Answered step by step

Verified Expert Solution

Question

1 Approved Answer

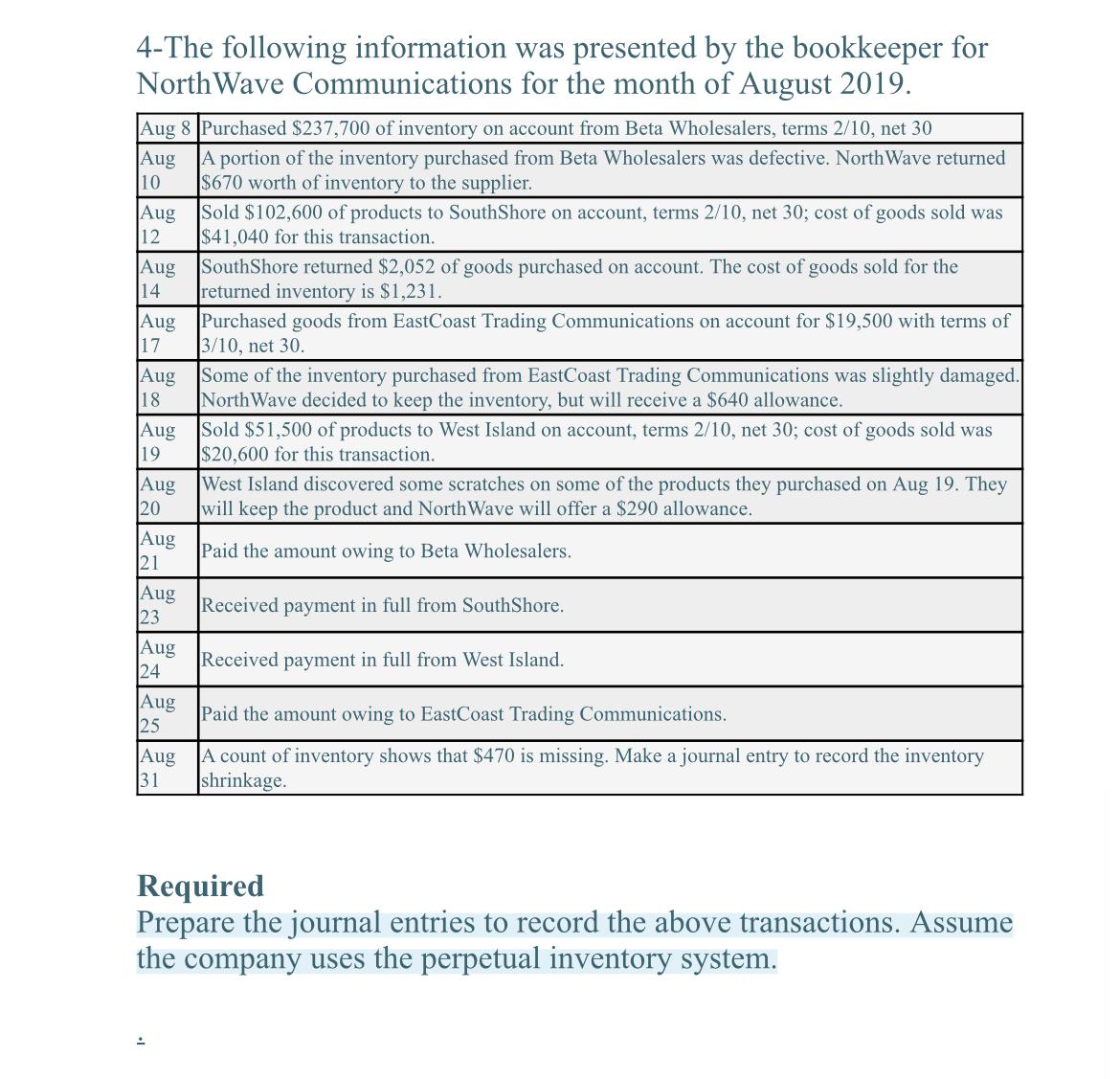

4-The following information was presented by the bookkeeper for NorthWave Communications for the month of August 2019. Aug 8 Purchased $237,700 of inventory on

4-The following information was presented by the bookkeeper for NorthWave Communications for the month of August 2019. Aug 8 Purchased $237,700 of inventory on account from Beta Wholesalers, terms 2/10, net 30 A portion of the inventory purchased from Beta Wholesalers was defective. North Wave returned $670 worth of inventory to the supplier. Aug 10 Aug 12 Aug 14 Aug 17 Aug 18 Aug 19 Aug 20 Aug 21 Aug 23 Aug 24 Aug 25 Aug 31 Sold $102,600 of products to SouthShore on account, terms 2/10, net 30; cost of goods sold was $41,040 for this transaction. : SouthShore returned $2,052 of goods purchased on account. The cost of goods sold for the returned inventory is $1,231. Purchased goods from EastCoast Trading Communications on account for $19,500 with terms of 3/10, net 30. Some of the inventory purchased from East Coast Trading Communications was slightly damaged. NorthWave decided to keep the inventory, but will receive a $640 allowance. Sold $51,500 of products to West Island on account, terms 2/10, net 30; cost of goods sold was $20,600 for this transaction. West Island discovered some scratches on some of the products they purchased on Aug 19. They will keep the product and NorthWave will offer a $290 allowance. Paid the amount owing to Beta Wholesalers. Received payment in full from South Shore. Received payment in full from West Island. Paid the amount owing to East Coast Trading Communications. A count of inventory shows that $470 is missing. Make a journal entry to record the inventory shrinkage. Required Prepare the journal entries to record the above transactions. Assume the company uses the perpetual inventory system.

Step by Step Solution

★★★★★

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Date Aug 82019 Date Aug 102019 Date Aug 122019 Date Aug 122019 Account Titles Mercha...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started