Question

5. (10 pts) Suppose that the dollar-yen spot exchange rate is $0.0090/% and the 90-day forward exchange rate is $0.0091/%. The annual interest rate

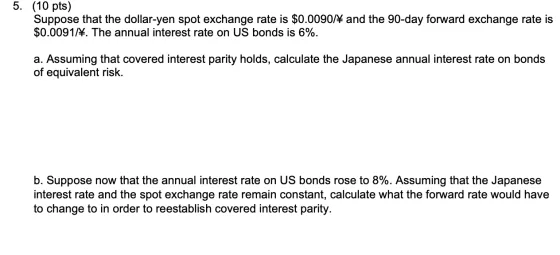

5. (10 pts) Suppose that the dollar-yen spot exchange rate is $0.0090/% and the 90-day forward exchange rate is $0.0091/%. The annual interest rate on US bonds is 6%. a. Assuming that covered interest parity holds, calculate the Japanese annual interest rate on bonds of equivalent risk. b. Suppose now that the annual interest rate on US bonds rose to 8%. Assuming that the Japanese interest rate and the spot exchange rate remain constant, calculate what the forward rate would have to change to in order to reestablish covered interest parity.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Covered Interest Parity Calculations a Japanese Interest Rate Assuming covered interest parity CIP h...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Derivatives Principles And Practice

Authors: Rangarajan Sundaram

2nd Edition

0078034736, 9780078034732

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App