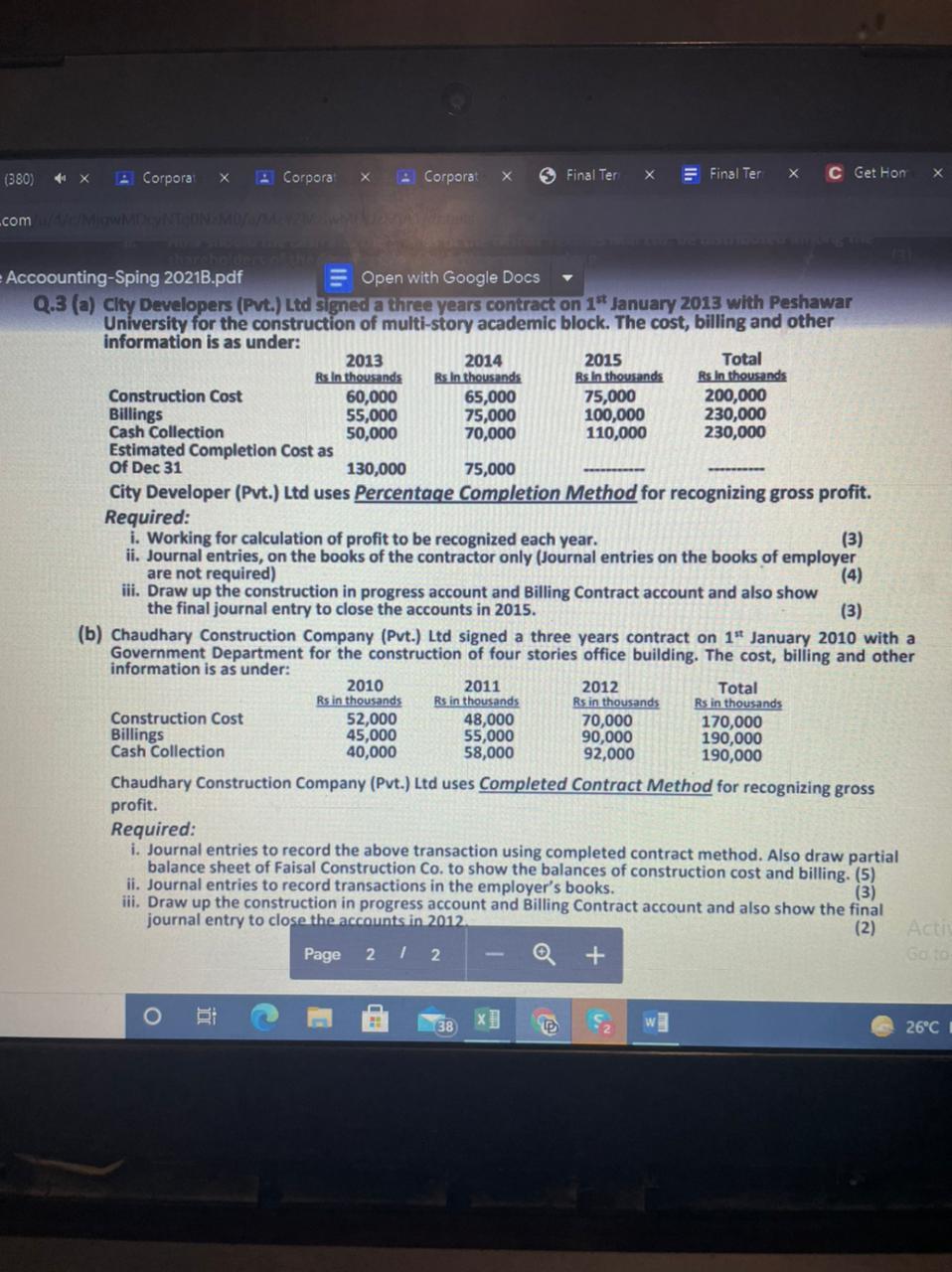

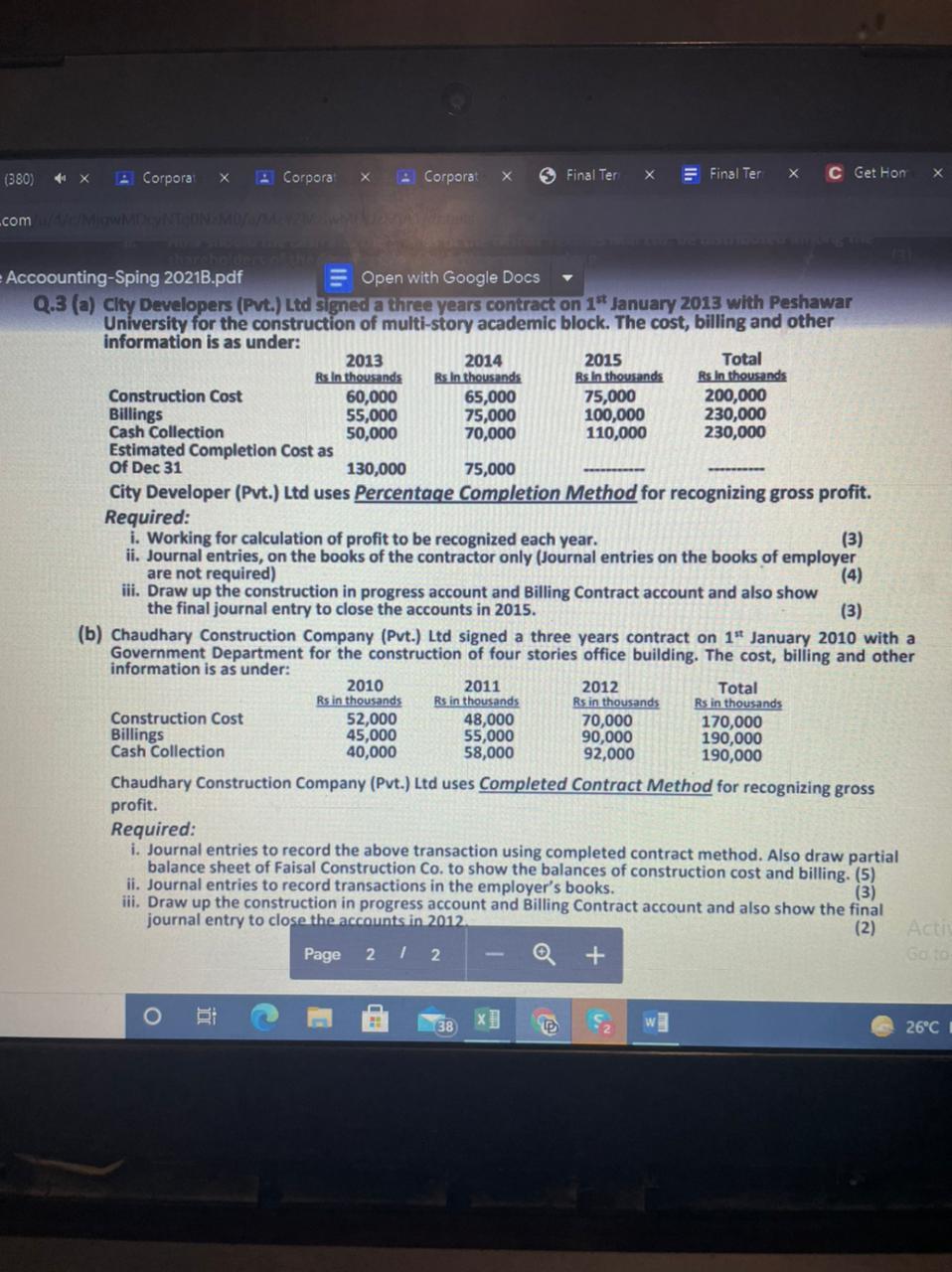

4x (380) Corporat Corpora Corpora Final Ter = Final Ter C Get Hon .com Accoounting-Sping 2021B.pdf Open with Google Docs Q.3 (a) City Developers (Pvt.) Ltd Signed a three years contract on 1st January 2013 with Peshawar University for the construction of multi-story academic block. The cost, billing and other information is as under: 2013 2014 2015 Total Rs In thousands Rs In thousands Rs In thousands Rs in thousands Construction Cost 60,000 65,000 75,000 200,000 Billings 55,000 75,000 100,000 230,000 Cash Collection 50,000 70,000 110,000 230,000 Estimated Completion Cost as Of Dec 31 130,000 75,000 City Developer (Pvt.) Ltd uses Percentage Completion Method for recognizing gross profit. Required: i. Working for calculation of profit to be recognized each year. (3) ii. Journal entries, on the books of the contractor only (Journal entries on the books of employer are not required) (4) iii. Draw up the construction in progress account and Billing Contract account and also show the final journal entry to close the accounts in 2015. (3) (b) Chaudhary Construction Company (Pvt.) Ltd signed a three years contract on 1 January 2010 with a Government Department for the construction of four stories office building. The cost, billing and other information is as under: 2010 2011 2012 Total Rs in thousands Rs in thousands Rs in thousands Rs in thousands Construction Cost 52,000 48,000 70,000 170,000 Billings 45,000 55,000 90,000 190,000 Cash Collection 40,000 58,000 92,000 190,000 Chaudhary Construction Company (Pvt.) Ltd uses Completed Contract Method for recognizing gross profit. Required: i. Journal entries to record the above transaction using completed contract method. Also draw partial balance sheet of Faisal Construction Co. to show the balances of construction cost and billing. (5) ii. Journal entries to record transactions in the employer's books. (3) iii. Draw up the construction in progress account and Billing Contract account and also show the final journal entry to close the accounts in 2012 (2) Acti Page 2 1 2 + Go to o x] 38 26C 4x (380) Corporat Corpora Corpora Final Ter = Final Ter C Get Hon .com Accoounting-Sping 2021B.pdf Open with Google Docs Q.3 (a) City Developers (Pvt.) Ltd Signed a three years contract on 1st January 2013 with Peshawar University for the construction of multi-story academic block. The cost, billing and other information is as under: 2013 2014 2015 Total Rs In thousands Rs In thousands Rs In thousands Rs in thousands Construction Cost 60,000 65,000 75,000 200,000 Billings 55,000 75,000 100,000 230,000 Cash Collection 50,000 70,000 110,000 230,000 Estimated Completion Cost as Of Dec 31 130,000 75,000 City Developer (Pvt.) Ltd uses Percentage Completion Method for recognizing gross profit. Required: i. Working for calculation of profit to be recognized each year. (3) ii. Journal entries, on the books of the contractor only (Journal entries on the books of employer are not required) (4) iii. Draw up the construction in progress account and Billing Contract account and also show the final journal entry to close the accounts in 2015. (3) (b) Chaudhary Construction Company (Pvt.) Ltd signed a three years contract on 1 January 2010 with a Government Department for the construction of four stories office building. The cost, billing and other information is as under: 2010 2011 2012 Total Rs in thousands Rs in thousands Rs in thousands Rs in thousands Construction Cost 52,000 48,000 70,000 170,000 Billings 45,000 55,000 90,000 190,000 Cash Collection 40,000 58,000 92,000 190,000 Chaudhary Construction Company (Pvt.) Ltd uses Completed Contract Method for recognizing gross profit. Required: i. Journal entries to record the above transaction using completed contract method. Also draw partial balance sheet of Faisal Construction Co. to show the balances of construction cost and billing. (5) ii. Journal entries to record transactions in the employer's books. (3) iii. Draw up the construction in progress account and Billing Contract account and also show the final journal entry to close the accounts in 2012 (2) Acti Page 2 1 2 + Go to o x] 38 26C