year ended December 31, 2017. d. Prepare a Balance Sheet for the Street and Highway Fund as of December 31, 2017. Assume any unexpended net resources are classified as Restricted Fund Balance. 0 . 4-C. Part 1. General Fund Transactions 017. Make any computations red. Use control accounts for is not necessary to reflect subsidiary Required: a. Record journal entries for the following transactions for FY 2017. Make a to the nearest dollar. Journal entry explanations are not required. Use con revenues, expenditures and budgetary accounts. It is not necessary to read ledger entries. (1) Encumbrances of $ 17,000 for purchase orders outstanding at the end of 2010 were re-established. (2) The January 1, 2017, balance in Deferred Inflows - Property Taxes relates to amount of the 2016 levy that was expected to be collected more than 60 days after December 31. This amount should be recognized as 2017 revenues. (3) A general tax levy in the amount of $6,800,000 was made. It is estimated that 2/4 percent (.0225) of the tax will be uncollectible. (4) Tax anticipation notes in the amount of $500,000 were issued. (5) Goods and supplies related to all encumbrances outstanding as of December 31, 2016 were received, along with invoices amounting to $16,600; the invoices were approved for payment. The City maintains immaterial amounts in supply, inventories and it is the practice of the City to charge supplies to expenditure when received (6) All accounts payable and the amount due other funds were paid. (7) The General Fund collected the following ($ 10,811,500) in cash: o prior year taxes, $158,000; o interest and penalties receivable on prior year taxes, $3,500; o current taxes, $6,400,000; o $210,000 previously recorded as due from the state government; o licenses and permits, $800,000; o sales taxes, $2,890,000; and o miscellaneous revenues, $350,000. 4-C. Part 2. Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions for FY 2017 and post to the general ledger. As there are relatively few revenues and expenditures, the use of control accounts is not necessary. (Make entries directly to individual revenue and expenditure accounts). (1) The state government notified the City that $1,065,000 will be available for street and highway maintenance during 2017 (i.e. the City has met eligibility requirements). The funds are not considered reimbursement-type as defined by GASB standards. (2) Cash in the total amount of $997,000 was received from the state government. (3) Contracts, all eligible for payment from the Street and Highway Fund, were signed in the amount of $1,062,000. (4) Contractual services (see transaction 3) were received; the related contracts amounted to $1,042,000. Invoices amounting to $1,040,500 for these items were approved for payment. The goods and services all were for street and highway maintenance. (5) Investment revenue of $5,120 was earned and received. (6) Accounts payable were paid in the amount of $923,000. (7) All required legal steps were accomplished to increase appropriations in the amount of $4,500. b. Prepare and post the necessary closing entries for the Street and Highway Fund. c. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the Street and Highway Fund for the fiscal year ended December 31, 2017. d. Prepare a Balance Sheet for the Street and Highway Fund as of December 31, 2017. Assume any unexpended net resources are classified as Restricted Fund Balance. Expenditures General Government ... $1,646,900 Public Safety ......... 3,026,900 2,942,000 Revenues Property Taxes . . . . . . $6,657,500 Sales Taxes Interest and Penalties on Taxes 16,100 Licenses and Permits. Intergovernmental Revenue Miscellaneous Revenue 350.000 Total . . . . . . . . . . . $11,097,600 800,000 Highways and Streets.. Sanitation ... ....... 1,441,400 591,400 332,000 Health ..... 724,100 Welfare 374,300 Culture and Recreation. 917,300 Capital Outlay ........ 492,800 Total $9,215,100 e. Prepare in good form a Balance Sheet for the General Fund as of the end of fiscal year, December 31, 2017. 4-C. Part 2. Special Revenue Fund Transactions Required: a. Record journal entries for the following transactions for FY 2017 and post to the general ledger. As there are relatively few revenues and expenditures, the use of control accounts is not necessary. (Make entries directly to individual revenue and expenditure accounts). (1) The state government notified the City that $1,065,000 will be available for street and highway maintenance during 2017 (i.e. the City has met eligibility requirements). The funds are not considered reimbursement-type as defined by GASB standards. (2) Cash in the total amount of $997,000 was received from the state government. (3) Contracts, all eligible for payment from the Street and Highway Fund, were signed in the amount of $1,062,000. (4) Contractual services (see transaction 3) were received; the related contracts amounted to $1,042,000. Invoices amounting to $1,040,500 for these items were approved for payment. The goods and services all were for street and highway maintenance. (5) Investment revenue of $5,120 was earned and received. (6) Accounts payable were paid in the amount of $923,000. (7) All required legal steps were accomplished to increase appropriations in the amount of $4,500. b. Prepare and post the necessary closing entries for the Street and Highway Fund. c. Prepare a Statement of Revenues, Expenditures, and Changes in Fund Balances for the Street and Highway Fund for the fiscal year ended December 31, 2017. d. Prepare a Balance Sheet for the Street and Highway Fund as of December 31, 2017. Assume any unexpended net resources are classified as Restricted Fund Balance. 0 . 4-C. Part 1. General Fund Transactions 017. Make any computations red. Use control accounts for is not necessary to reflect subsidiary Required: a. Record journal entries for the following transactions for FY 2017. Make a to the nearest dollar. Journal entry explanations are not required. Use con revenues, expenditures and budgetary accounts. It is not necessary to read ledger entries. (1) Encumbrances of $ 17,000 for purchase orders outstanding at the end of 2010 were re-established. (2) The January 1, 2017, balance in Deferred Inflows - Property Taxes relates to amount of the 2016 levy that was expected to be collected more than 60 days after December 31. This amount should be recognized as 2017 revenues. (3) A general tax levy in the amount of $6,800,000 was made. It is estimated that 2/4 percent (.0225) of the tax will be uncollectible. (4) Tax anticipation notes in the amount of $500,000 were issued. (5) Goods and supplies related to all encumbrances outstanding as of December 31, 2016 were received, along with invoices amounting to $16,600; the invoices were approved for payment. The City maintains immaterial amounts in supply, inventories and it is the practice of the City to charge supplies to expenditure when received (6) All accounts payable and the amount due other funds were paid. (7) The General Fund collected the following ($ 10,811,500) in cash: o prior year taxes, $158,000; o interest and penalties receivable on prior year taxes, $3,500; o current taxes, $6,400,000; o $210,000 previously recorded as due from the state government; o licenses and permits, $800,000; o sales taxes, $2,890,000; and o miscellaneous revenues, $350,000 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started