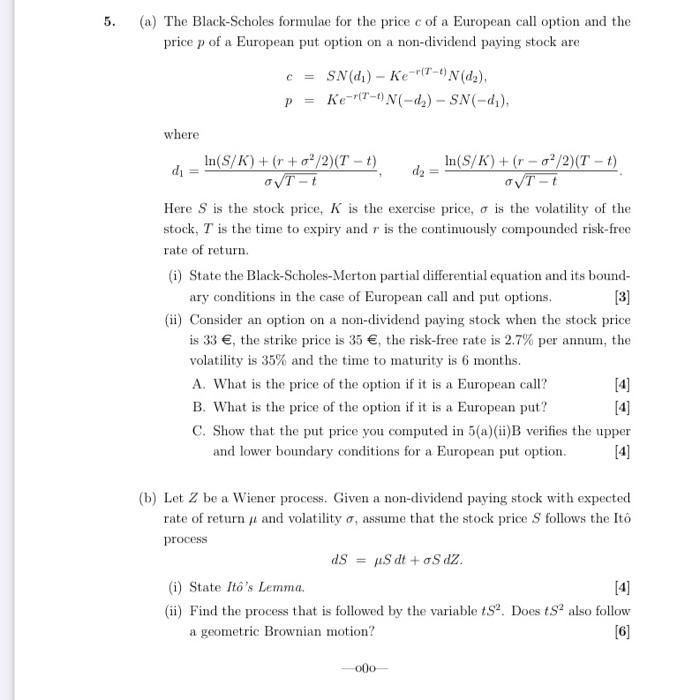

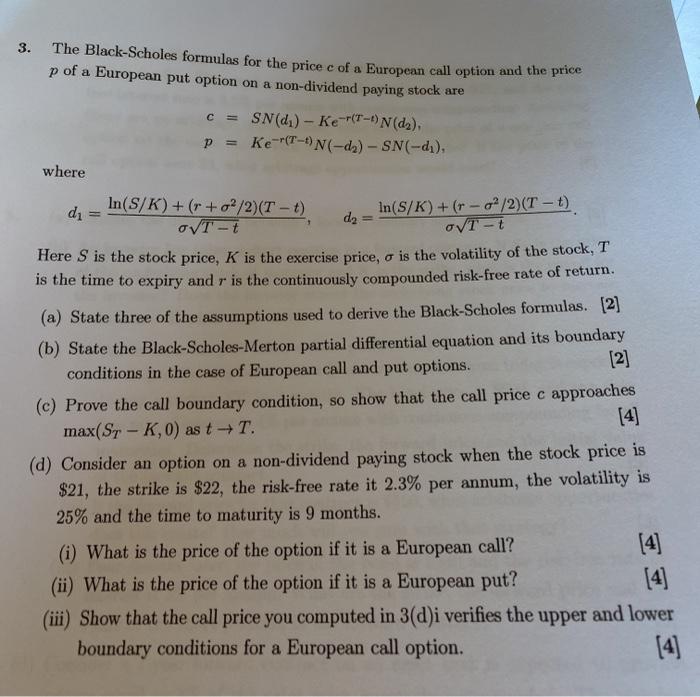

5. (a) The Black-Scholes formulae for the price c of a European call option and the price p of a European put option on a non-dividend paying stock are C = SN(d) - Ke-'(7-6) (de) p = KerT-ON(-dy) - SN(-d), where In(S/K) + (r +o/2)(T - 1) di In(S/K) + (r-/2)(T-) OVT-t VT- Here is the stock price, K is the exercise price, o is the volatility of the stock, T is the time to expiry and r is the continuously compounded risk-free rate of return (i) State the Black-Scholes-Merton partial differential equation and its bound- ary conditions in the case of European call and put options. (ii) Consider an option on a non-dividend paying stock when the stock price is 33 , the strike price is 35 , the risk-free rate is 2.7% per annum, the volatility is 35% and the time to maturity is 6 months. A. What is the price of the option if it is a European call? B. What is the price of the option if it is a European put? C. Show that the put price you computed in 5(a)(ii)B verifies the upper and lower boundary conditions for a European put option. [3] (b) Let Z be a Wiener process. Given a non-dividend paying stock with expected rate of return i and volatility, assume that the stock price follows the Ito process dS = MS dt+oS dz. (i) State Ito's Lemma. (ii) Find the process that is followed by the variablets. Does ts also follow a geometric Brownian motion? [6] [4] 000 3. The Black-Scholes formulas for the price e of a European call option and the price p of a European put option on a non-dividend paying stock are c = SN(d) - Ke- (T-1)(dz), p = Ke-r(T-N(-da) - SN(-d), where di In(S/K) + (r + o2/2)(T t) In(S/K)+(r - 02/2)(T - t) OVT-t dg OVT-t Here is the stock price, K is the exercise price, o is the volatility of the stock, T is the time to expiry and r is the continuously compounded risk-free rate of return. (a) State three of the assumptions used to derive the Black-Scholes formulas. [2] (b) State the Black-Scholes-Merton partial differential equation and its boundary conditions in the case of European call and put options. [2] (c) Prove the call boundary condition, so show that the call price c approaches max(Sr - K0) as t+T. [4] (d) Consider an option on a non-dividend paying stock when the stock price is $21, the strike is $22, the risk-free rate it 2.3% per annum, the volatility is 25% and the time to maturity is 9 months. (i) What is the price of the option if it is a European call? (ii) What is the price of the option if it is a European put? [4] (iii) Show that the call price you computed in 3(d)i verifies the upper and lower boundary conditions for a European call option. [4]