#5

#5

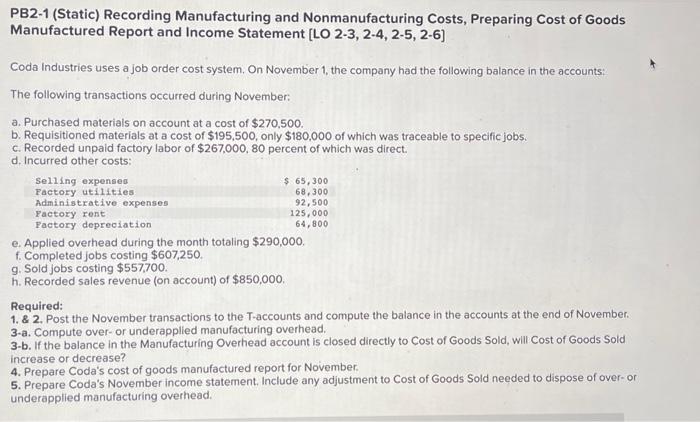

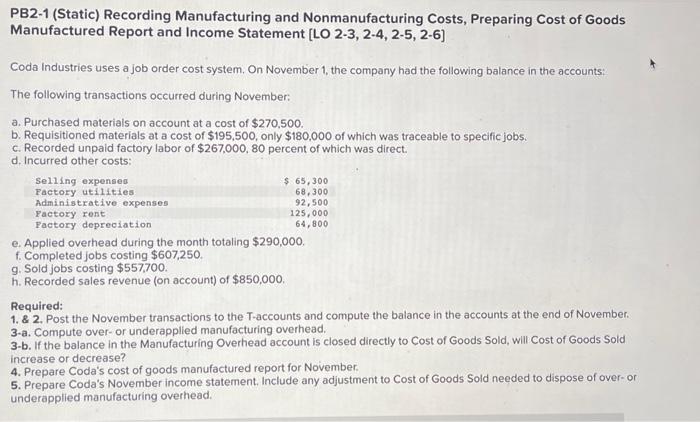

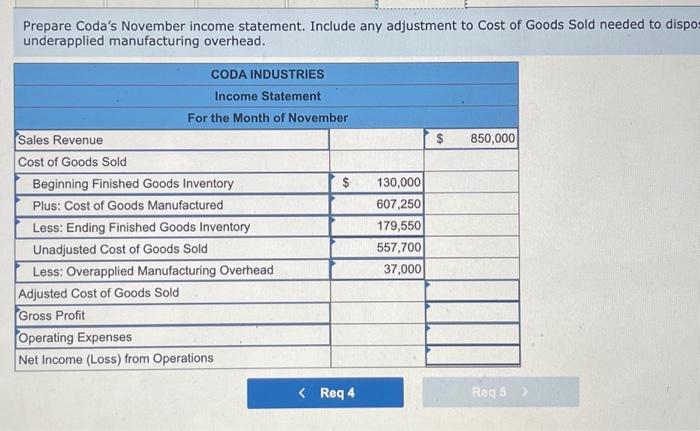

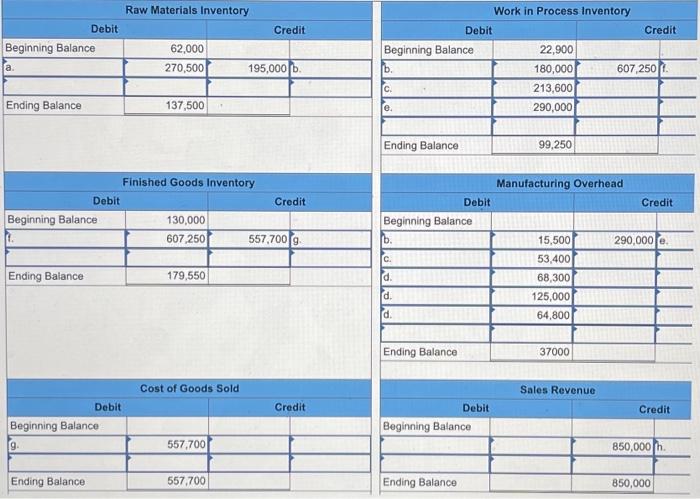

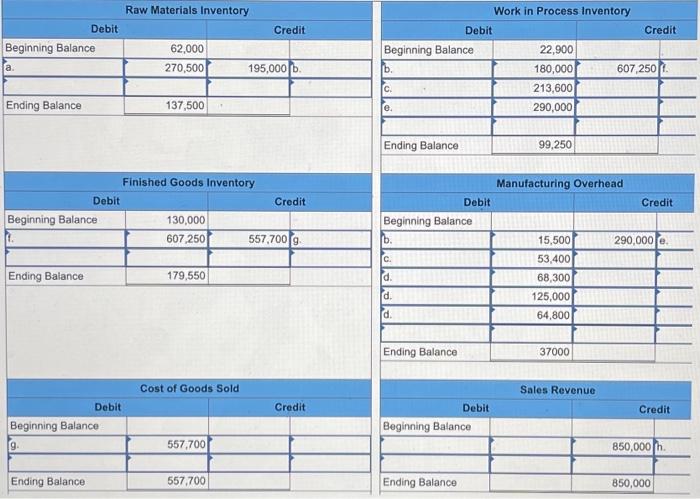

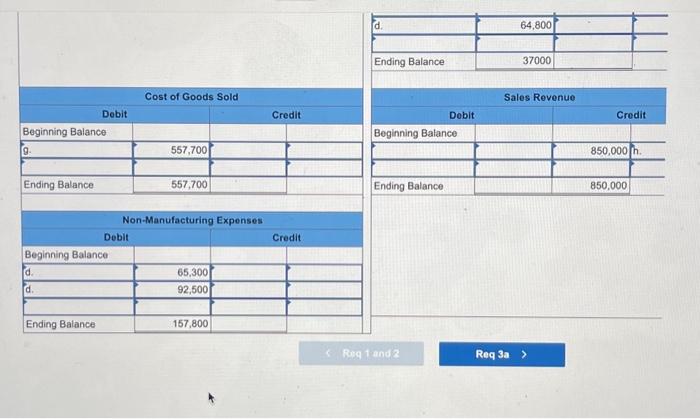

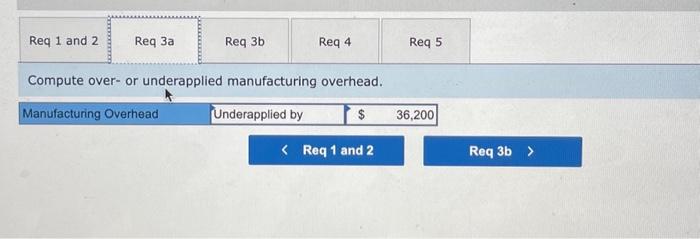

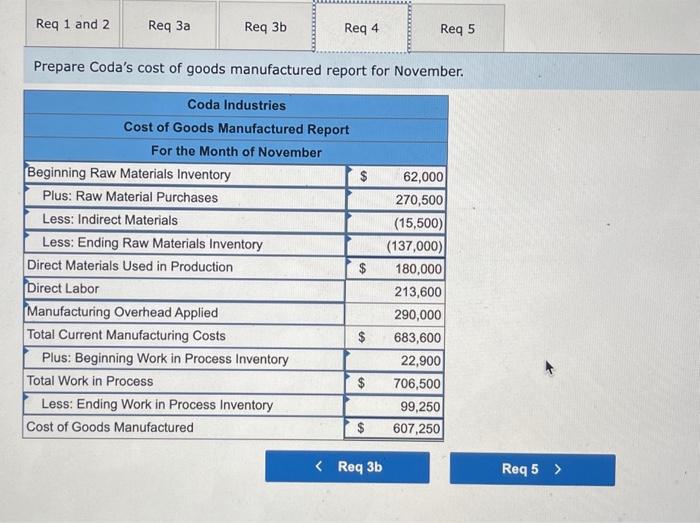

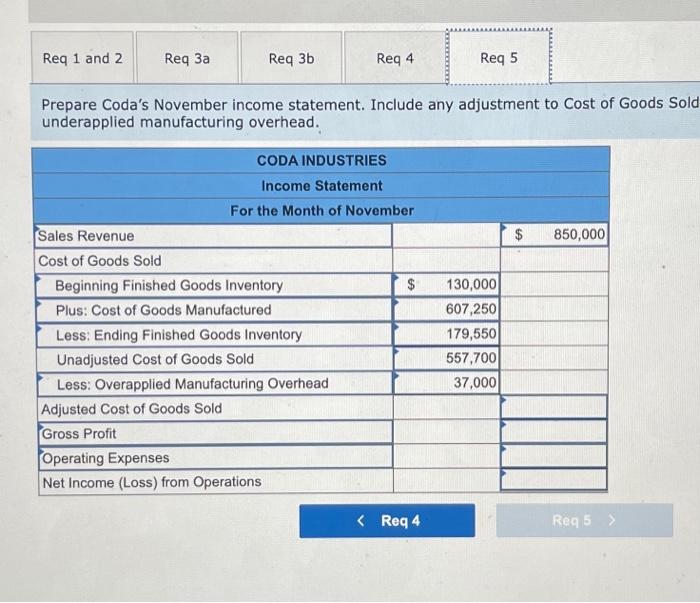

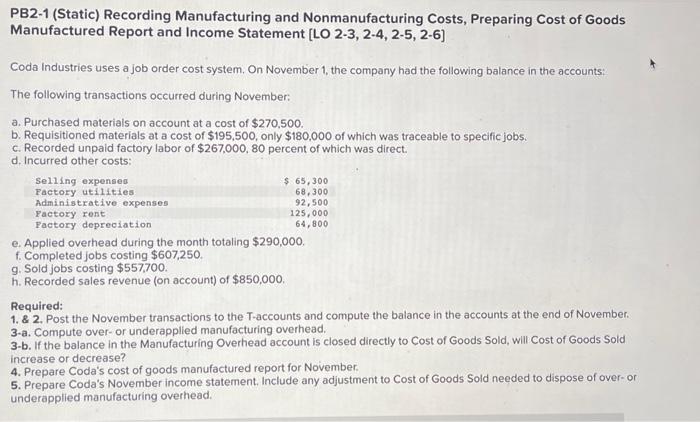

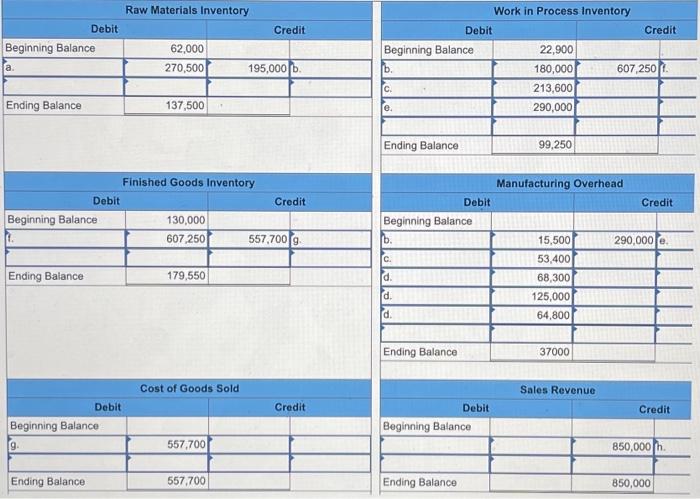

PB2-1 (Static) Recording Manufacturing and Nonmanufacturing Costs, Preparing Cost of Goods Manufactured Report and Income Statement [LO 2-3, 2-4, 2-5, 2-6] Coda Industries uses a job order cost system. On November 1, the company had the following balance in the accounts: The following transactions occurred during November: a. Purchased materials on account at a cost of $270,500. b. Requisitioned materials at a cost of $195,500, only $180,000 of which was traceable to specific jobs. c. Recorded unpaid factory labor of $267,000,80 percent of which was direct. d. Incurred other costs: e. Applied overhead during the month totaling $290,000. f. Completed jobs costing $607,250. g. Sold jobs costing $557,700. h. Recorded sales revenue (on account) of $850,000. Required: 1. \& 2. Post the November transactions to the T-accounts and compute the balance in the accounts at the end of November. 3-a. Compute over- or underapplied manufacturing overhead. 3-b. If the balance in the Manufacturing Overhead account is closed directly to Cost of Goods Sold, will Cost of Goods Sold increase or decrease? 4. Prepare Coda's cost of goods manufactured report for November. 5. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispose of over-or underapplied manufacturing overhead. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sold needed to dispo underanolied manufacturino overhead. Raw Materials Inventory Finished Goods Inventory Work in Process Inventory \begin{tabular}{|l|l|l|l} \hline \multicolumn{3}{|c|}{ Manufacturing Overhead } \\ \hline Beginning Balance & & & \\ \hline b. & 15,500 & & Credit \\ \hline C. & 53,400 & & \\ \hline d. & 68,300 & & \\ \hline d. & 125,000 & & \\ \hline d. & 64,800 & & \\ \hline & & & \\ \hline Ending Balance & 37000 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{2}{c|}{ Sales Revenue } \\ \hline \multicolumn{1}{|c|}{ Debit } & \multicolumn{2}{c|}{ Credit } \\ \hline Beginning Balance & & & \\ \hline & & 850,000 & h. \\ \hline & & & \\ \hline & & 850,000 & \\ \hline Ending Balance & & & \\ \hline \end{tabular} Compute over- or underapplied manufacturing overhead. Prepare Coda's cost of goods manufactured report for November. Prepare Coda's November income statement. Include any adjustment to Cost of Goods Sole underapplied manufacturing overhead