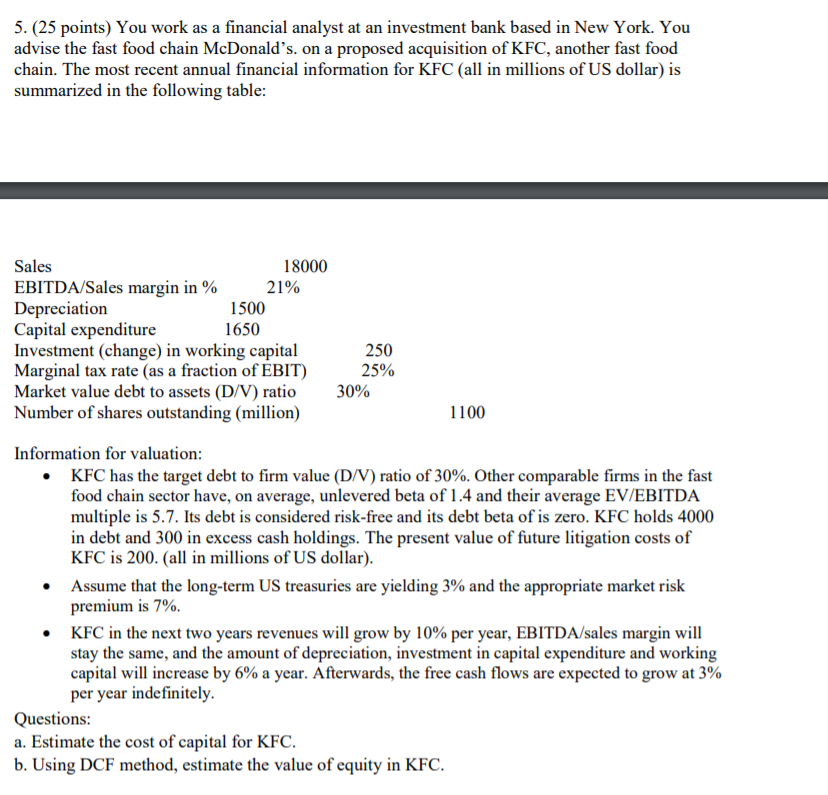

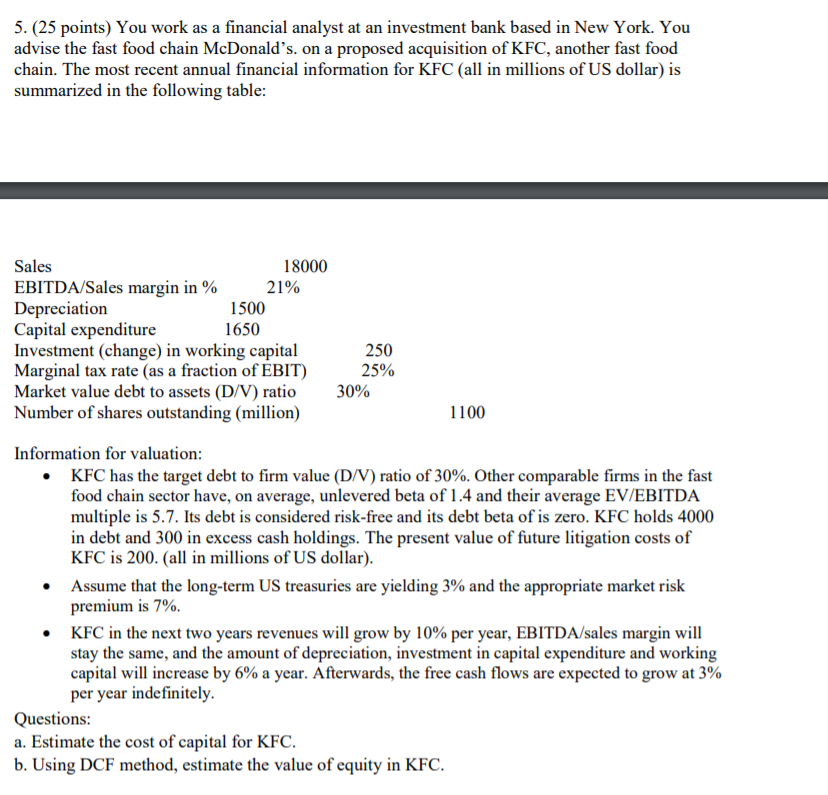

5. (25 points) You work as a financial analyst at an investment bank based in New York. You advise the fast food chain McDonald's. on a proposed acquisition of KFC, another fast food chain. The most recent annual financial information for KFC (all in millions of US dollar) is summarized in the following table: Sales 18000 EBITDA/Sales margin in % 21% Depreciation 1500 Capital expenditure 1650 Investment (change) in working capital 250 Marginal tax rate (as a fraction of EBIT) 25% Market value debt to assets (D/V) ratio 30% Number of shares outstanding (million) 1100 Information for valuation: KFC has the target debt to firm value (D/V) ratio of 30%. Other comparable firms in the fast food chain sector have, on average, unlevered beta of 1.4 and their average EV/EBITDA multiple is 5.7. Its debt is considered risk-free and its debt beta of is zero. KFC holds 4000 in debt and 300 in excess cash holdings. The present value of future litigation costs of KFC is 200. (all in millions of US dollar). Assume that the long-term US treasuries are yielding 3% and the appropriate market risk premium is 7%. KFC in the next two years revenues will grow by 10% per year, EBITDA sales margin will stay the same, and the amount of depreciation, investment in capital expenditure and working capital will increase by 6% a year. Afterwards, the free cash flows are expected to grow at 3% per year indefinitely Questions: a. Estimate the cost of capital for KFC. b. Using DCF method, estimate the value of equity in KFC. 5. (25 points) You work as a financial analyst at an investment bank based in New York. You advise the fast food chain McDonald's. on a proposed acquisition of KFC, another fast food chain. The most recent annual financial information for KFC (all in millions of US dollar) is summarized in the following table: Sales 18000 EBITDA/Sales margin in % 21% Depreciation 1500 Capital expenditure 1650 Investment (change) in working capital 250 Marginal tax rate (as a fraction of EBIT) 25% Market value debt to assets (D/V) ratio 30% Number of shares outstanding (million) 1100 Information for valuation: KFC has the target debt to firm value (D/V) ratio of 30%. Other comparable firms in the fast food chain sector have, on average, unlevered beta of 1.4 and their average EV/EBITDA multiple is 5.7. Its debt is considered risk-free and its debt beta of is zero. KFC holds 4000 in debt and 300 in excess cash holdings. The present value of future litigation costs of KFC is 200. (all in millions of US dollar). Assume that the long-term US treasuries are yielding 3% and the appropriate market risk premium is 7%. KFC in the next two years revenues will grow by 10% per year, EBITDA sales margin will stay the same, and the amount of depreciation, investment in capital expenditure and working capital will increase by 6% a year. Afterwards, the free cash flows are expected to grow at 3% per year indefinitely Questions: a. Estimate the cost of capital for KFC. b. Using DCF method, estimate the value of equity in KFC