Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. A credit sale of 6,400 is made on April 25, terms 2/10, n/30, on which a return of 400 is granted on April 28.

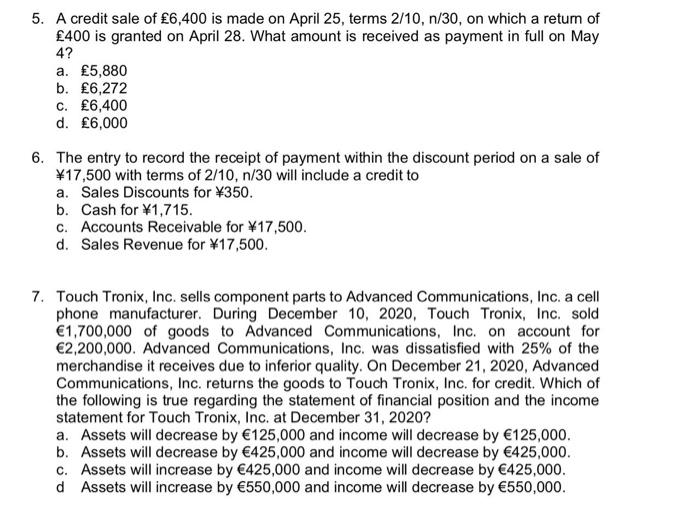

5. A credit sale of 6,400 is made on April 25, terms 2/10, n/30, on which a return of 400 is granted on April 28. What amount is received as payment in full on May 4? a. 5,880 b. 6,272 c. 6,400 d. 6,000 6. The entry to record the receipt of payment within the discount period on a sale of 17,500 with terms of 2/10, n/30 will include a credit to a. Sales Discounts for 350. b. Cash for 1,715. c. Accounts Receivable for 17,500. d. Sales Revenue for 17,500. 7. Touch Tronix, Inc. sells component parts to Advanced Communications, Inc. a cell phone manufacturer. During December 10, 2020, Touch Tronix, Inc. sold 1,700,000 of goods to Advanced Communications, Inc. on account for 2,200,000. Advanced Communications, Inc. was dissatisfied with 25% of the merchandise it receives due to inferior quality. On December 21, 2020, Advanced Communications, Inc. returns the goods to Touch Tronix, Inc. for credit. Which of the following is true regarding the statement of financial position and the income statement for Touch Tronix, Inc. at December 31, 2020? a. Assets will decrease by 125,000 and income will decrease by 125,000. b. Assets will decrease by 425,000 and income will decrease by 425,000. c. Assets will increase by 425,000 and income will decrease by 425,000. d Assets will increase by 550,000 and income will decrease by 550,000.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started