Answered step by step

Verified Expert Solution

Question

1 Approved Answer

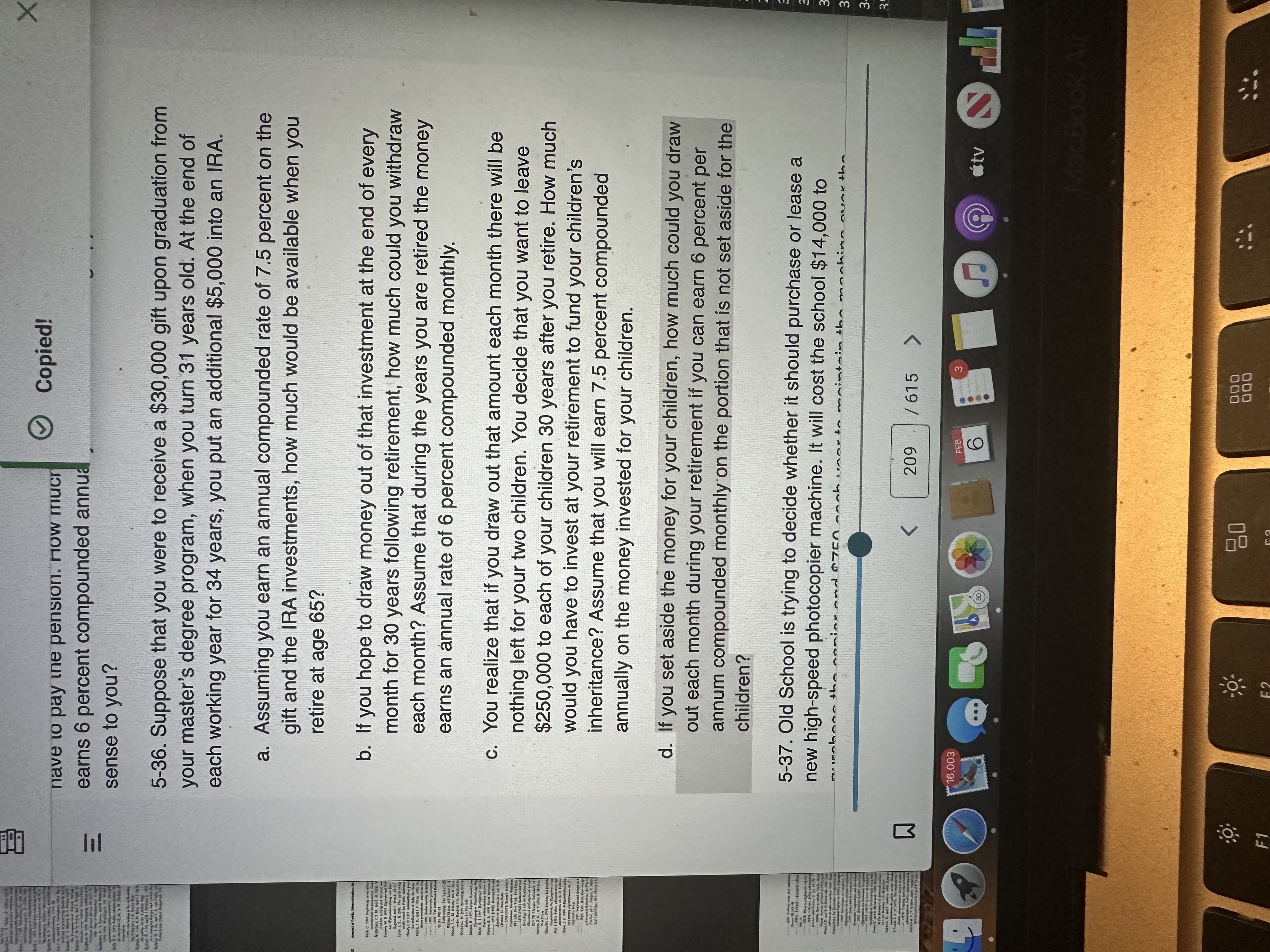

5 - 3 6 . Suppose that you were to receive a $ 3 0 , 0 0 0 gift upon graduation from your master's

Suppose that you were to receive a $ gift upon graduation from

your master's degree program, when you turn years old. At the end of

each working year for years, you put an additional $ into an IRA.

a Assuming you earn an annual compounded rate of percent on the

gift and the IRA investments, how much would be available when you

retire at age

b If you hope to draw money out of that investment at the end of every

month for years following retirement, how much could you withdraw

each month? Assume that during the years you are retired the money

earns an annual rate of percent compounded monthly.

c You realize that if you draw out that amount each month there will be

nothing left for your two children. You decide that you want to leave

$ to each of your children years after you retire. How much

would you have to invest at your retirement to fund your children's

inheritance? Assume that you will earn percent compounded

annually on the money invested for your children.

d If you set aside the money for your children, how much could you draw

out each month during your retirement if you can earn percent per

annum compounded monthly on the portion that is not set aside for the

children?

Old School is trying to decide whether it should purchase or lease a

new highspeed photocopier machine. It will cost the school $ to

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started