Answered step by step

Verified Expert Solution

Question

1 Approved Answer

5. A project for a new factory has upfront costs of ( $ 50,000 ). It deprecates in a straight line method to zero over

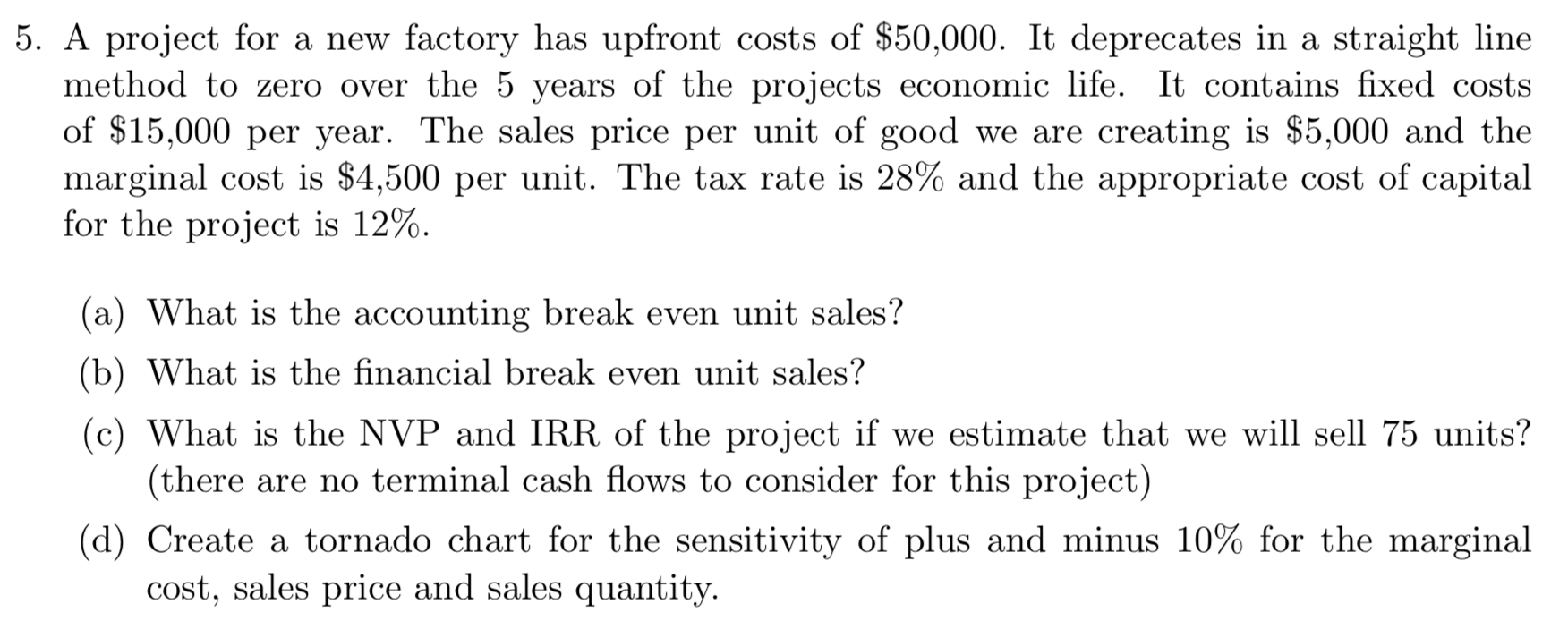

5. A project for a new factory has upfront costs of \\( \\$ 50,000 \\). It deprecates in a straight line method to zero over the 5 years of the projects economic life. It contains fixed costs of \\( \\$ 15,000 \\) per year. The sales price per unit of good we are creating is \\( \\$ 5,000 \\) and the marginal cost is \\( \\$ 4,500 \\) per unit. The tax rate is \28 and the appropriate cost of capital for the project is \12. (a) What is the accounting break even unit sales? (b) What is the financial break even unit sales? (c) What is the NVP and IRR of the project if we estimate that we will sell 75 units? (there are no terminal cash flows to consider for this project) (d) Create a tornado chart for the sensitivity of plus and minus \10 for the marginal cost, sales price and sales quantity

5. A project for a new factory has upfront costs of \\( \\$ 50,000 \\). It deprecates in a straight line method to zero over the 5 years of the projects economic life. It contains fixed costs of \\( \\$ 15,000 \\) per year. The sales price per unit of good we are creating is \\( \\$ 5,000 \\) and the marginal cost is \\( \\$ 4,500 \\) per unit. The tax rate is \28 and the appropriate cost of capital for the project is \12. (a) What is the accounting break even unit sales? (b) What is the financial break even unit sales? (c) What is the NVP and IRR of the project if we estimate that we will sell 75 units? (there are no terminal cash flows to consider for this project) (d) Create a tornado chart for the sensitivity of plus and minus \10 for the marginal cost, sales price and sales quantity Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started