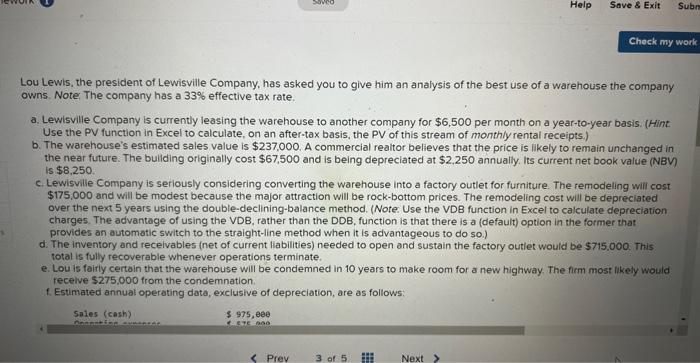

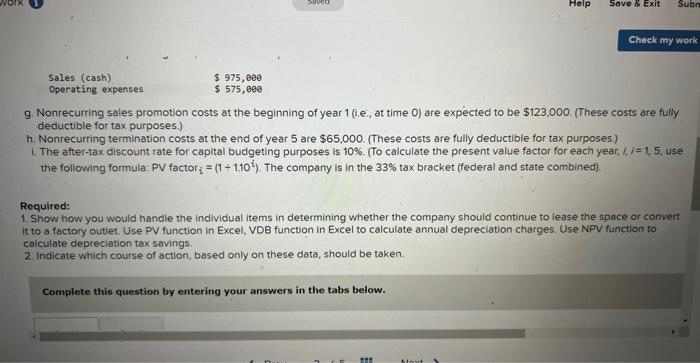

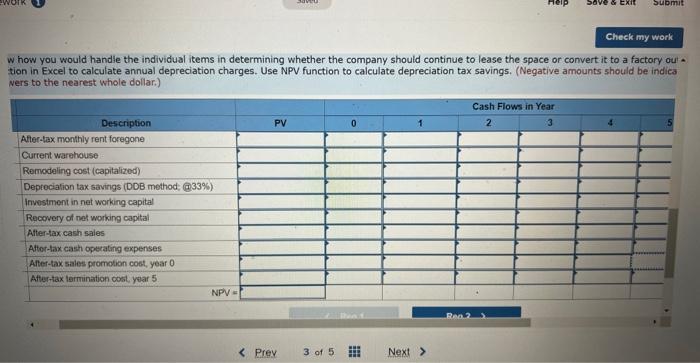

Lou Lewis, the president of Lewisville Company, has asked you to give him an analysis of the best use of a warehouse the company owns. Note. The company has a 33% effective tax rate. a. Lewisville Company is currently leasing the warehouse to another company for $6,500 per month on a year-to-year basis. (Hint Use the PV function in Excel to calculate, on an after-tax basis, the PV of this stream of monthly rental receipts.) b. The warehouse's estimated sales value is $237,000. A commercial realtor believes that the price is likely to remain unchanged in the near future. The buliding originally cost $67,500 and is being depreciated at $2,250 annually. Its current net book value (NBV) is $8,250. c. Lewisville Company is seriously considering converting the warehouse into a factory outlet for furniture. The remodeling will cost $175,000 and will be modest because the major attraction will be rock-bottom prices. The remodeling cost will be depreciated over the next 5 years using the double-declining-balance method. (Note: Use the VDB function in Excel to calculate depreciation charges. The advantage of using the VDB, rather than the DDB, function is that there is a (default) option in the former that provides an automatic switch to the straight-line method when it is advantageous to do so.) d. The inventory and receivables (net of current liabilities) needed to open and sustain the factory outlet would be $715.000. This total is fully recoverable whenever operations terminate. e. Lou is foirly certain that the warehouse will be condemned in 10 years to make room for a new highway. The firm most ilikely would recelve $275.000 from the condemnation. f. Estimated annual operating date, exclusive of depreciation, are as follows: 9. Nonrecurring sales promotion costs at the beginning of year 1 (i.e., at time 0) are expected to be $123,000. (These costs are fully deductible for tax purposes.) h. Nonrecurring termination costs at the end of year 5 are $65,000. (These costs are fully deductible for tax purposes.) 1. The after-tax discount rate for capital budgeting purposes is 10%. (To calculate the present value factor for each year, 1, 1=1,5, use the following formula: PV factor ri=(1+1.10i). The company is in the 33% tax bracket (federal and state combined). Required: 1. Show how you would handle the individual items in determining whether the company should continue to lease the space or convert it to a factory outlet. Use PV function in Excel, VDB function in Excel to calculate annual depreciation charges. Use NPV function to calculate depreciation tax savings. 2 . Indicate which course of action, based only on these data, should be taken. Complete this question by entering your answers in the tabs below. W how you would handle the individual items in determining whether the company should continue to lease the space or convert it to a factory out tion in Excel to calculate annual depreciation charges. Use NPV function to calculate depreciation tax savings. (Negative amounts should be indica Ners to the nearest whole dollar.)