Answered step by step

Verified Expert Solution

Question

1 Approved Answer

# 5 & 6 only please. be as detailed as possible . thank you 3:204 Husband and wife, John and Mae West, decided to start

# 5 & 6 only please. be as detailed as possible . thank you

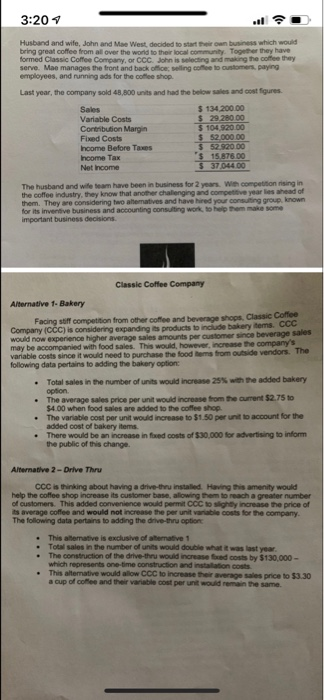

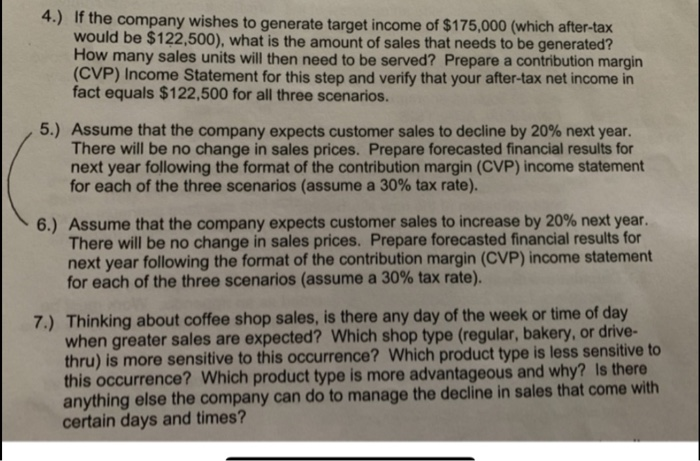

3:204 Husband and wife, John and Mae West, decided to start the own business which would bring great coffee from all over the world to the local community Together they have formed Classic Coffee Company, or CCC John is selecting and making the coffee they serve. Mae manages the front and back office selling come to oustomers, paying employees, and running ads for the coffee shop Last year, the company sold 48,800 units and had the below and cost figures Sales $ 134,200.00 Variable Costs $ 29 280 DO Contribution Margin $ 104,920.00 Fixed Costs $ $2 000 00 Income Before Taxes $52.320.00 Income Tax '$ 15.876.00 Net Income $ 37.044.00 The husband and wife team have been in business for 2 years with competition rising in the coffee industry, they know that another challenging and competitive years ahead of them. They are considering to amatives and have red your consulting group known for its inventive business and accounting consulting work to help them make some important business decisions Classic Coffee Company Alternative 1- Bakery Facing stiff competition from other coffee and beverage shops, Classic Coffee Company (CCC) is considering expanding its products to include bakery items. CCC would now experience higher average sales amounts per customer since beverage sales may be accompanied with food sales. This would, however, increase the company's variable costs since it would need to purchase the food hems from outside vendors. The following data pertains to adding the bakery option Total sales in the number of units would increase 25% with the added bakery option The average sales price per unit would increase from the current $2.75 to $4.00 when food sales are added to the coffee shop The variable cost per unit would increase to $1.50 per unit to account for the added cost of bakery items There would be an increase in fred costs of $30,000 for advertising to inform the public of this change. Alternative 2-Drive Thru CCC is thinking about having a drive-thru installed. Having this amenity would help the coffee shop increase its customer base allowing them to reach a greater number of customers. This added convenience would permit CCC to sighty increase the price of its average coffee and would not increase the per unit variable costs for the company The following data pertains to adding the drive-thru option This alternative is exclusive of hernative 1 Total sales in the number of units would double what it was last year The construction of the drive-thru would increase feed costs by $130.000 - which represents one-time construction and installation costs This alternative would allow CCC to increase the average sales price to $3.30 a cup of coffee and their variable cost per unit would remain the same 4.) If the company wishes to generate target income of $175,000 (which after-tax would be $122,500), what is the amount of sales that needs to be generated? How many sales units will then need to be served? Prepare a contribution margin (CVP) Income Statement for this step and verify that your after-tax net income in fact equals $122,500 for all three scenarios. 5.) Assume that the company expects customer sales to decline by 20% next year. There will be no change in sales prices. Prepare forecasted financial results for next year following the format of the contribution margin (CVP) income statement for each of the three scenarios (assume a 30% tax rate). 6.) Assume that the company expects customer sales to increase by 20% next year. There will be no change in sales prices. Prepare forecasted financial results for next year following the format of the contribution margin (CVP) income statement for each of the three scenarios (assume a 30% tax rate). 7.) Thinking about coffee shop sales, is there any day of the week or time of day when greater sales are expected? Which shop type (regular, bakery, or drive- thru) is more sensitive to this occurrence? Which product type is less sensitive to this occurrence? Which product type is more advantageous and why? Is there anything else the company can do to manage the decline in sales that come with certain days and times Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started