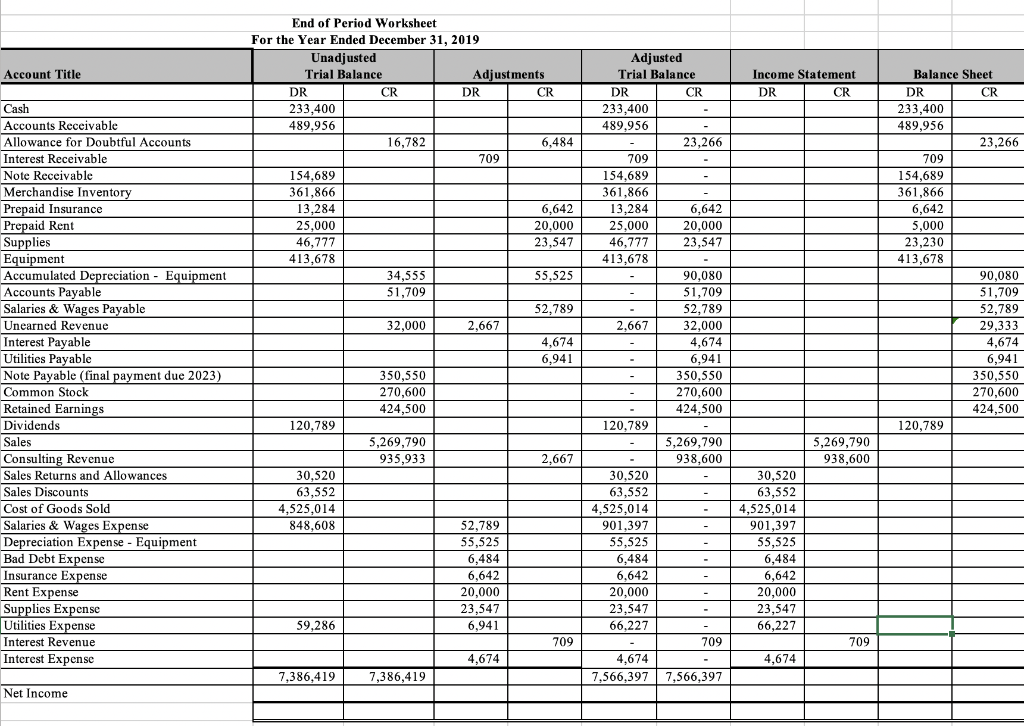

4.Prepare a multiple-step income statement on the Income Statement (5) tab. Your Income Statement should be in good form (proper titles, etc., see text page 230) and well formatted. The accounts of the financial statements should follow the order of accounts on the trial balance. You should use formulas in all cells, not constant numbers. (That means, your income statement should be linked to the adjusted numbers on your worksheet.)

5. Prepare a Statement of Retained Earnings (6) on the proper worksheet. Your Statement should be formatted. You should use formulas in all cells, not constant numbers.

6. Prepare a Classified Balance Sheet (7) on the proper worksheet as of 12/31/19. Your Statement should be formatted as shown on page 175. You should use formulas in all cells, not constant numbers.

7. On the Closing Entries (8) worksheet tab, prepare in journal entry form the appropriate closing entries and the end of 12/31/19. Link entries to the Worksheet (1) and/or financial statement tabs.

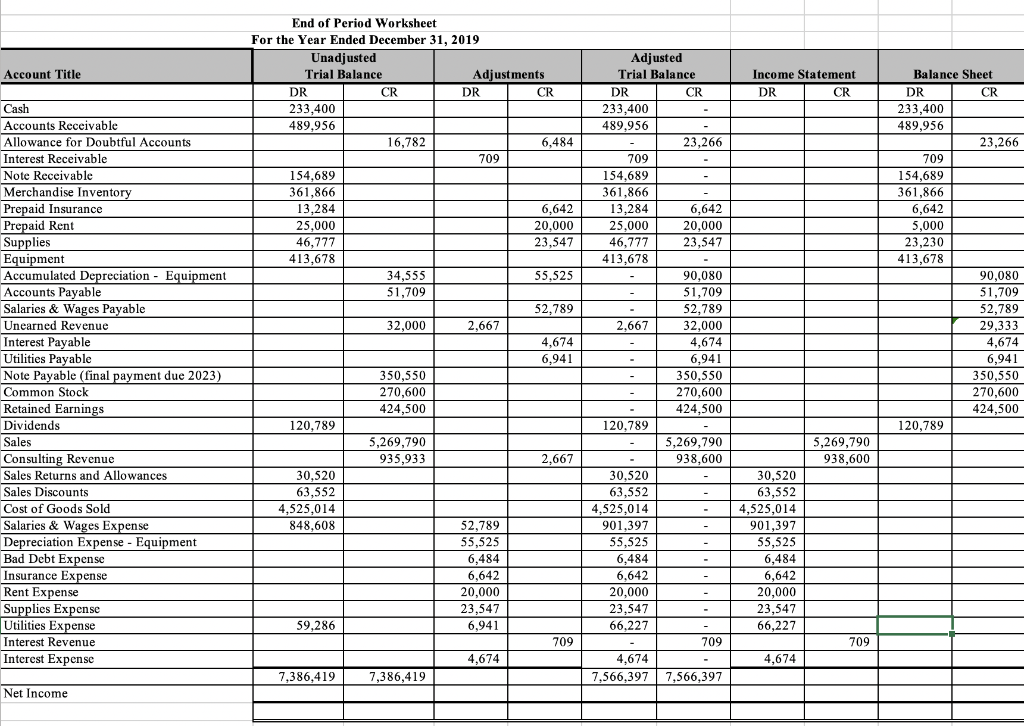

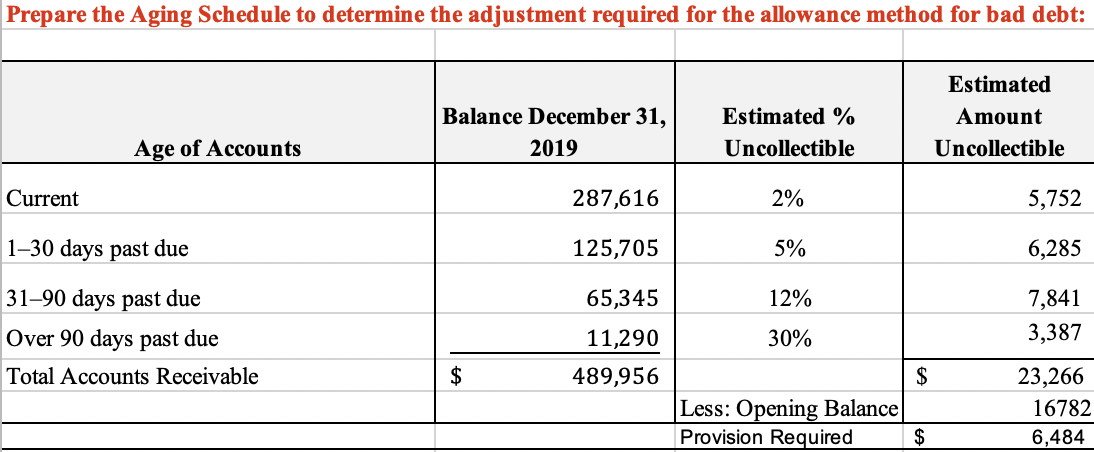

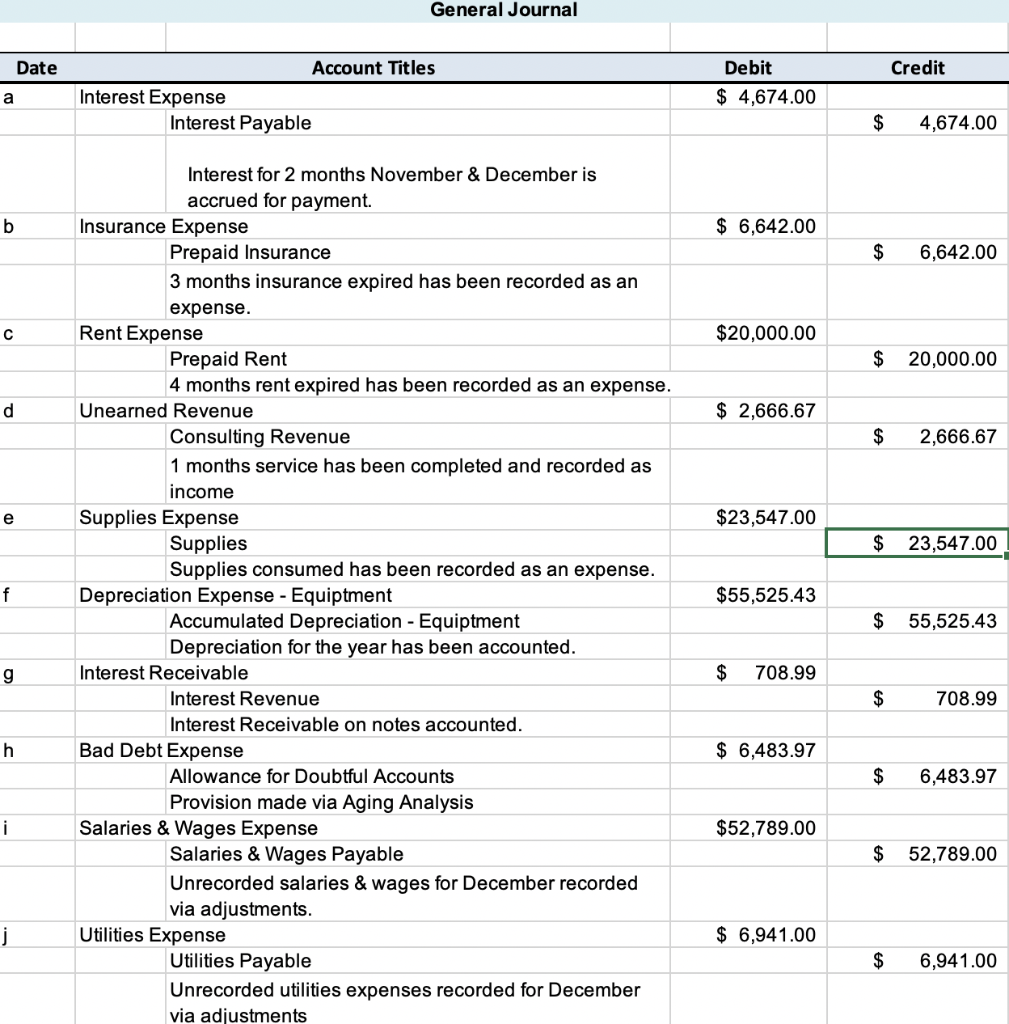

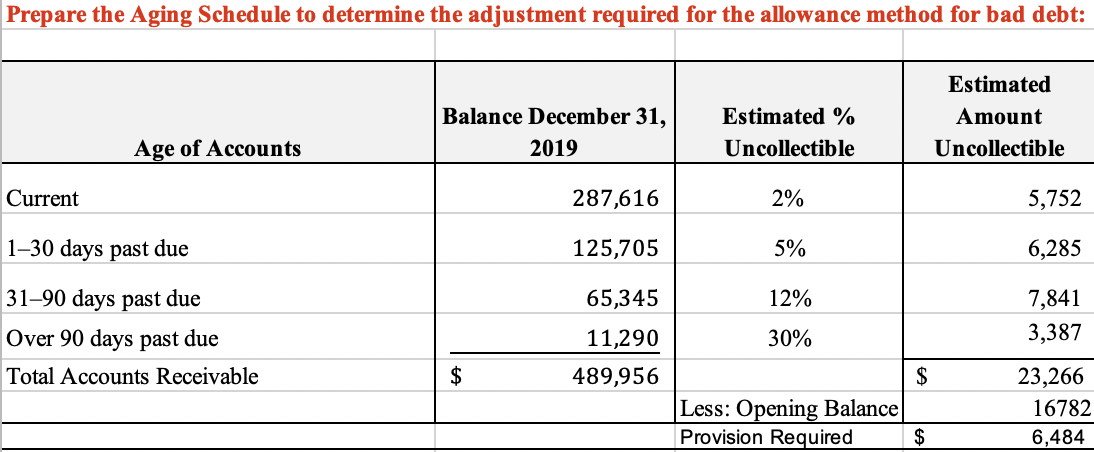

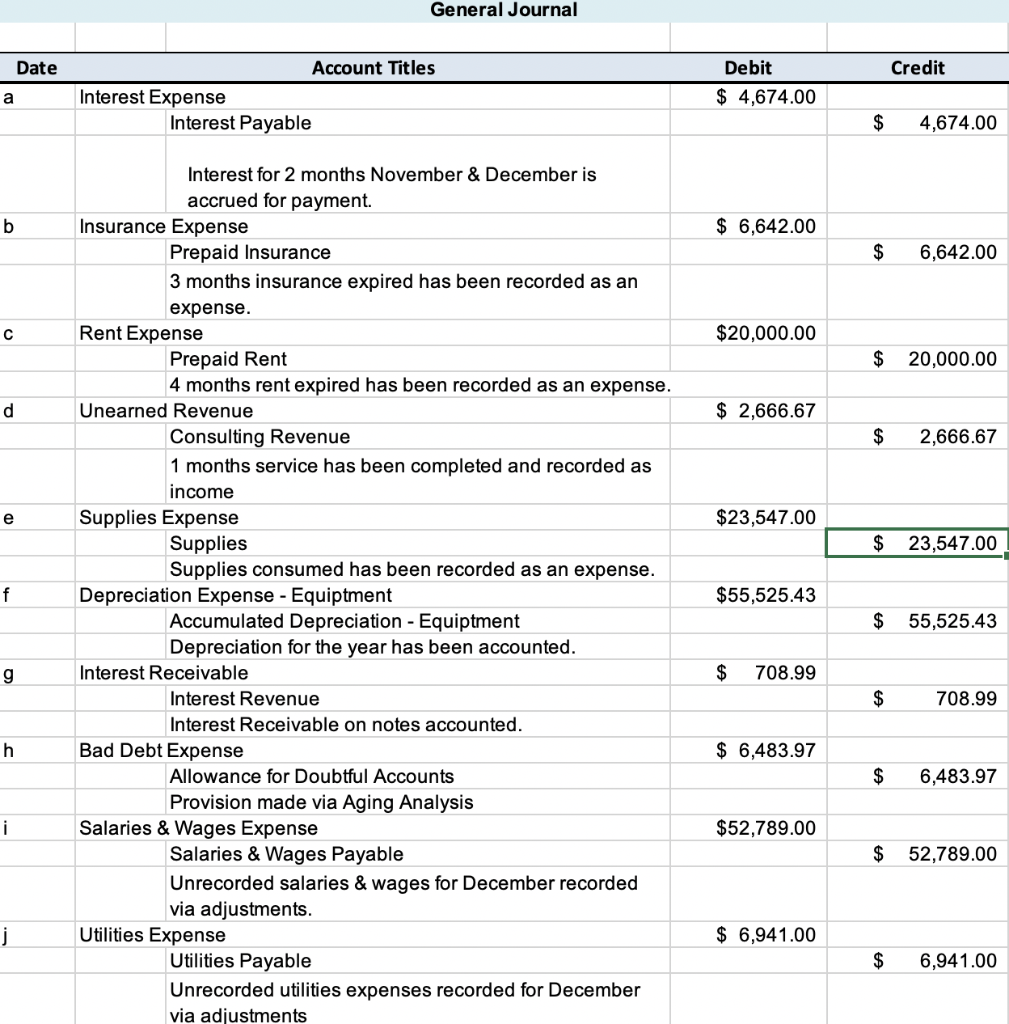

Account Title Income Statement DR CR |||||| Balance Sheet D R CR 233,400 489,956 23,266 709 154,689 361,866 6,642 5,000 23,230 413,678 90,080 51,709 52,789 29,333 4,674 End of Period Worksheet For the Year Ended December 31, 2019 Unadjusted Adjusted Trial Balance Adjustments Trial Balance DR CR DR CR DR I CR 233,400 233,400 489,956 489,956 16,782 6,484 23,266 709 709 154,689 154,689 361,866 361,866 13,284 6,642 13.284 6,642 25,000 20.000 25.000 20,000 46,777 23,547 | 46,777 23,547 413,678 413.678 34,555 55,525 - 90.080 51,709 51,709 1 52,789 52.789 | 32,000 2,667 2.667 32,000 4,674 4,674 6.941 6,941 350,550 350.550 270,600 270,600 424,500 424,500 120,789 120.789 5,269,790 5,269,790 935,933 2,667 - 938,600 30.520 - 63,552 63,552 - 4,525,014 4,525.014 - 848,608 52,789 901.397 55,525 55,525 6,484 6,484 6,642 6.642 20,000 20.000 23,547 23,547 59,286 6,941 66.227 709 709 4,674 4,674 7,386,4191 7,386,419 7,566,3977,566,397 Cash Accounts Receivable Allowance for Doubtful Accounts Interest Receivable Note Receivable Merchandise Inventory Prepaid Insurance Prepaid Rent Supplies Equipment Accumulated Depreciation - Equipment Accounts Payable Salaries & Wages Payable Unearned Revenue Interest Payable Utilities Payable Note Payable (final payment due 2023) Common Stock Retained Earnings Dividends Sales Consulting Revenue Sales Returns and Allowances Sales Discounts Cost of Goods Sold Salaries & Wages Expense Depreciation Expense - Equipment Bad Debt Expense Insurance Expense Rent Expense Supplies Expense Utilities Expense Interest Revenue Interest Expense 6,941 350,550 270,600 424,500 120,789 5,269,790 938,600 30,520 63,552 4,525,014 901,397 55,525 6,484 6,642 20,000 23,547 66,227 4,674 Net Income Prepare the Aging Schedule to determine the adjustment required for the allowance method for bad debt: Balance December 31, 2019 Estimated % Uncollectible Estimated Amount Uncollectible Age of Accounts Current 287,616 2% 5,752 125,705 5% 6,285 65,345 12% 130 days past due 3190 days past due Over 90 days past due Total Accounts Receivable 7,841 3,387 30% 11,290 489,956 Less: Opening Balance Provision Required 23,266 16782 6,484 $ General Journal Date Credit Account Titles Interest Expense Interest Payable Debit $ 4,674.00 $ 4,674.00 $ 6,642.00 $ 6,642.00 $20,000.00 $ 20,000.00 $ 2,666.67 $ 2,666.67 $23,547.00 $ 23,547.00 Interest for 2 months November & December is accrued for payment. Insurance Expense Prepaid Insurance 3 months insurance expired has been recorded as an expense. Rent Expense Prepaid Rent 4 months rent expired has been recorded as an expense. Unearned Revenue Consulting Revenue 1 months service has been completed and recorded as income Supplies Expense Supplies Supplies consumed has been recorded as an expense. Depreciation Expense - Equiptment Accumulated Depreciation - Equiptment Depreciation for the year has been accounted. Interest Receivable Interest Revenue Interest Receivable on notes accounted. Bad Debt Expense Allowance for Doubtful Accounts Provision made via Aging Analysis Salaries & Wages Expense Salaries & Wages Payable Unrecorded salaries & wages for December recorded via adjustments. Utilities Expense Utilities Payable Unrecorded utilities expenses recorded for December via adjustments $55,525.43 $ 55,525.43 g $ 708.99 $ 708.99 $ 6,483.97 $ 6,483.97 $52,789.00 $ 52,789.00 $ 6,941.00 $ 6,941.00